CURRENT AFFAIRS – 27/10/2023

- CURRENT AFFAIRS – 27/10/2023

- Lok Sabha’s Ethics Committee

- Contours of joint theatre commands ready, await Govtnod

- The new made-in-India EV charging standard

- Eight former Indian Navy officers get death penalty in Qatar

- The T.N. experience on caste survey

- Supreme Court allows surrogacy, strikes down rule banning use of donor gametes

- Widening Tax Base in India: CBDT report

CURRENT AFFAIRS – 27/10/2023

Lok Sabha’s Ethics Committee

(General Studies- Paper II)

Source : The Indian Express

The Lok Sabha Ethics Committee is set to address a complaint against MahuaMoitra by Nishikant Dubey.

- The committee last met on July 27, 2021, as per the Parliament website.

- The committee has been dealing with complaints for over two decades, with most cases involving minor offenses.

- Committee members are appointed by the Speaker for a one-year term.

Key Highlights

- Current Composition of the Ethics Committee

- The committee is currently chaired by Vinod Kumar Sonkar, the BJP’s Kaushambi MP.

- It includes members from various political parties, including the BJP, Congress, YSR Congress, Shiv Sena, JD-U, CPI-M, and BSP.

- Origins of Ethics Committees

- The idea of ethics panels for both the Lok Sabha and Rajya Sabha was first proposed at a Presiding Officers’ Conference in Delhi in 1996.

- Rajya Sabha Ethics Committee

- Vice President K R Narayanan, who also chaired the Rajya Sabha, established the Ethics Committee for the Upper House on March 4, 1997.

- The Rajya Sabha Ethics Committee was inaugurated in May 1997 to oversee members’ moral and ethical conduct and examine cases of misconduct.

- Lok Sabha Ethics Committee’s Delay

- In the case of the Lok Sabha, a study group from the House Committee of Privileges visited Australia, the UK, and the US in 1997 to research legislative conduct and ethics.

- The group recommended the creation of an Ethics Committee for the Lok Sabha, but the proposal was not immediately taken up.

- The Committee of Privileges eventually recommended the formation of an Ethics Committee during the 13th Lok Sabha.

- An ad hoc Ethics Committee was established in 2000 under the late Speaker G M C Balayogi, but it only became a permanent part of the Lok Sabha in 2015.

- The 2005 Cash-for-Query Case

- In 2005, 10 Lok Sabha MPs and one Rajya Sabha MP faced expulsion over allegations of accepting money in exchange for asking questions in Parliament.

- Lok Sabha adopted a motion to expel the MPs based on a report from a special committee headed by MP P K Bansal.

- In Rajya Sabha, the House Ethics Committee examined the complaint.

- The BJP requested that the Bansal Committee’s report be sent to the Privileges Committee for the MPs to defend themselves.

- Procedure for Complaints

- Any individual can file a complaint against a Member of Parliament (MP) through another Lok Sabha MP, accompanied by evidence of alleged misconduct and an affidavit confirming the complaint’s validity.

- MPs themselves can complain without the need for an affidavit.

- The Speaker can refer any complaint against an MP to the Ethics Committee.

- The committee conducts a prima facie inquiry before deciding to examine a complaint and makes recommendations based on its evaluation.

- The committee presents its report to the Speaker, who then asks the House if the report should be considered, including a provision for a half-hour discussion on the report.

- Privileges Committee

- The work of the Ethics Committee and the Privileges Committee can overlap in addressing allegations against MPs.

- The Privileges Committee’s main role is to protect the “freedom, authority, and dignity of Parliament,” which extends to individual MPs and the House as a whole.

- This committee handles cases of breach of privilege, where actions attack the authority and dignity of the House.

- The Ethics Committee focuses on cases of misconduct involving MPs but does not deal with privilege issues.

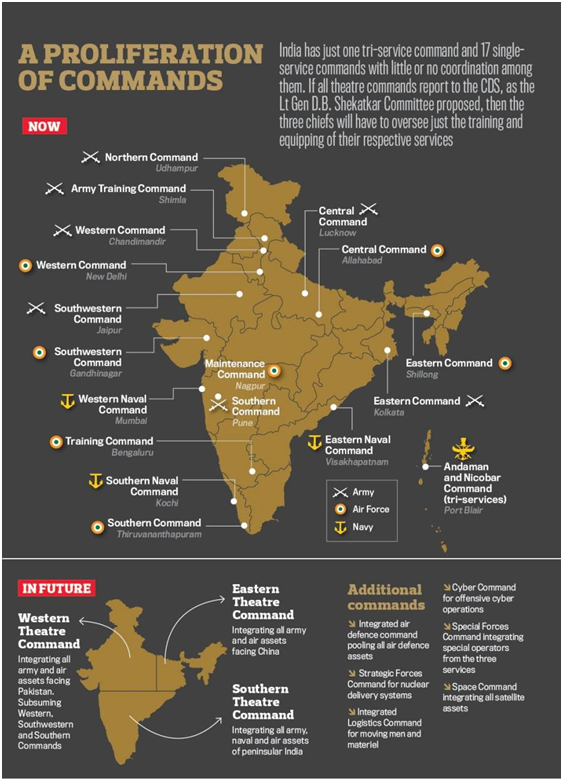

Contours of joint theatre commands ready, await Govtnod

(General Studies- Paper III)

Source : The Indian Express

India’s armed forces have made progress in shaping the structure of integrated theatre commands.

- The proposed theatre commanders are expected to function under a national defence committee, possibly chaired by the Defence Minister.

- Government approval is pending for the proposed structures, and further adjustments may be made based on this approval.

Key Highlights

- Integrated Theatre Commands

- The primary objective of the theatreisation plans is to integrate the Army, Navy, and Indian Air Force, along with their resources, into specific theatre commands.

- This move aims to enhance the joint operational capabilities and effectiveness of India’s armed forces.

- Key Decision-Making Bodies

- Members of the Chiefs of Staff Committee (COSC) are likely to be part of the national defence committee, which will oversee the work of theatre commanders.

- COSC comprises the three service chiefs and the Chief of Defence Staff (CDS) and plays a crucial role in higher defense-related decisions.

- Roles of Vice CDS and Deputy CDS

- In line with the theatreisation plans, there is a proposal for the appointment of a Vice CDS and a Deputy CDS.

- These officials would oversee various aspects, including operations, intelligence and planning, training, procurements, and other defense-related responsibilities.

- Earlier discussions suggested a clear division of roles, with service chiefs handling “raise, train, and sustain” responsibilities while theatre commanders manage operations.

- However, the current discussions indicate that service chiefs may retain some operational roles.

- Theatre Command Structure

- Theatre commands are key to dealing with threats along India’s northern and western borders.

- While the basic structure of these commands is nearly finalized, certain human resource matters are still pending.

- The theatreisation plans also involve overall transformation and improved integration of the three service headquarters.

- Three theatre commands will be established, focusing on regions facing Pakistan, China, and maritime threats beyond coastal borders.

- Locations for these theatre commands are likely to be Jaipur, Lucknow, and Karwar, respectively.

- Future Integration

- Existing tri-service agencies, such as those for cyber, space, and special operations, may evolve into a fourth theatre command in the future, but this plan is still under discussion.

- Command Upgrades

- One regular command from each of the three services is expected to be upgraded to a theatre command.

- The Andaman and Nicobar Command may be incorporated into the maritime theatre command, and HQIDS (Headquarters Integrated Defence Staff) may come under the Chief of Defence Staff (CDS).

- The Strategic Forces Command (SFC) will continue to operate independently.

- Other commands will continue to oversee operational theatres, with a focus on improving jointness in areas like intelligence, logistics, training, and infrastructure.

- Leadership and Previous Objections

- It remains uncertain which service will lead each theatre command.

- Earlier theatreisation plans that included an air defence command faced objections from the Indian Air Force (IAF), which expressed concerns about dividing its fighting assets.

- The Chief of Defence Staff, General Anil Chauhan, is leading the theatreisation plans, which have involved extensive deliberations, studies, and exercises to examine the application of theatres in various operational scenarios.

About the Chiefs of Staff Committee (COSC)

- The Chiefs of Staff Committee (COSC) is a crucial decision-making and advisory body within the Indian armed forces.

- Composition:

- The committee includes the Chief of Army Staff, Chief of Naval Staff, and Chief of the Air Staff, who represent the Indian Army, Indian Navy, and Indian Air Force, respectively.

- The Chief of Defence Staff (CDS) is also a member of the COSC. The CDS is a four-star military officer who acts as the principal military advisor to the government and is responsible for promoting jointness and synergy among the three services.

- Role and Functions:

- The primary function of the COSC is to facilitate coordination and collaboration among the three services.

- It aims to ensure that the armed forces work together seamlessly to achieve common defense objectives.

- The committee serves as an advisory body to the government on defense-related matters.

- The primary function of the COSC is to facilitate coordination and collaboration among the three services.

The new made-in-India EV charging standard

(General Studies- Paper III)

Source : The Indian Express

The Bureau of Indian Standards (BIS) has approved a new charging connector standard for Light Electric Vehicles (LEVs) in India.

- This standard encompasses both AC (Alternating Current) and DC (Direct Current) charging for LEVs.

- Collaboration among NITI Aayog, the Department of Science and Technology, Ather Energy, and various government and industry stakeholders led to the development of this standard.

Key Highlights

- Key Features of the New Standard

- Combining AC and DC:

- The significant feature of this standard is its combination of both AC and DC charging for LEVs, making it the first of its kind in the world.

- Interoperability:

- This standard promotes interoperability, allowing different EV models and charging infrastructure providers to use it.

- Similar to Mobile Charging Standards:

- The concept of EV charging connector standards is similar to those used for mobile phones, such as USB Type-C chargers.

- Comparison with Global Standards

- Europe has adopted combined AC and DC charging standards for electric four-wheelers, including the Combined Charging System (CCS) standard, which is widely used in Europe.

- The new Indian standard for LEVs aligns with global trends in charging infrastructure, promoting consistency and compatibility.

- Charging Standards in India

- EV makers in India, such as Ola Electric, Ather Energy, and Ultraviolette Automotive, use different charging standards for their EVs, leading to a lack of uniformity.

- Proprietary charging standards like Ola’s Hyperchargers, Ather Energy’s open source standard, and Ultraviolette’s IEC 62196-6 create compatibility issues.

- Challenges with Multiple Standards

- Having multiple charging standards for EVs complicates the establishment of public charging stations, contributing to range anxiety.

- Range anxiety is the fear that EVs may run out of charge, with no compatible charging infrastructure available.

- Global Comparison: Charging Standards

- China:

- China employs a national standard for EV charging connectors known as GB/T, along with an extensive charging station network, effectively addressing range anxiety.

- United States:

- While the U.S. lacks a national standard, some EV manufacturers are working towards standardization.

- Ford and General Motors are adopting the North American Charging Standard (NACS), developed by Tesla.

- Europe:

- Europe primarily uses the CCS (Combined Charging System) standard, and the EU mandates this standard for EV charging networks.

- Japan:

- Japan employs the CHAdeMO charging standard, which is being phased out in North America.

- Lack of Mandate in India

- Although a new combined charging standard for India has been approved by BIS, EV manufacturers are not mandated to use a uniform standard.

- A consistent standard would facilitate faster EV adoption and address range anxiety in India.

- China:

- Combining AC and DC:

About Bureau of Indian Standards (BIS)

- The Bureau of Indian Standards (BIS) is a statutory body established by the Indian government under the Bureau of Indian Standards Act, 1986.

- It functions under the aegis of the Ministry of Consumer Affairs, Food and Public Distribution.

- BIS is India’s national standards body responsible for the development and promotion of product quality and standards to ensure the safety and reliability of products for the Indian market.

- BIS was established on April 1, 1987, by merging the Indian Standards Institution (ISI) and the Bureau of Indian Standards (BIS).

- Mandate:

- BIS is responsible for the formulation and implementation of standards for various products and services, such as industrial and manufacturing processes, consumer goods, food products, agricultural products, and more.

- These standards help ensure the quality and safety of products and services.

- Certification and Marking:

- BIS offers certification services, and products that meet the prescribed standards are awarded the ISI mark, indicating that they conform to the specified quality and safety standards.

Eight former Indian Navy officers get death penalty in Qatar

(General Studies- Paper II)

Source : TH

Eight former Indian Navy personnel employed by a company in Doha were handed the death penalty by a local court in Doha on October 26, 2023, in an alleged case of espionage.

- The Indian government expressed shock at the verdict and is exploring legal options.

- The men have been in Qatari custody since August 2022.

Key Highlights

- Espionage Allegations:

- The Indian nationals were accused of breaching sensitive secrets at the time of their arrest.

- They were working for Al Dahracompany and involved in training security-related service providers of Qatar.

- The company was also engaged in producing high-tech Italian-origin submarines known for their stealth capabilities.

- Legal Response:

- The Indian Ministry of External Affairs (MEA) expressed deep shock at the death penalty verdict and is awaiting the detailed judgment.

- They are in contact with the family members and the legal team while exploring all legal options.

- India attaches high importance to this case and is committed to providing consular and legal assistance.

- Consular Access:

- The men were granted consular access on multiple occasions, and the Indian ambassador to Qatar met them as recently as October 1.

- However, both sides have maintained a veil of secrecy over the case due to its sensitive nature.

- Impact on India-Qatar Relations:

- The verdict represents the first major crisis in the India-Qatar relationship, which has generally been steady.

- The relationship is of high economic importance, with India being a major importer of liquefied natural gas (LNG) and other products from Qatar.

- The verdict could potentially strain these economic ties and relations.

- Qatar is a significant supplier of LNG to India, constituting over 48% of India’s global LNG imports, and also provides other essential products.

About India-Qatar Relations

- India was among the few countries that recognized Qatar shortly after its independence in 1971.

- Expatriate Community:

- One of the most significant aspects of India-Qatar relations is the presence of a large Indian expatriate community in Qatar.

- This community, comprising both skilled and unskilled labor, has played a pivotal role in Qatar’s economic development and is a binding force in the bilateral relationship.

- Indian community is the largest expatriate group in Qatar which is estimated to be around 700 million people.

- Bilateral Trade:

- Bilateral trade for the financial year 2020-21 reached approximately $9.21 billion.

- Qatar’s exports to India amounted to $7.93 billion, while Indian exports to Qatar totaled $1.2 billion.

- Key Exports:

- Qatar’s exports to India include LNG, LPG, chemicals, petrochemicals, plastics, and aluminum articles.

- India’s exports to Qatar include cereals, copper articles, iron and steel articles, vegetables, fruits, spices, processed food products, machinery, plastic products, construction materials, textiles, garments, chemicals, precious stones, and rubber.

- Energy Trade:

- Qatar is the largest supplier of LNG to India, contributing over 40% of India’s global LNG imports.

- An agreement between Petronet LNG and Qatar’s RasGas Co. Ltd secured an additional supply of 1 million tonnes of LNG annually, extending until 2028.

- Direct Shipping Lines:

- The opening of direct shipping lines called the “India Qatar Express Service” has facilitated a substantial increase in Qatar’s imports from India.

- These shipping lines connect Hamad Port in Qatar with Mundra (Gujarat) and NhavaSheva Port (Maharashtra) in India.

- Connectivity:

- India and Qatar have well-established air connectivity with direct flights operated by airlines such as Air India, Air India Express, Indigo, Vistara, GoAir, and Qatar Airways.

- These direct flights connect various international airports in India and Doha, ensuring ease of travel and cargo transport between the two countries.

The T.N. experience on caste survey

(General Studies- Paper II)

Source : TH

The Bihar caste-based survey has sparked calls for a nationwide census on caste and discussions about exceeding the 50% reservation limit.

- Tamil Nadu’s historical experience with a caste census is examined to understand its implications for Other Backward Class (OBC) reservations.

Key Highlights

- Formation of the Second Backward Classes Commission:

- In January 1980, the AIADMK-led government in Tamil Nadu, under M.G. Ramachandran, raised the reservation for Backward Classes (BCs) from 31% to 50%.

- This led to a total of 68% reservations (which later increased to 69% with STs getting an additional 1% in 1990).

- The decision faced legal challenges in the Supreme Court, leading to the government’s undertaking to set up a panel to review the enumeration and classification of BCs.

- The Second Backward Classes Commission was constituted in October 1982, with J.A. Ambasankar, the former Chairman of the Tamil Nadu Public Services Commission, as its head.

- Highlights of the Commission’s Work:

- The commission conducted a Socio-Educational-cum-Economic Survey in two stages during 1983-84.

- In the first stage, a door-to-door enumeration was carried out to accurately enumerate and classify BCs.

- The previous Sattanathan Commission had relied on the 1921 Census and projected it over 50 years, which the Ambasankar Commission found inadequate.

- The Ambasankar Commission identified 298 communities, categorizing them under groups like BCs, Most BCs, Denotified Communities (DNCs), Scheduled Castes (SCs), Scheduled Tribes (STs), and others.

- The focus of the commission was primarily on BCs, without providing a comprehensive breakdown of all communities.

- The Commission estimated the BC population to be 67.15% of the state’s total population, accounting for 3,35,70,805 people.

- SCs constituted 92,08,917, STs 5,54,918, and others 66,56,103.

- In March 1989, the Commission allocated an exclusive 20% quota for Most Backward Classes (MBCs) and DNCs within the total 50% share for BCs.

- The Commission also conducted surveys of students in schools and colleges and evaluated the representation of BCs in public services as of July 1, 1983.

- Key Recommendations of the Commission

- Quantum of Reservation:

- There were differences between the Chairman and the majority of members regarding the quantum of reservation for Backward Classes (BCs).

- Ambasankar suggested reducing the BC reservation to 32% to avoid exceeding the 50% ceiling for total reservations, while dissenting members argued that the reservation should be at least 50% since the BC population was approximately 67%.

- Coverage of Reservations:

- Ambasankar proposed the creation of two separate lists of BCs, one for Article 15(4) and another for Article 16(4) of the Indian Constitution.

- The former deals with special provisions for socially and educationally backward classes, while the latter pertains to reservations in jobs for any backward class that is “not adequately represented” in public services.

- The majority of members favored a single list, asserting that social and educational backwardness were intertwined, and educational benefits under Article 15(4) were a means to secure benefits under Article 16(4) for job opportunities.

- Inclusion and Deletion of Communities:

- The Commission recommended the inclusion of 29 communities and the deletion of 24 communities from the list of BCs.

- Impact of the 1992 Supreme Court Judgment:

- In 1992, following the Supreme Court’s judgment in the Mandal Commission case, the Tamil Nadu government was compelled to enact a law to protect the 69% reservation for BCs, SCs, and STs by placing it under the Ninth Schedule of the Indian Constitution.

- During 2007-09, the DMK government provided 3.5% reservation each for Muslims and Christians within the BC quota.

- However, the separate quota for Christians was later withdrawn.

- In May 2009, Arunthathiyars, a constituent of Scheduled Castes (SCs), were granted 3% reservation within the 18% quota for the SCs.

- In February 2021, the AIADMK government passed a bill in the Assembly, providing for 10.5% reservation for Vanniyars or Vanniyakula Kshatriyas in education and employment within the overall 20% reservation for Most Backward Classes (MBCs).

- However, the Supreme Court invalidated the law a year later, citing that the data from the Ambasankar panel were not contemporaneous, leading to the reservation being struck down.

- Quantum of Reservation:

Article 15(4) and Article 16(4) of the Indian Constitution

- Article 15(4):

- Article 15 of the Indian Constitution prohibits discrimination on grounds of religion, race, caste, sex, or place of birth.

- However, Clause 4 of Article 15 allows the state to make special provisions for the advancement of socially and educationally backward classes.

- This means that the government can provide reservations or special treatment to individuals or groups who are considered socially and educationally disadvantaged.

- These provisions can include reservations in educational institutions and in public employment.

- Article 16(4):

- Article 16 of the Indian Constitution deals with equality of opportunity in matters of public employment.

- It prohibits discrimination on similar grounds as Article 15.

- Article 16(4) allows the state to make reservations in favour of backward classes of citizens who are not adequately represented in public services.

- This means that the government can reserve a certain percentage of job positions in the public sector for individuals from socially and educationally backward classes who are underrepresented in these positions.

Supreme Court allows surrogacy, strikes down rule banning use of donor gametes

(General Studies- Paper II and III)

Source : TH

The Supreme Court has intervened to protect the right to parenthood of a woman who suffers from Mayer RokitanskyKuster Hauser (MRKH) syndrome, a rare medical condition that causes the absence of ovaries and a uterus.

Key Highlights

- Challenging the Amendment:

- The woman and her husband had initiated the surrogacy process using a donor on December 7 last year.

- A government notification on March 14, 2023, amended the surrogacy law, prohibiting the use of donor gametes, stating that “intending couples” must use their own gametes for surrogacy.

- The woman filed a petition in the Supreme Court, challenging the amendment as a violation of her right to parenthood.

- Woman’s Choice and Retrospective Implementation:

- The lawyer representing the couple emphasized that Rule 14(a) of the Surrogacy Rules clearly stated that the choice to opt for surrogacy was solely that of the woman.

- The client had initiated the surrogacy process months before the amendment to the law, making it clear that the amendment could not be applied retrospectively.

- Government’s Argument:

- The government, presented by Additional Solicitor General AishwaryaBhati, argued that surrogacy under the law required the child to be “genetically related” to the intending couple, thereby exempting the use of donor eggs.

- Court’s Ruling:

- The court, in its 11-page order, agreed with the argument put forth that gestational surrogacy was primarily centered on the woman’s circumstances.

- The Court acknowledged that the amendment hindered the couple’s ability to achieve parenthood through surrogacy.

- The decision to opt for surrogacy is based on the woman’s inability to become a mother due to medical or congenital conditions, including the absence of a uterus or conditions that make pregnancy life-threatening or impossible to carry to term.

- The Supreme Courtfound that the amendment contradicted the main provisions of the Surrogacy Act and was against the intended purpose of the Act, both in form and substance.

- The court held that the amendment could not contradict Rule 14(a), which explicitly recognizes the absence of a uterus or related conditions as valid medical indications necessitating gestational surrogacy.

- Addressing the government’s contention about genetic relation, the court clarified that the child would be considered genetically related to the husband.

- Therefore, the expression “genetically related to the intending couple” should be understood as related to the husband when Rule 14(a) is applicable.

About Mayer-Rokitansky-Küster-Hauser (MRKH) syndrome

- Mayer-Rokitansky-Küster-Hauser (MRKH) syndrome, also known as Müllerian agenesis or congenital absence of the uterus and vagina, is a rare congenital condition that primarily affects the female reproductive system.

- This syndrome is named after the physicians who first described it.

- One of the defining characteristics of MRKH syndrome is the absence or underdevelopment of the uterus (womb) and the upper part of the vagina.

- This condition is often not apparent until a girl reaches adolescence and does not menstruate, which is usually the first sign of a problem.

Summary of the Surrogacy (Regulation) Act 2019

The act defines surrogacy as the practice where a woman gives birth to a child for an intending couple with the intention to hand over the child after birth to the intending couple.

- Regulation of Surrogacy:

- The Bill prohibits commercial surrogacy but allows altruistic surrogacy.

- Altruistic surrogacy involves no monetary compensation to the surrogate mother other than covering medical expenses and insurance during pregnancy.

- Commercial surrogacy includes surrogacy undertaken for monetary benefit exceeding basic medical expenses and insurance.

- Purposes for Permitted Surrogacy:

- Surrogacy is permitted when it is for intending couples with proven infertility, is altruistic, not for commercial purposes, not for producing children for sale, prostitution, or exploitation, and is for conditions or diseases specified through regulations.

- Eligibility Criteria for Intending Couples:

- Intending couples should have a ‘certificate of essentiality’ and a ‘certificate of eligibility’ issued by the appropriate authority.

- A certificate of essentiality is issued based on infertility certification, an order of parentage and custody, and insurance coverage.

- A certificate of eligibility is issued to Indian citizens married for at least five years, within specified age ranges (between 23 to 50 years old (wife) and 26 to 55 years old (husband)), with no surviving child (biological, adopted, or surrogate), and other conditions as per regulations.

- Eligibility Criteria for Surrogate Mother:

- The surrogate mother should be a close relative of the intending couple, a married woman with a child of her own, within a specific age range (25 to 35 years old), surrogating only once, and possess a certificate of medical and psychological fitness.

- She cannot provide her own gametes for surrogacy.

- Appropriate Authority:

- Central and state governments appoint appropriate authorities within 90 days of the Bill becoming an Act.

- Appropriate authorities have functions related to registration of surrogacy clinics, enforcing standards, investigating breaches, and recommending modifications.

- Registration of Surrogacy Clinics:

- Surrogacy clinics must be registered by the appropriate authority to undertake surrogacy-related procedures.

- Clinics must apply for registration within 60 days from the date of the appointment of the appropriate authority.

- National and State Surrogacy Boards:

- The central and state governments constitute National Surrogacy Board (NSB) and State Surrogacy Boards (SSB).

- NSB advises the central government, lays down clinic conduct, and supervises SSBs.

- Parentage and Abortion of Surrogate Child:

- A child born through surrogacy is deemed to be the biological child of the intending couple.

- Abortion of the surrogate child requires the written consent of the surrogate mother and authorization from the appropriate authority, following the Medical Termination of Pregnancy Act, 1971.

- The surrogate mother can withdraw from surrogacy before embryo implantation.

- Offenses and Penalties:

- Offenses under the Bill include undertaking or advertising commercial surrogacy, exploiting the surrogate mother, abandoning or exploiting a surrogate child, and selling or importing human embryo or gametes for surrogacy.

- Penalties for offenses include imprisonment up to 10 years and a fine up to 10 lakh rupees, with a range of offenses and penalties for contraventions of the Bill’s provisions.

Widening Tax Base in India: CBDT report

(General Studies- Paper III)

Source : TH

India’s tax base has significantly expanded since 2013-14, with more individuals moving up the income ladder and an increase in the number of income tax returns filed.

Key Highlights

- Growth in Individual Tax Returns

- The number of income tax returns filed by individuals has risen from 3.36 crore to 6.37 crore over the assessment years 2013-14 to 2021-22.

- Expanding Tax Base Across Income Ranges

- In the income range up to ₹5 lakh, the number of returns filed increased from 2.62 crore in AY 2013-14 to 3.47 crore in AY 2021-22, marking a 32% increase.

- For higher income ranges of ₹5 lakh to ₹10 lakh and ₹10 lakh to ₹25 lakh, the number of individual returns filed surged by 295% and 291%, respectively, over the same period.

- This trend suggests that individual taxpayers are moving towards higher income brackets.

- Changing Income Distribution

- The proportionate contribution of the top 1% of individual taxpayers to gross total income decreased from 15.9% to 14.6%.

- The share of the bottom 25% of taxpayers increased slightly from 8.3% to 8.4% during the same period.

- The middle 74% group’s proportion of gross total income increased from 75.8% to 77%.

- The average gross total income for individual taxpayers increased from about ₹4.5 lakh to about ₹7 lakh over nine years, representing a 56% increase.

- The increase in average gross total income for the top 1% of individual taxpayers was 42%, while for the bottom 25%, it was 58%.

- Impact on Tax Collections

- The data reflects robust growth in the gross total income of individuals across different income groups since AY 2013-14.

- This growth is reflected in the increase in net direct tax collections from ₹6.38 lakh crore in 2013-14 to ₹16.61 lakh crore in 2022-23.

- As of now, 7.41 crore income tax returns have been filed this year, including 53 lakh first-time tax filers.

About Central Board of Direct Taxes (CBDT)

- The Central Board of Direct Taxes (CBDT) is a statutory authority that operates under the Department of Revenue in the Ministry of Finance, Government of India.

- It is responsible for administering and enforcing direct tax laws in India.

- The CBDT was established by the Central Board of Revenue Act, 1963.

- It replaced the earlier Central Board of Revenue and took over the responsibilities related to direct taxes.

- The CBDT is headed by a Chairman, who is usually a senior Indian Revenue Service (IRS) officer.

- The board comprises several members, each responsible for specific functions such as revenue, legislation, investigation, and other critical areas related to taxation.

- The CBDT has jurisdiction over the entire country and plays a central role in ensuring uniform administration of direct taxes throughout India.

- Functions:

- Formulating policies and procedures for the administration of direct taxes in India.

- Implementing and enforcing the provisions of the Income Tax Act and other direct tax laws.

- Supervising and controlling the functioning of the Income Tax Department.

- Collecting and analyzing tax revenue data.

- Conducting tax assessments, audits, and investigations.

- Providing guidance and clarifications to taxpayers on tax matters.

- Developing and implementing tax policies and initiatives to promote compliance and revenue collection.