CURRENT AFFAIRS – 02/02/2024

- CURRENT AFFAIRS – 02/02/2024

- Committee will study ‘fast population growth’ and demographic changes: FM

- Net zero gain for job guarantee scheme

- Marginal rise in allocations for farming, fisheries

- School, Higher Education Departments get more money in interim Budget

- Fertilizer subsidy set to decline, food subsidy sees increase

- ASHA, anganwadi staff get health cover

- Centre moots₹1 lakh crore corpus for R&D

- Govt. raises Lakhpati Didi scheme target

- New scheme for biomanufacturing, bio foundry on the card

- One cr. homes to get free power via solar panels

- Three economic rail corridors on the anvil

- How is the interim Budget different from Annual Budget?

- Where does the money come from and where is it allocated?

CURRENT AFFAIRS – 02/02/2024

Committee will study ‘fast population growth’ and demographic changes: FM

(General Studies- Paper II)

Source : TH

Finance Minister Nirmala Sitharaman has announced the formation of a high-powered committee to address challenges arising from “fast population growth and demographic changes” in India.

- The committee’s mandate is to make recommendations that comprehensively address these challenges, aligning with the goal of developing India (Viksit Bharat).

Key Highlights

- Backdrop of Census Postponement:

- The announcement comes amid the indefinite postponement of the Census, leading to a lack of reliable data supporting claims of “fast” population growth.

- Existing data, including the Sample Registration System (SRS) and National Family Health Survey (NFHS)-5, suggests a decline in the total fertility rate (TFR), challenging the narrative of rapid population growth.

- The latest SRS report for 2020 indicates a TFR drop to 2, from 2.1 in 2019.

- NFHS-5 (2019-2021) states a national TFR decline from 2.2 to 2, with only five outlier states having a TFR above replacement level.

- However, concerns are raised about the NFHS data’s completeness due to a small sample size and data spread over multiple years, leading to questions about its statistical soundness.

- Committee’s Focus and Response:

- Economic Affairs Secretary Ajay Seth emphasizes that India’s demographics pose both opportunities and challenges.

- The committee will examine these aspects, and the final terms of reference will reflect its focus.

- The response suggests a broader consideration beyond population stabilization, and the committee’s initiation timeline is not explicitly tied to the next Census.

- Delay in Census and Delimitation:

- Union Home Minister Amit Shah announced in the Lok Sabha on September 20, specifying that the Census and delimitation of parliamentary seats would only occur after the 2024 general election.

- However, the exact year for these exercises remains unspecified.

- The Census, originally planned for two phases in 2020 and 2021, has been indefinitely postponed.

- The Registrar General of India (RGI) has extended the deadline nine times for freezing administrative boundaries of districts, tehsils, and police stations in states, causing further delays in the Census.

- Additionally, the ‘Vital Statistics of India Based on the Civil Registration System (CRS)’ report, last released for 2020, has not been published for the years 2021, 2022, and 2023.

- Activist have also filed a petition in the Supreme Court, urging timely publication of the ‘Vital Statistics of India’ report.

- It isargued that the report is crucial for transparency and effective demographic research, supporting interventions in socio-economic planning.

- In 2011, the Supreme Court had directed all states to publish demographic data up to the gram panchayat level on their websites.

- Demographic Changes and Security Concerns:

- At the annual Director General of Police (DGP) conference in 2021, police officers from Uttar Pradesh and Assam presented a research paper expressing concerns about demographic changes in districts along the international borders with Nepal and Bangladesh.

- The officers specifically highlighted an increase in the number of mosques and seminaries, as well as a high decadal growth in population in these border areas.

- According to the Assam police paper, the decadal population growth between 2011 and 2021 within 10 km of the Bangladesh border was reported at 31.45%.

- This figure is significantly higher than the projected national and state averages of 12.5% and 13.54%, respectively.

- The concerns raised in the paper suggest potential security implications.

- In November 2021, the then-Border Security Force (BSF) Director General Pankaj Kumar Singh pointed to demographic changes in certain border districts of Assam and West Bengal as a possible reason for a Home Ministry notification.

- This notification extended the jurisdiction of the BSF up to 50 kilometers from the border.

- Singh noted that the 2011 Census reflected demographic shifts leading to changes in voting patterns and emphasized the government’s interest in addressing infiltrator-related challenges.

- The Uttar Pradesh police paper revealed data on villages in seven border districts, including Maharajganj, Siddharthnagar, Balrampur, Bahraich, Shravasti, Pilibhit, and Khiri.

- Out of 1,047 villages, 303 had a Muslim population between 30% and 50%, and 116 villages had a Muslim population exceeding 50%, raising concerns about the demographic composition of these border areas.

About Sample Registration System (SRS)

- The Sample Registration System (SRS) in India serves as a crucial source of demographic data for socioeconomic development, population control, and planning.

- The need for reliable demographic data was recognized shortly after India gained independence, leading to the enactment of the Registration of Births & Deaths Act, 1969, to unify Civil Registration activities.

- Despite compulsory registration, some states faced challenges in achieving satisfactory levels of registration.

- Initiation of Sample Registration System (SRS):

- To address the need for continuous and reliable demographic data, the Office of Registrar General, India, launched the Sample Registration System (SRS) on a pilot basis in 1964-65 and expanded it to full-scale implementation from 1969-70.

- The SRS has since been providing regular and dependable data on birth rate, death rate, and other fertility and mortality indicators.

- Methodology and Components:

- The SRS in India operates on a dual record system.

- It involves continuous enumeration of births and deaths in a sample of villages/urban blocks by part-time enumerators and an independent six-month retrospective survey by full-time supervisors.

- The data collected from these two sources are cross-checked, and unmatched or partially matched events are re-verified in the field to ensure accuracy.

- Key Components of SRS:

- Base-line survey of sample units to establish the usual resident population of the sample areas.

- Continuous (longitudinal) enumeration of vital events by part-time enumerators.

- Independent retrospective half-yearly surveys conducted by full-time supervisors to record births and deaths and update relevant demographic information.

- Matching of events recorded during continuous enumeration with those listed in the half-yearly survey.

- Field verification of unmatched and partially matched events to ensure accuracy.

- Filling of Verbal Autopsy Forms for finalized deaths, adding a qualitative dimension to mortality data.

- Objective:

- The primary goal of SRS is to provide reliable estimates of birth rate, death rate, and other fertility and mortality indicators at both the national and sub-national levels.

- This comprehensive system ensures the accuracy and completeness of demographic data, which is essential for informed decision-making in various sectors, including health, family planning, and overall socioeconomic planning.

About the National Family Health Survey (NFHS)

- The National Family Health Survey (NFHS) is a comprehensive, large-scale, and multi-round survey conducted in a representative sample of households across India.

- The survey aims to provide crucial state and national-level information on various health and family welfare indicators.

- NFHS covers a range of topics including fertility, infant and child mortality, family planning practices, maternal and child health, reproductive health, nutrition, anaemia, and the utilization and quality of health and family planning services.

- Survey Goals:

- Each successive round of the NFHS serves two main objectives.

- Firstly, it aims to furnish essential data on health and family welfare, meeting the needs of the Ministry of Health and Family Welfare and other relevant agencies for policy and program formulation.

- Secondly, NFHS strives to offer information on emerging health and family welfare issues, ensuring the survey remains relevant and adaptive to changing circumstances.

- Nodal Agency and Collaboration:

- The Ministry of Health and Family Welfare (MOHFW), Government of India, designates the International Institute for Population Sciences (IIPS) in Mumbai as the nodal agency responsible for coordinating and providing technical guidance for the survey.

- IIPS collaborates with various Field Organizations (FO) for the implementation of the NFHS.

- Each Field Organization is tasked with conducting survey activities in specific states covered by the NFHS, contributing to the comprehensive and representative nature of the survey.

Net zero gain for job guarantee scheme

(General Studies- Paper II)

Source : TH

The budget for the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) in the financial year 2024-25 has been allocated ₹86,000 crore, marking a ₹26,000 crore increase compared to the 2023-24 Budget estimates.

- However, this allocation is the same as the revised estimates for the ongoing financial year (2023-24), raising concerns about potential zero or negative net gain for the rural employment scheme.

Key Highlights

- Expenditure and Dues:

- As of the latest available statistics on the Union Rural Development Ministry website, the total expenditure on the MGNREGS program has been ₹88,309.72 crore.

- The Centre reportedly owes ₹16,000 crore in wages to State governments, with a significant portion linked to outstanding dues in West Bengal.

- The Centre has halted the program in West Bengal for the past two years, citing corruption concerns, resulting in an owed amount of nearly ₹7,000 crore to the State.

- Budget Trends and Activists’ Perspective:

- The 2024 Budget breaks the trend of reducing the MGNREGS budget, as seen in the 2023 Budget, where only ₹60,000 crore was allocated, reflecting an 18% decrease from the Budget estimates and a 33% reduction from the revised estimates for the financial year 2023-24.

- Activists and academics argue that the ₹86,000 crore allocation falls short of the required sum for effective implementation of the program.

- The shortfall is deemed inadequate to meet employment needs, raising serious concerns about jeopardizing the guaranteed right to work under MGNREGS and constituting a violation of this fundamental entitlement.

About the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS)

- The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), initially known as the National Rural Employment Guarantee Act 2005, is a significant Indian labour law and social security measure.

- Its primary aim is to guarantee the “right to work” for rural households, contributing to livelihood security by providing a minimum of 100 days of wage employment in a financial year.

- Key Features and Objectives:

- Right to Work Guarantee: MGNREGA guarantees the right to work, focusing on unskilled manual labor in rural areas.

- The primary objective is to enhance livelihood security in rural regions.

- Every household with willing adult members is entitled to a minimum of 100 days of wage employment in a financial year.

- MGNREGA aims to create durable assets such as roads, canals, ponds, and wells during the employment process.

- Employment opportunities are to be provided within 5 km of the applicant’s residence.

- The Act mandates the payment of minimum wages for the work undertaken.

- If work is not provided within 15 days of applying, applicants are entitled to receive an unemployment allowance.

- Employment under MGNREGA is recognized as a legal entitlement.

- Implementation and Prohibitions:

- Gram Panchayats (GPs): MGNREGA is primarily implemented by gram panchayats, ensuring decentralized governance.

- The involvement of contractors is prohibited, emphasizing community-driven and labor-intensive initiatives.

- The Act prioritizes labor-intensive tasks related to infrastructure development for water harvesting, drought relief, flood control, and other community-oriented projects.

Marginal rise in allocations for farming, fisheries

(General Studies- Paper III)

Source : TH

The allocation for the Agriculture Ministry stands at ₹1, 17,528.79 crore in the latest Budget, reflecting an increase of ₹1,997 crore compared to the previous budget.

- In the revised estimates, the allocation was ₹1, 16,788.96 crore, while the actual expenditure in 2022-23 amounted to ₹99,877.01 crore.

Key Highlights

- Schemes and Allocations:

- Pradhan MantriFasalBimaYojana: This scheme witnessed an increase in allocation, reflecting the government’s commitment to crop insurance and risk mitigation in agriculture.

- PM KisanSamman Nidhi: The allocation for this scheme remains the same at ₹60,000 crore, providing direct financial assistance to 11.8 crore farmers, including marginal and small farmers.

- PM Kisan Man DhanYojana: However, there is a decrease in allocation for this scheme, indicating a shift in budgetary priorities.

- Agricultural Research: An allocation of ₹9,941.09 crore is earmarked for agricultural research, emphasizing the importance of innovation and development in the agricultural sector.

- Agriculture and Allied Sectors: Highlights

- Electronic National Agriculture Market (E-Nam):

- Integration of 1,361 markets.

- Providing services to 1.8 crore farmers.

- Trading volume of ₹3 lakh crore.

- Pradhan MantriKisanSampadaYojana:

- Benefited 38 lakh farmers.

- Generated employment for 10 lakh individuals.

- Pradhan MantriFormalisation of Micro Food Processing Enterprises Yojana:

- Assisted 2.4 lakh self-help groups and 60,000 individuals.

- Provided credit linkages.

- Self-Reliance for Oil Seeds:

- Strategy formulation for achieving self-reliance in oil seeds (mustard, groundnut, sesame, soybean, sunflower).

- Involves research, modern farming techniques, market linkages, procurement, value addition, and crop insurance.

- Support for Dairy Farmers:

- Comprehensive program to support dairy farmers.

- Focus on controlling foot and mouth disease.

- Building on existing schemes like RashtriyaGokul Mission, National Livestock Mission, and Infrastructure Development Funds.

- Allocation of ₹4,521.24 crore, an increase of almost ₹200 crore.

- Department for Fisheries:

- Doubling of both inland and aquaculture production.

- Seafood export doubled since 2013-14.

- Pradhan MantriMatsyaSampadaYojana (PMMSY) implementation to enhance aquaculture productivity.

- Aim to double exports to ₹1 lakh crore and generate 55 lakh employment opportunities.

- Allocation of ₹2,584.50 crore.

- Electronic National Agriculture Market (E-Nam):

School, Higher Education Departments get more money in interim Budget

(General Studies- Paper II)

Source : TH

In the Interim Budget presented by Union Finance Minister Nirmala Sitharaman, allocations for the departments of Higher Education and School Education, under the Union Education Ministry, have witnessed an increase.

- Key schemes such as PM Schools for Rising India (PM SHRI) received a significant boost in allocation.

Key Highlights

- School Education Department Allocations:

- Total allocation: ₹73,008.10 crore.

- Previous Budget: ₹68,804.85 crore.

- Revised Estimates: ₹72,473.80 crore.

- Actual expenditure in 2022-23: ₹58,639.56 crore.

- PM Poshan Shakti Nirman (mid-day meal scheme) allocation: ₹12,467.39 crore.

- PM SHRI allocation: ₹6,050 crore (almost 50% more than the previous budget).

- Higher Education Department Allocations:

- Total allocation: ₹47,619.77 crore.

- Previous Budget: ₹44,094.62 crore.

- Revised Estimates: ₹57,244.48 crore.

- Actual expenditure in 2022-23: ₹38,556.80 crore.

- Indian Knowledge Systems allocation: Halved.

- PM girls hostels allocation: Reduced to ₹2 crore from ₹10 crore in the previous Budget.

- Total financial aid to students: Reduced to ₹1,908 crore from ₹1,954 crore in the previous Budget.

- UGC and AICTE total allocation: Dropped to ₹2,900 crore from ₹5,780 crore in the previous Budget.

- PM UchchatarShikshaAbhiyan (PMUSHA) allocation: ₹1,814.94 crore.

- Observations and Concerns:

- While certain schemes like PM SHRI saw a substantial increase in allocation, others, such as Indian Knowledge Systems and PM girls hostels, experienced reductions.

- The total financial aid to students and the combined allocation for UGC and AICTE have decreased.

- Education Reforms and Women’s Empowerment: Fact Sheet

- Women’s Enrollment in Higher Education:

- Increased by 28% in the last 10 years.

- Acknowledgment of the transformative impact of the National Education Policy 2020.

- PM SHRI initiative contributing to quality teaching and nurturing holistic individuals.

- Expansion of Higher Learning Institutions:

- Establishment of new institutions, including seven IITs, 16 IIITs, seven IIMs, 15 AIIMS, and 390 universities.

- Focus on enhancing infrastructure and educational opportunities.

- Women in STEM Courses:

- Girls and women constitute 43% of enrollment in Science, Technology, Engineering, and Mathematics (STEM) courses.

- Recognized as one of the highest percentages globally.

- Positive correlation between educational reforms and increasing participation of women in the workforce.

- Emphasizes the establishment of new IITs and IIMs and the Skilling and up-skilling of 1.4 crore youth under Skill India for improved employment prospects.

- Women’s Enrollment in Higher Education:

Fertilizer subsidy set to decline, food subsidy sees increase

(General Studies- Paper II)

Source : TH

In the Interim Budget for 2024-25, the Centre has reduced fertilizer subsidies, anticipating that improved conditions in Ukraine and increased domestic production will help manage the situation.

- The Ministry of Fertilizers and Chemicals asserts that the rise in domestic production, especially of essential fertilisers like urea, will lead to a decrease in fertiliser subsidies.

Key Highlights

- Budget Allocations and Trends:

- Allocation for the Fertilisers Department: ₹1, 64,150.81 crore.

- Last Budget Allocation: ₹1, 75,148.48 crore.

- Revised Estimates for the last financial year: ₹1, 88,947.29 crore.

- Actual expenditure in 2022-23: ₹2, 51,369.18 crore.

- Payments for indigenous and imported urea constituted a significant portion of the expenditure.

- Finance Minister Nirmala Sitharaman also announced the expansion of Nano Di Ammonium Phosphate (Nano DAP) application on various crops to all agro-climatic zones.

- Increased Food Subsidy Allocations:

- In the Interim Budget for 2024-25, the allocation for food subsidy has increased compared to the previous year.

- The total food subsidy includes ₹2, 05,250 crore for the Pradhan MantriGaribKalyan Anna Yojana (PM-GKAY) and ₹1 lakh crore for the Sugar Subsidy under the Public Distribution System.

- Key Points:

- Total food subsidy allocation: Increased to address welfare initiatives.

- PM-GKAY allocation: ₹2, 05,250 crore.

- Sugar Subsidy under PDS: ₹1 lakh crore.

- Previous Budget allocation: ₹1, 97,350 crore.

- Actual expenditure in 2022-23: ₹2, 72,802.38 crore.

- Impact of Welfare Measures:

- Finance Minister Nirmala Sitharaman highlighted the elimination of concerns about food through free ration distribution to 80 crore people.

- Emphasized periodic increases in Minimum Support Prices (MSP) for farmers’ produce.

- Provision of basic necessities contributing to enhanced real income in rural areas.

- Expected positive impact on economic growth and job generation through addressing economic needs.

ASHA, anganwadi staff get health cover

(General Studies- Paper II)

Source : TH

Finance Minister Nirmala Sitharaman announced key provisions for the health sector in the Interim Budget for 2024-25.

- While a comprehensive budget will follow after the Lok Sabha elections, the interim budget allocates increased funds for health and family welfare.

Key Highights

- Ayushman Bharat Pradhan Mantri Jan ArogyaYojana coverage extended to all Accredited Social Health Activist (ASHA) and anganwadi workers and helpers.

- Ministry of Health and Family Welfare allocation Increased from ₹89,155 crore in 2023-24 to ₹90,658.63 crore.

- Ayush Ministry: Saw a hike from ₹3,647.50 crore to ₹3,712.49 crore.

- U-WIN Platform for Immunisation:

- Introduction of the U-WIN platform for managing immunisation efforts.

- Mission Indradhanush to be intensified, rolled out expeditiously throughout the country.

- Utilizing existing hospital infrastructure under various departments to offer medical seats to students.

- Encouraging HPV vaccination for girls aged 9 to 14 years for cervical cancer prevention.

- Proposing the combination of various schemes for maternal and childcare under one comprehensive programme.

- Skill India Mission:

- Training youth through world-class institutes, including 15 newly constructed All India Institute of Medical Sciences.

- Plans to set up more medical colleges by utilizing existing hospital infrastructure.

- Upgradation of Anganwadi Centres:

- ‘SakshamAnganwadi’ initiative to upgrade Anganwadi centres expedited.

- Poshan 2.0 to enhance nutrition delivery, early childhood care, and development.

- Allocation Trends:

- Increased funds for Ayushman Bharat-Pradhan Mantri Jan ArogyaYojana, CGHS pensioners, and the National AIDS and STD programme.

- A drop in the allocation for the development of nursing services.

Centre moots₹1 lakh crore corpus for R&D

(General Studies- Paper III)

Source : TH

In the Interim Budget for 2024-25, Finance Minister Nirmala Sitharaman announced a significant provision to encourage research and development in “sunrise sectors” by introducing a corpus of ₹1 lakh crore.

- The corpus aims to provide funds at minimal or nil interest rates to stimulate private sector investments in research and innovation.

Key Highlights

- A ₹1 lakh crore corpus earmarked for research and development in sunrise sectors.

- The funds will be made available at minimal or nil interest rates.

- The initiative is designed to encourage the private sector to actively invest in research and development activities.

- Specific details regarding the beneficiaries and the implementation process are yet to be disclosed.

- National Research Foundation (NRF) Bill:

- The National Research Foundation Bill was cleared by the Science Ministry in 2023.

- The Department of Science and Technology (DST) will pilot the NRF, aiming for an autonomous body with a ₹50,000 crore corpus, with a significant contribution from the private sector and non-governmental sources.

- Concerns and Government Initiatives:

- Historically, the government has borne the majority (three-fourth) of expenses in core research and development.

- The DST has provisioned ₹2,000 crore in the 2024-25 budget towards the NRF.

- Budget Allocations for Civilian Science Departments:

- The Interim Budget for 2024-25 reveals modest allocations for civilian science departments, including the Department of Science and Technology (DST), the Department of Biotechnology, the Council of Scientific and Industrial Research (CSIR), and the Ministry of Earth Sciences (MoES).

- The Council of Scientific and Industrial Research (CSIR) sees a 10% raise from ₹5,746 crore in 2023-24 to ₹6,323 crore in the current budget, while the DST receives a 1% raise from ₹7,931 crore to ₹8,029 crore.

- National Quantum Mission:

- The National Quantum Mission, a DST initiative focusing on developing technologies based on quantum mechanics, receives a notable provision of ₹2,819 crore for the first time, indicating a commitment to advancing quantum technologies.

- New Scheme for Deep-Tech Technologies:

- Finance Minister Nirmala Sitharaman mentions the launch of a new scheme for strengthening deep-tech technologies for defense purposes and expediting self-reliance.

- The term “deeptech” refers to start-ups working on proprietary technologies, particularly in AI and other advanced research areas.

- Department of Biotechnology and MoES Allocations:

- The Department of Biotechnology sees a reduction in allocations from ₹2,683 crore in 2023-24 to ₹2,251 crore in the current budget.

- MoES experiences a decrease in allocations from ₹3,319 crore to ₹2,521 crore.

- Explanation for Cuts:

- Cuts in allocations for some departments are attributed to budgeting for major programs spanning 3-5 years and challenges in spending the entire budgeted amount within the stipulated financial years.

- Overall Research and Development Spending:

- The Finance Ministry allocates ₹13,208 crore for ‘Research and Development’ spending in 2024-25, compared to ₹12,850 crore in 2023-24.

- The actual spending during 2023-24 (till December) was ₹12,943 crore.

Govt. raises Lakhpati Didi scheme target

(General Studies- Paper II)

Source : TH

The Centre aims to increase the target for the ‘LakhpatiDidi’ scheme, which trains women’s self-help groups to establish micro-enterprises and earn a sustainable income.

- Finance Minister Nirmala Sitharaman announces an increase in the target from 2 crore to 3 crore for training ‘LakhpatiDidi.’

Key Highlights

- Focus on Four Major Sections:

- Emphasis on addressing the needs and aspirations of four major sections: ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth), and ‘Annadata’ (Farmer).

- These four groups receive government support for their welfare and improvement of their lives.

- Upgradation of AnganwadiCentres:

- The Interim Budget highlights the expedited upgradation of Anganwadi Centres under the “SakshamAnganwadi and Poshan 2.0” scheme.

- The integrated nutrition support program, SakshamAnganwadi, and Poshan 2.0 receive significant allocations to address malnutrition challenges.

- Allocation of Funds:

- SakshamAnganwadi and Poshan 2.0 programs receive the highest allocation of funds at ₹21,200 crore.

- Mission Shakti, focusing on the protection and empowerment of women, is allocated ₹3,145.97 crore.

- The total allocation for the Women and Child Development Ministry for 2024-25 is ₹26,000 crore, reflecting a marginal increase of 2.52% from the previous year.

- Women Empowerment Achievements:

- Finance Minister highlights achievements such as making ‘Triple Talaq’ illegal, reserving one-third seats for women in legislative assemblies, and allocating over 70% of PM AwasYojana houses in rural areas to women as sole or joint owners.

- Other accomplishments include providing 30 crore Mudra Yojana loans to women entrepreneurs and witnessing a 28% increase in female enrollment in higher education over ten years.

About the ‘Lakhpati Didi’ scheme

- The ‘LakhpatiDidi’ scheme, aimed at providing skill training to women across the country, was announced by Prime Minister Narendra Modi on August 15, 2023.

- The scheme initially operated in a few states and now seeks to expand nationwide.

- Objective of the Scheme:

- The primary objective is to create 2 crore ‘LakhpatiDidis’ in villages through collaboration with Women’s Self-Help Groups (SHGs).

- The scheme focuses on skill development in various practical areas aligned with emerging industry demands, including plumbing, LED bulb manufacturing, and drone operation and repair.

- Women undergoing training are equipped with diverse skills to explore entrepreneurial opportunities in different sectors.

- The scheme aims to empower women by providing them with practical skills that enhance their employability and entrepreneurial potential.

New scheme for biomanufacturing, bio foundry on the card

(General Studies- Paper III)

Source : TH

Finance Minister Nirmala Sitharaman announced a new scheme for bio-manufacturing and bio-foundry in the 2024-2025 Budget.

- The scheme aims to provide environment-friendly alternatives such as biodegradable polymers, bio-plastics, bio-pharmaceuticals, and bio-agri-inputs.

Key Highlights

- Bio-Economy Contribution Targets:

- The bio-manufacturing initiative is part of a larger goal to have the bio-economy contribute $300 billion to the Indian economy by 2030.

- The target represents a significant increase of around ₹18 lakh crore in value from current levels, with a further goal of reaching $1 trillion by 2047.

- Emphasis on investing in bio-manufacturing is seen as a strategy to upskill India’s bio-science sector, going beyond prioritizing research alone.

- The move reflects the government’s commitment to fostering a robust bio-economy and encouraging sustainable alternatives.

- Budget Allocation for Department of Biotechnology (DBT):

- The total allocation for the Department of Biotechnology (DBT) in the 2024-2025 Budget has been reduced by 16% to ₹2,251.52 crore.

- Despite the cut, the bio-manufacturing scheme signals a strategic focus on leveraging biotechnologies for economic growth.

- Role of Biotechnology Industry Research Assistance Council (BIRAC):

- BIRAC, a public-sector enterprise under the DBT facilitating collaboration between academia and industry, maintains its allocation at ₹40 crore, despite higher actual expenditure in the previous fiscal year.

- Bio-Economy Overview:

- The bio-economy encompasses economic activities utilizing biotechnologies to produce value, including vaccines, diagnostics, bio-ethanol, bio-plastics, and genetically modified crops.

- The Indian BioEconomy Report (IBER) envisions India becoming one of the top 5 global bio-manufacturing hubs and a top 10 biotechnology destination globally.

About Biotechnology Industry Research Assistance Council (BIRAC)

- The Biotechnology Industry Research Assistance Council (BIRAC) is a government-supported organization in India that plays a crucial role in promoting and nurturing the biotechnology industry.

- It was established by the Department of Biotechnology (DBT), Ministry of Science & Technology, Government of India.

- BIRAC was set up to facilitate the strategic growth of the biotechnology sector in India by providing financial assistance, supporting research and development initiatives, and fostering collaborations between academia, industry, and other stakeholders.

- Key Strategies

- Foster innovation and entrepreneurship

- Promote affordable innovation in key social sectors

- Empowerment of start-ups & small and medium enterprises

- Contribute through partners for capability enhancement and diffusion of innovation

- Enable commercialization of discovery

- Ensure global competitiveness of Indian enterprises

One cr. homes to get free power via solar panels

(General Studies- Paper III)

Source : TH

In the Interim Budget for 2024-25, Union Finance Minister Nirmala Sitharaman reiterated the government’s commitment to electrify one crore households through rooftop solar installations.

- The initiative aims to enable households to receive up to 300 units of free electricity every month, translating to an annual benefit of ₹15,000-18,000 per household.

- The surplus electricity generated can be sold to distribution companies under the net-metering policy.

Key Highlights

- The government allocated ₹4,555 crore for the rooftop solar power programme in the budget, compared to ₹2,167 crore spent in the previous year.

- The increased budget signifies a focus on expanding rooftop solar installations across the country.

- Current Rooftop Solar Capacity:

- As of now, India has approximately 11 GW of installed rooftop solar capacity, with only 2.7 GW in residential units and the majority in commercial or industrial spaces.

- Subsidy and Installation Costs:

- The Ministry of New and Renewable Energy (MNRE) estimates the installation cost for a 1-2 kW system at around ₹43,000 per unit.

- Units up to 3 kW are eligible for a subsidy of approximately ₹14,000 per unit.

- The Finance Minister did not specify whether the government would fund new installations or subsidize those opting for rooftop solar.

- Net-Metering Policy:

- The net-metering policy allows users to supply surplus solar power back to the grid, offsetting their electricity bills.

- Insights from CEEW Study and Offshore Wind Support

- A research study conducted by the Council on Energy, Environment and Water (CEEW) reveals insights into the challenges faced by India in adopting rooftop solar systems.

- Despite potential benefits, low consumption levels and existing subsidies for coal-fired electricity make solar power less attractive.

- Here are key points:

- The CEEW study, spanning 14,000 households across 21 states, suggests that India’s limited uptake of rooftop solar is influenced by low electricity consumption and current coal-fired electricity subsidies.

- The study indicates that solarising one crore households could potentially support 20-25 GW of rooftop solar capacity.

- However, the primary challenge lies in encouraging residential consumers, who receive subsidized electricity from distribution companies (discom), to transition to solar power.

- If one crore households adopt solar power, it could save discoms approximately ₹2 lakh crore over the next 25 years, considering the life of a solar plant.

- Viability Gap Funding for Offshore Wind:

- Finance Minister Nirmala Sitharaman also announced support for the capital-intensive offshore wind sector, offering “viability gap funding” for up to 1 gigawatt capacity of offshore wind farms.

- This initiative aims to encourage private sector investments, with the government contributing a portion of installation costs.

- Offshore Wind Potential:

- India currently has around 44 GW of onshore wind installations, and studies suggest a significant potential of almost 72 GW of offshore wind in the seas off Gujarat and Tamil Nadu.

- The budget announcement did not provide details or budgetary allocations for the offshore wind support, leaving room for further clarification.

Three economic rail corridors on the anvil

(General Studies- Paper III)

Source : TH

The Union Ministry of Railways is set to receive ₹2.55 lakh crore for the financial year 2024-25, reflecting a 5.8% increase from the previous year’s allocation of ₹2.41 lakh crore.

Key Highlights

- The increased allocation aims to support infrastructure development within the railways sector.

- Union Railways Minister Ashwini Vaishnaw noted that up to 82% of the previous year’s allocation had been spent by the end of January.

- Despite the increased allocation, the Ministry of Railways could only utilize ₹1.6 lakh crore based on the actual numbers released for 2022-23.

- Efforts are being made to enhance the efficiency of fund utilization.

- Revised Operating Ratio:

- The revised operating ratio for 2023-24 is reported at 98.7%, indicating the ratio of working expenses to traffic earnings.

- Notably, all expenditures for pension are being covered from railway revenue.

- Major Economic Railway Corridors:

- Finance Minister Nirmala Sitharaman highlighted the implementation of three major economic railway corridor programs:

- Energy, Mineral, and Cement Corridor: Also known as the Energy Economic Corridor.

- Port Connectivity Corridor: Referred to as Rail Sagar.

- High Traffic Density Corridors: Known as AmritChaturbhuj.

- The Railways Minister stated that a total of 434 projects, with an investment of ₹11 lakh crore, will be initiated under these corridor programs.

- An integrated planning approach involved consultation with 18 ministries over two years, with detailed project reports in progress.

- Focus on PM Gati Shakti Corridors and Bogie Overhaul

- The corridors are strategically planned by analyzing the origin and destination nodes of railways across India.

- The focus is on understanding and addressing specific needs, such as adding railway sections, doubling or multi-tracking routes, deploying new lines, and improving passenger traffic flow.

- The Railways Ministry also aims to revamp 40,000 train bogies over the next five years, with an estimated cost of ₹15,200 crore.

- The objective is to provide passengers with an enhanced experience similar to that of the Vande Bharat trains.

- Upgraded coaches will incorporate features such as high-quality toilets, enhanced safety standards (including semi-permanent coupling), charging points, automatic water measurement systems for tank filling, GPS, and CCTV cameras.

- Private Sector Engagement:

- The budget allocation for investment in public sector units and joint ventures has decreased, suggesting a potential shift towards opening up the market to private players.

- This aligns with the Railways’ interest in fostering private sector participation.

- Bullet Train Project:

- The National High-Speed Rail Corridor Limited’s bullet train project has received a significant allocation increase, rising from ₹19,592 crore to ₹25,000 crore.

- The project aims to reduce travel time between Mumbai and Ahmedabad from five to six hours to three hours.

How is the interim Budget different from Annual Budget?

(General Studies- Paper II and III0

Source : TH

In India, an interim budget serves a specific purpose, primarily arising from constitutional and procedural considerations, particularly during election years.

Important Points

- Constitutional Basis:

- Article 112 of the Indian Constitution mandates the presentation of the annual financial statement, detailing the estimated receipts and expenditure of the Government of India for a specific financial year.

- However, in election years, presenting a full Budget is avoided due to potential changes in the executive after polls.

- Need for an Interim Budget:

- In an election year, the incumbent government opts for an interim budget as a transitional financial plan.

- This is because, during elections, the political landscape may change, and the new government will have its priorities, potentially leading to alterations in budgetary allocations.

- Votes on Account:

- Article 116 empowers the Lok Sabha to pass a ‘vote on account,’ allowing the government to withdraw funds in advance for part of any financial year.

- This facilitates the continuity of government operations during the transitional period.

- Interim Budget vs. Simple Vote on Account:

- While a simple vote on account involves presenting fund requirements for ongoing expenditures without debate, an interim budget provides a more comprehensive overview.

- The Finance Minister outlines the current economic state, fiscal status, planned expenditures, and receipts.

- Unlike a simple vote on account, an interim budget can include revisions to tax rates.

- Key Components of an Interim Budget:

- The interim budget typically includes a snapshot of the economy, revised growth estimates, planned expenditures, and revenue projections for the upcoming financial year.

- It refrains from major announcements or new schemes that could influence voters.

- The interim budget serves as a financial bridge until the new government assumes office.

- After the new government is in place, a full Budget is presented, incorporating its policy priorities and financial allocations.

- Distinguishing the Interim Budget from the Union Budget in India

- In India, both the Union Budget and the Interim Budget are critical financial instruments, each serving distinct purposes within the constitutional and procedural framework.

- Union Budget Presentation:

- Occurs at the beginning of Parliament’s Budget session on February 1.

- Finance Minister presents the annual financial statement.

- Comprehensive document outlining the nation’s economic state, growth projections, fiscal policies, and allocation of funds for various schemes.

- Detailed Budget speech summarizing achievements, proposed initiatives, and fiscal strategies.

- Subject to voting and approval by both Houses of Parliament.

- Interim Budget Presentation:

- Presented on February 1 by the Finance Minister.

- Serves as a transitional financial plan, especially in election years.

- Provides an overview of the current economic status, revised growth estimates, and financial projections.

- Outlines planned government expenditure until the new government presents a full Budget.

- May include revisions to tax rates and other financial adjustments.

- Subject to voting and approval by both Houses of Parliament.

- Common Aspects:

- Both budgets are presented on February 1, voted on, and sent for Presidential approval.

- Comprehensive financial documents that undergo parliamentary scrutiny and approval.

- Provide insights into the government’s economic vision, fiscal policies, and resource allocation.

- Functional Duration:

- The Union Budget covers the entire fiscal year (April-March).

- The Interim Budget serves as a financial bridge until a new government presents a full Budget, often covering the transitional period from February to June/July.

- Decision Implications:

- Failure to pass the Union Budget in the Lok Sabha may lead to the resignation of the Prime Minister and the Cabinet.

- The Interim Budget, while subject to parliamentary approval, is a temporary arrangement and does not carry the same weight in determining the government’s continuation.

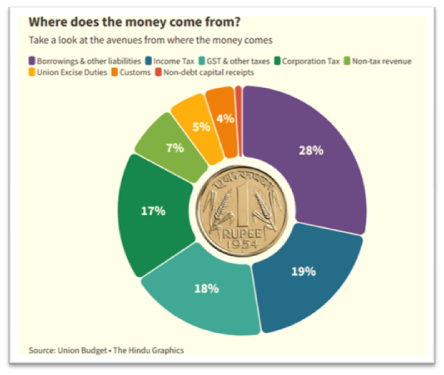

Where does the money come from and where is it allocated?

(General Studies- Paper III)

Source : TH

Budget 2024-25: From and To – A Financial Breakdown

- Revenue Sources:

- Borrowings and Other Liabilities: 28%

- Income Tax: 19%

- GST and Other Taxes: 18%

- Corporation Tax: 17%

- Non-Tax Revenue, Union Excise Duties, Customs, and Non-Debt Capital Receipts: 18%

- Expenditure Allocations:

- Interest Payments and States’ Share of Taxes and Duties: 20%

- Central Sector Schemes: 16%

- Finance Commission and Other Transfers: 8%

- Defence Sector: 8%

- Centrally-Sponsored Schemes: 8%

- Miscellaneous Expenditures: 9%

- Subsidies: 6%

- Pensions: 4%