CURRENT AFFAIRS – 22/04/2024

- CURRENT AFFAIRS – 22/04/2024

- IRDAI removes age bar for purchasing health insurance

- India chooses to ‘regulate’, not ban, single-use plastic

- What are the new Green Credit Programme rules?

- Net direct tax collections exceed 2023-24 target

- Preparing India for water stress, climate resilience

- Global Economic Outlook

- On the fall in household savings

CURRENT AFFAIRS – 22/04/2024

IRDAI removes age bar for purchasing health insurance

(General Studies- Paper III)

Source : The Hindu

The Insurance Regulatory and Development Authority of India (IRDAI) has made a significant policy shift, eliminating the age limit previously imposed on purchasing health insurance policies.

- Effective from April 1, this decision aims to extend health benefits to the elderly population.

Key Highlights

- Prior Restrictions and Current Mandate

- Previously, individuals above the age of 65 were barred from buying new health insurance policies.

- However, with the latest directive from IRDAI, there is no longer an age restriction.

- Additionally, insurance providers are now required to develop specialized policies tailored for senior citizens.

- These policies must include dedicated channels for addressing claims and grievances specific to this demographic.

- It is expected that this policy change could lead to better healthcare access and reduced medical expenditure burdens for individuals aged 65 and above.

About the Insurance Regulatory and Development Authority of India (IRDAI)

- The Insurance Regulatory and Development Authority of India (IRDAI) is a statutory body established under the jurisdiction of the Ministry of Finance, Government of India.

- Its primary role is to regulate and license the insurance and re-insurance industries in India.

- IRDAI was constituted by the Insurance Regulatory and Development Authority Act, 1999, an Act of Parliament passed by the Government of India.

- The agency’s headquarters are in Hyderabad, Telangana, where it moved from Delhi in 2001.

- IRDAI is a 10-member body including the chairman, five full-time and four part-time members appointed by the government of India.

- The current chairman is Debasish Panda, IAS.

- IRDAI has been instrumental in implementing various regulations and guidelines to ensure the smooth functioning of the insurance industry in India.

- Objectives:

- The primary objective of IRDAI is to protect the interests of policyholders while ensuring the orderly growth and development of the insurance industry in India.

- Regulatory Functions:

- IRDAI regulates various aspects of the insurance business, including licensing and registration of insurance companies, setting guidelines for insurance products and services, overseeing insurance intermediaries such as agents and brokers, and ensuring compliance with legal and financial requirements.

- IRDAI also plays a crucial role in ensuring the cybersecurity and information security of insurance companies.

- The authority has issued the IRDAI Information and Cyber Security Guidelines, 2023, and the Master Guidelines on Anti-Money Laundering/ Counter Financing of Terrorism (AML/CFT), 2022, to ensure the security and integrity of the insurance industry in India.

India chooses to ‘regulate’, not ban, single-use plastic

(General Studies- Paper III)

Source : The Hindu

Ahead of the upcoming week-long negotiations in Toronto, Canada, involving 192 countries to address plastic pollution, India’s position is in favor of regulating single-use plastic rather than outright eliminating it, according to an analysis by the Centre for Science and Environment (CSE), a New Delhi-based not-for-profit organization.

Key Highlights

- India’s Plastic Regulations

- In 2022, India implemented the Plastic Waste Management Amendment Rules (2021), which banned 19 categories of single-use plastics.

- These include disposable plastic items like cups, spoons, earbuds, decorative thermocol, and wrapping or packaging film.

- Notably, plastic bottles and multi-layered packaging boxes, such as those used in milk cartons, were not included in the ban.

- However, enforcement of the ban varies across the country, with many outlets continuing to sell banned plastic items.

- Basis of Plastic Ban

- The decision to ban certain types of plastic while excluding others stems from a report by an expert committee on single-use plastics, commissioned by the Department of Chemicals and Petrochemicals.

- The committee evaluated different plastic goods based on their utility and environmental impact, leading to the current ban.

- However, the ban only covers approximately 11% of single-use plastics in India, according to the CSE report.

- International Deliberations

- During the upcoming negotiations, one of the topics countries will discuss is “problematic and avoidable plastic products, including single-use plastics.”

- The aim is to implement global and national measures to address these products, which are harmful to the environment and human health.

- This includes removing such products from the market, reducing production through alternative practices or non-plastic substitutes, and redesigning items to meet sustainable and safe criteria.

- India’s Position in Negotiations

- According to the CSE analysis, India has opted for language in the current version of the negotiating document, known as a ‘zero draft,’ that supports regulating rather than prohibiting the production, sale, import, and export of problematic and avoidable plastic goods.

- However, India has agreed to establish science-based criteria for identifying such plastics, indicating a commitment to addressing plastic pollution through informed decision-making and regulatory measures.

- Global Positions on Plastic Regulation

- Countries like the European Union advocate for strict restrictions on the production and sale of problematic plastic categories, aligning with efforts to curb plastic pollution.

- Conversely, the United States shares a position closer to India’s, advocating for each country to develop its own list of problematic and avoidable plastic goods rather than enforcing a blanket ban.

- India, along with most countries, holds varying positions on 16 other issues related to plastic production, waste management, trade, and the use of alternative plastics.

- These stances are influenced by factors such as the importance of plastic production to the economy, recycling capabilities, and waste management infrastructure.

- Global Efforts and Challenges

- The journey toward eliminating plastic pollution began with a resolution passed by the United Nations Environment Assembly (UNEA) in 2022 to end plastic pollution.

- Subsequently, an Intergovernmental Negotiating Committee (INC) was established to develop a legally binding global treaty governing plastic production and usage.

- Stalled Negotiations

- Despite extensive discussions and negotiations, the world faces significant challenges in reaching an agreement on addressing plastic waste.

- The fourth round of negotiations in Canada indicates a lack of consensus on dealing with the plastic waste menace.

- Economic Interests vs. Environmental Concerns

- According to CSE, many oil, gas, and plastic-producing nations are reluctant to reduce the production of primary/virgin plastics.

- Some member states prioritize protecting economic interests over public health concerns, weakening the provisions of the draft treaty.

- Environmental Impact of Plastic Production

- Plastic production has doubled over the last two decades, with 99% of plastics derived from non-renewable hydrocarbons.

- This production process contributes significantly to greenhouse gas emissions, with plastic production alone accounting for 90% of these emissions in 2019.

About the Plastic Waste Management Amendment Rules (2021)

- The Plastic Waste Management (Amendment) Rules, 2021, were notified on August 12, 2021, by the Ministry of Environment, Forest, and Climate Change, Government of India, with the primary objective of prohibiting identified single-use plastic items that have low utility and high littering potential by 2022.

- The amendment rules aim to address the adverse impacts of littered plastic on both terrestrial and aquatic ecosystems, in line with the clarion call given by Prime Minister Narendra Modi to phase out single-use plastic by 2022.

- The amendment rules prohibit the manufacture, import, stocking, distribution, sale, and use of specific single-use plastic items, including polystyrene and expanded polystyrene, from July 1, 2022.

- These items include earbuds with plastic sticks, plastic flags, plastic sticks for balloons, ice-cream sticks, candy sticks, polystyrene for decoration, cups, plates, cutlery like spoons, forks, straws, wrapping/packing films around sweet boxes, trays, cigarette packets, and invitation cards, glasses, plastic or PVC banners less than 100 microns, stirrers, and commodities made of compostable plastic are excluded from the prohibition.

- In addition to the prohibition of single-use plastic items, the amendment rules also increase the thickness of plastic carry bags.

- With effect from September 30, 2021, the thickness of plastic carry bags has been increased from 50 microns to 75 microns, and thereafter, from 75 microns to 120 microns with effect from December 31, 2021.

- This increase in thickness is aimed at stopping littering due to lightweight plastic carry bags and enabling reuse.

- The amendment rules also carry out amendments relating to marking or labeling.

- The producer or brand owner of the carry bags is required to mention the information like name, registered number, and thickness of the carry bags, and this information needs to be mentioned on the plastic packing as well.

- Multi-layered packaging used for imported goods is excluded from the requirement of mentioning the name and registered number of the manufacturer.

- The amendment rules also define the terms “Non-woven plastic bags” and “Plastic waste processing.”

- The term “Non-woven plastic bags” means a non-woven plastic bag made up of any of the following which is bonded by mechanical or chemical or thermal means- Plastic sheet; or Web structure fabric of entangled plastic fibers.

- The term “Plastic waste processing” is defined as a process, wherein, plastic waste is handled for any of the following purposes- Reuse, Recycling, Transformation in new product, or Co-processing.

- Extended Producer Responsibility (EPR):

- The amendment strengthens the EPR framework, making producers, importers, and brand owners responsible for the collection, segregation, and management of plastic waste generated from their products.

- Producers are required to establish systems for the collection and recycling of plastic waste and contribute to the development of the waste management infrastructure.

- Registration of Producers:

- Producers, importers, and brand owners of plastic products are required to register with the State Pollution Control Boards (SPCBs) or Pollution Control Committees (PCCs) to comply with the extended producer responsibility requirements.

- This registration ensures accountability and facilitates monitoring and enforcement of the regulations.

- The amendment empowers ULBs to enforce the provisions of the Plastic Waste Management Rules within their jurisdictions.

- ULBs are responsible for ensuring compliance with waste segregation, collection, and disposal practices, as well as imposing penalties on violators.

What are the new Green Credit Programme rules?

(General Studies- Paper III)

Source : The Hindu

The Green Credit Programme (GCP) was officially introduced in October 2023 as part of the broader vision of Mission Life, championed by Prime Minister Narendra Modi.

- It aims to promote sustainability, reduce waste, and enhance the natural environment by incentivizing voluntary environmental conservation actions through an innovative, market-based mechanism.

Key Highlights

- Programme Objectives and Mechanism

- The GCP encourages individuals, organizations, and both public and private companies to invest in various environmental sectors such as afforestation, water conservation, air pollution control, waste management, and mangrove conservation.

- In return for their investments, participants become eligible to receive ‘green credits’.

- These credits serve as a measure of their contribution to environmental conservation.

- Administration and Oversight

- The Indian Council of Forestry Research and Education (ICFRE), an autonomous body under the Environment Ministry, is tasked with administering the programme.

- The ICFRE defines methodologies for calculating green credits generated by different environmental activities and manages a trading platform for the exchange of these credits.

- Afforestation Initiative and Rules

- In February, the Ministry outlined rules governing the first initiative under the GCP, focusing on afforestation.

- Under this initiative, companies, organizations, and individuals can finance afforestation projects in specific degraded forest and wasteland areas.

- State forest departments are responsible for carrying out the actual tree planting activities.

- After two years, each planted tree undergoes evaluation by the ICFRE, and if successful, earns one ‘green credit’.

- Current Status and Participation

- Thirteen state forest departments have offered 387 land parcels totaling nearly 10,983 hectares of degraded forest land for afforestation projects.

- Public sector companies such as Indian Oil, Power Grid Corporation of India, National Thermal Power Corporation, Oil India, Coal India, and National Hydropower Corporation have reportedly registered to invest in the programme.

- Successful participants receive an estimate of the costs involved in afforestation upon meeting the criteria outlined by the Ministry.

- Recent Modifications and Prioritization

- On April 12, the Environment Ministry issued additional guidelines for the GCP, emphasizing the restoration of ecosystems over merely planting trees.

- This modification reflects a shift towards a more holistic approach to environmental conservation under the programme.

- Controversies Surrounding the Green Credit Programme

- Despite not being fully operational, the Green Credit Programme (GCP) has faced criticism on several fronts.

- Critics argue that the programme commodifies environmental conservation, which conflicts with India’s forest conservation laws.

- These laws mandate industries permitted to clear forests for non-forestry purposes to provide equivalent non-forest land to forest authorities and finance afforestation on that land.

- Under the GCP, companies can exchange green credits for complying with compensatory afforestation requirements.

- Critics view this as potentially reducing forest diversion requirements for mining and infrastructure projects.

- Moreover, planting trees does not automatically enhance ecosystems, as India’s diverse forest types require careful consideration.

- Planting unsuitable tree species could lead to invasive species proliferation or disrupt ecosystem sustainability.

- Additionally, the programme allows green credits for carbon sequestration activities, but the precise equivalence between these activities remains unclear and controversial.

- Government’s Response and Guidelines

- The Ministry has issued guidelines for states to calculate the cost of restoring degraded forest landscapes, addressing concerns over insufficient tree density requirements.

- The previous requirement of 1,100 trees per hectare has been adjusted, recognizing that some degraded forests may not support such density and allowing states to specify suitable standards.

- Preference is given to indigenous species to restore ecosystems, although quantifying the contributions of shrubs and grasses towards green credits remains a challenge.

- Pilot Project Mode and Clarifications

- The GCP is currently operating as a pilot project, with ongoing efforts to address questions surrounding the quantification of shrubs and grasses in terms of green credits.

- Companies cannot offset all their compensatory afforestation obligations using green credits but can claim a portion of it.

- This clarification aims to balance environmental conservation goals with industry requirements.

About the Indian Council of Forestry Research and Education (ICFRE)

- The Indian Council of Forestry Research and Education (ICFRE) is an autonomous organization under the Ministry of Environment, Forests, and Climate Change, Government of India.

- Established in 1986, ICFRE is headquartered in Dehradun and is responsible for directing and managing research, education, and extension activities in the forestry sector in India.

- It is the largest organization responsible for forestry research in the country.

- ICFRE has a mandate to organize, direct, and manage research and education in the forestry sector, including cooperation with international bodies like FORTIP (UNDP/FAO Regional Forest Tree Improvement Project), UNDP, and the World Bank on economically important species.

- The council has 9 research institutes and 4 advanced centers strategically located across different bio-geographical regions in India to cater to the research needs of diverse ecosystems.

- The key functions of ICFRE include conservation, protection, regeneration, rehabilitation, and sustainable development of natural forest ecosystems.

- The council is actively involved in revegetation efforts on barren, waste, marginal, and mined lands.

- It also focuses on developing new varieties and clones of trees for farm forestry and agroforestry to meet the increasing demand for wood and timber.

- ICFRE also plays a crucial role in providing technical skills to forest dwellers, guiding them in enhancing their livelihood opportunities through better utilization of forest resources.

- The council has established Van VigyanKendras in various states to extend the benefits of ICFRE technologies to farmers and forest-dependent communities.

Net direct tax collections exceed 2023-24 target

(General Studies- Paper III)

Source : The Hindu

India’s net direct tax collections for the fiscal year 2023-24 witnessed significant growth, reaching ₹19.58 lakh crore.

- This surpasses the revised estimates, marking a 17.7% increase from the previous fiscal year.

- Notably, the surge in personal income taxes (PIT) played a pivotal role, accounting for 53.3% of the total tax kitty, while corporate taxes’ contribution decreased to 46.5%.

Key Highlights

- Breakdown of Contributions

- Personal income taxes experienced a notable rise, increasing their share from 50.06% in the previous year to 53.3% in 2023-24.

- Conversely, corporate taxes’ contribution declined from 49.6% to 46.5%.

- The final fortnight of the financial year saw a notable uptick in net tax collections, primarily driven by PIT and securities transaction tax (STT) collections, while net corporate tax collections saw a slight decrease.

- PIT and STT receipts exhibited robust growth, nearly double that of corporate taxes.

- Gross corporate tax collections increased, but net receipts after adjusting for refunds showed a slight decline.

- Prior to refunds, gross PIT and STT collections grew 24.3% while gross corporate tax collections grew 13.06% in 2023-24.

- After adjusting for refunds, however, corporate tax receipts reflected only a 10.26% growth over 2022-23 figures.

- On the other hand, net PIT and STT receipts rose 25.33%, almost two and a half times quicker than corporate taxes’ growth.

- Gross direct tax kitty for 2023-24 stood at ₹23.37 lakh crore, reflecting an 18.5% growth.

- Performance Against Estimates

- The Budget Estimates (BE) for direct tax revenue in 2023-24 were initially set at ₹18.23 lakh crore but were revised to ₹19.45 lakh crore.

- The provisional direct tax collections exceeded the BE by 7.40% and the Revised Estimates (RE) by 0.67%.

What is Net direct tax?

- Net direct tax refers to the total amount of direct taxes collected by the government from individuals and entities, after deducting refunds.

- Direct taxes are levied on individuals or entities directly by the government, based on their ability to pay.

- The most common forms of direct taxes in India include income tax, corporate tax, and wealth tax.

- The Central Board of Direct Taxes (CBDT) is the authority that governs the direct taxation system in India.

- The CBDT is responsible for the administration of direct taxes, and it is governed by the Department of Revenue.

Preparing India for water stress, climate resilience

(General Studies- Paper II)

Source : The Hindu

The India Meteorological Department (IMD) predicts a hotter summer with longer heat waves from April to June, signaling potential water stress issues.

- Traditionally, acute stresses like heatwaves or water scarcity have been treated as temporary crises, often addressed through disaster relief measures.

- However, there’s a growing need to shift from reactive panic responses, such as seen during the water crisis in Bengaluru, towards understanding and addressing the chronic nature of these risks.

Key Highlights

- Urgency for Long-Term Response

- It’s imperative to recognize that climate action cannot be confined to specific sectors or businesses, nor can environmental sustainability be reduced to short-term initiatives like tree plantation drives.

- This Earth Day, observed on April 22, should serve as a wake-up call.

- The intertwined relationship between climate and economy demands a holistic approach.

- The economic production frontier will either expand or contract based on how effectively we manage the intersections between land, food, energy, and water resources.

- India’s Water Resources and Climate Vulnerability

- India, with 18% of the global population but only 2.4% of the Earth’s surface area, faces significant water resource challenges.

- Despite being home to just 4% of global freshwater resources, nearly half of its rivers are polluted, and many primary reservoirs are operating at significantly reduced capacity.

- Compounding this issue, India is the world’s largest consumer of groundwater.

- Moreover, three-quarters of the country’s districts are considered hotspots for extreme climate events.

- Shift in Disaster Preparedness Paradigm

- While India has invested substantially in disaster preparedness, the evolving nature of climatic shocks demands a reevaluation of strategies.

- Climate change brings both sudden shocks, such as heavy rainfall or rapid declines in water availability, and slow-onset but recurring stresses like changes in soil water retention and rainfall trends.

- Hence, relying solely on seasonal disaster preparedness and responses is inadequate in addressing the emerging climate risks.

- Water’s Integral Role in the Economy

- Interconnected Systems

- Water plays a crucial role in various sectors of the economy, yet historically, its significance has been overlooked, with natural resources often treated in isolation.

- However, water serves as a vital link connecting hydrological, food, and energy systems, impacting millions of people.

- Impact on Agriculture

- Both blue (surface and groundwater) and green (soil moisture and vegetation) water are essential for agriculture, influencing crop irrigation, harvests, and overall productivity.

- Agriculture remains a significant employer, employing around 45% of India’s population.

- However, it faces increasing climate vulnerability, with changing rainfall patterns affecting crop cycles and agricultural practices.

- Clean Energy Transition

- Water is a critical component of the global clean energy transition.

- Green hydrogen production, vital for decarbonizing industries and transportation, relies on water and renewable energy sources.

- Pumped storage hydropower, acting as a natural battery, plays a crucial role in balancing the power grid load, ensuring reliability in clean energy systems.

- Climate Crisis and Hydrometeorological Disasters

- The climate crisis exacerbates hydrometeorological disasters, with almost 75% of natural disasters in the past two decades being water-related.

- In India, the frequency of flood-associated events has surged, posing significant challenges.

- Additionally, freshwater, considered one of the nine planetary boundaries crucial for Earth’s stability, has been compromised.

- Ingredients of Water Security

- Policy Integration for Water Governance

- Achieving water security in India requires policies that acknowledge the interconnectedness of water with food and energy systems.

- While India has implemented numerous policies, many fail to recognize this nexus during planning and implementation.

- For example, the expansion of green hydrogen production must consider water availability.

- Similarly, scaling up solar irrigation pumps should assess its impact on groundwater levels.

- Policies need to incorporate the food-land-water nexus by integrating localized evidence and community engagement.

- Judicious Use of Water Resources

- India must focus on the prudent utilization of blue and green water through effective water accounting and efficient reuse.

- Initiatives like the National Water Mission aim to increase water use efficiency by 20% by 2025, while schemes like Atal Mission on Rejuvenation and Urban Transformation (AMRUT) 2.0 target reducing non-revenue water in urban areas.

- However, these efforts lack baseline data for water use, hindering accurate quantification of progress.

- Water accounting is crucial for promoting efficiency and incentivizing investments in treated wastewater reuse.

- Financial Instruments for Climate Adaptation

- Leveraging financial tools is vital to secure funding for climate adaptation in the water sector.

- Despite significant focus on climate mitigation, investments in adaptation, particularly in water and agriculture, remain relatively small in India.

- There’s a need to increase funding for adaptation-specific interventions, such as wastewater management and climate-resilient agricultural practices.

- Financial innovations like India’s Green Credit Programme can bridge the adaptation funding gap by encouraging investments in relevant infrastructure.

- Progress Towards Water Security

- While overnight systemic change is unrealistic, incremental steps can be taken towards coherence in water, energy, and climate policies.

- Establishing data-driven baselines is essential for increasing water savings, while enabling new financial instruments and markets can facilitate investments in adaptation.

- A water-secure economy lays the foundation for a climate-resilient future.

- Policy Integration for Water Governance

- Interconnected Systems

About Earth Day

- Earth Day is an annual event held on April 22 to demonstrate support for environmental protection.

- It was first held in 1970 and is now coordinated globally by Earthday.org, which includes events in more than 193 countries.

- The official theme for 2024 is “Planet vs. Plastics.”

- Origin:

- The first Earth Day was held on April 22, 1970, in the United States, initiated by Senator Gaylord Nelson, who was concerned about the environmental degradation caused by pollution and the lack of environmental regulations.

- It led to the creation of the Environmental Protection Agency (EPA) and the passage of various environmental laws in the United States.

- In 1990, Earth Day went international, with events in 141 nations.

- On Earth Day 2016, the landmark Paris Agreement was signed by 120 countries.

- Earth Day is an important event for raising awareness about environmental issues and promoting action to protect the planet.

- It is a time for individuals, communities, and governments to come together and take steps to reduce their environmental impact and create a more sustainable future.

- Earth Day is also an opportunity to educate people about the importance of environmental protection and to inspire them to take action in their daily lives.

- org is the official organization that coordinates Earth Day events worldwide.

- The organization is committed to ending plastic pollution and advocating for a 60% reduction in the production of all plastics by 2040.

- org also promotes climate and environmental literacy, civic education, and strong government policies to address the climate crisis.

Global Economic Outlook

(General Studies- Paper III)

Source : The Hindu

Despite facing several adverse shocks and significant central bank interest rate increases aimed at restoring price stability, the global economy has managed to avoid a debilitating recession.

- The IMF has revised its forecast for worldwide aggregate growth in 2024 to 3.2%, up from the 2.9% projected in October.

- Advanced economies, particularly led by the U.S., have played a crucial role in underpinning demand and sustaining growth momentum.

Key Highlights

- Widening Economic Disparities

- However, the IMF highlights a growing gap between low-income developing countries and the rest of the world.

- These nations, particularly in Africa, Latin America, Pacific islands, and Asia, have experienced downward revisions in growth forecasts and upward revisions in inflation.

- They have also suffered the most significant scarring from the COVID-19 pandemic, struggling to recover amidst mounting debt service burdens.

- Impact on Poverty and Development

- The World Bank, in a separate report, notes a historic reversal of development, with half of the world’s 75 poorest countries experiencing a widening income gap with wealthier economies.

- This trend marks a concerning setback, especially considering that these countries are home to a quarter of humanity and 90% of people facing hunger or malnutrition.

- Many of these nations are stuck in what could potentially be labeled as ‘a lost decade’, with governments paralyzed by debt distress.

- Call for International Support

- The Chief Economist of the World Bank Group emphasizes the importance of financial support from wealthier nations to aid the poorest countries.

- He cites examples of successful transitions from borrowers to donors, such as South Korea, China, and India, underscoring the potential for economic growth when supported adequately.

- It’s crucial for the world to rally behind these nations, as universal peace and prosperity require tapping into every reserve of economic potential, including those of the most vulnerable populations.

About IMF and World Bank

- International Monetary Fund (IMF):

- Establishment:

- The IMF was established in 1944 during the United Nations Monetary and Financial Conference, also known as the Bretton Woods Conference, held in Bretton Woods, New Hampshire, USA.

- Purpose:

- The primary purpose of the IMF is to promote international monetary cooperation, exchange rate stability, balanced growth of international trade, and financial stability.

- It aims to facilitate the expansion and balanced growth of international trade and contribute to the promotion and maintenance of high levels of employment and real income.

- Functions:

- The IMF provides policy advice, financial assistance, and technical assistance to its member countries.

- It conducts economic surveillance, monitors global economic developments, provides policy recommendations, and offers financial support to member countries facing balance of payments problems.

- Membership:

- The IMF has 190 member countries.

- Each member country contributes funds to the IMF, which are used to provide financial assistance to countries in need and to maintain the stability of the international monetary system.

- Governance:

- The IMF is governed by its Board of Governors, which consists of representatives from each member country.

- The day-to-day operations of the IMF are managed by its Executive Board, which is composed of 24 Executive Directors representing member countries or groups of countries.

- Headquarters:

- The headquarters of the IMF is located in Washington, D.C., United States.

- World Bank:

- Establishment:

- The World Bank was established in 1944 during the Bretton Woods Conference along with the IMF.

- Its primary goal was to provide financial and technical assistance for the reconstruction of war-torn Europe after World War II.

- Purpose:

- The World Bank aims to reduce poverty and promote sustainable development by providing financial assistance, technical expertise, and policy advice to developing countries.

- It focuses on areas such as infrastructure development, education, healthcare, agriculture, and environmental protection.

- Institutions: The World Bank Group consists of five institutions:

- The International Bank for Reconstruction and Development (IBRD)

- The International Development Association (IDA)

- The International Finance Corporation (IFC)

- The Multilateral Investment Guarantee Agency (MIGA)

- The International Centre for Settlement of Investment Disputes (ICSID)

- Functions:

- The World Bank provides loans, grants, and technical assistance to its member countries to support development projects and programs.

- It also conducts research and analysis on development issues, publishes reports and policy papers, and promotes knowledge sharing and capacity building.

- Membership:

- The World Bank has 189 member countries.

- Membership is open to any country that subscribes to the World Bank’s Articles of Agreement and meets certain eligibility criteria.

- Governance:

- The World Bank is governed by its Board of Governors, which consists of representatives from each member country.

- The Board of Governors delegates authority to the Board of Executive Directors, which is responsible for the day-to-day operations of the World Bank.

- Headquarters:

- The headquarters of the World Bank is located in Washington, D.C., United States.

- Establishment:

- Establishment:

On the fall in household savings

(General Studies- Paper II)

Source : The Hindu

There has been significant concern over the decline in household savings in India, particularly highlighted by the sharp reduction in net financial savings, leading to a four-decade low in the household net financial savings to GDP ratio.

- Despite a marginal recovery in physical savings, the overall trend in household savings has been on a downward trajectory.

Key Highlights

- Factors Influencing Lower Financial Savings

- Consumption Expenditure Financing

- Households may opt to finance additional consumption expenditure by either increasing borrowing or depleting their gross financial savings.

- This strategy, while reducing net financial savings, can stimulate aggregate demand and output, providing a short-term boost to the economy.

- Tangible Investment Financing

- Higher tangible (physical) investment by households can also lead to a reduction in net financial savings, as they may choose to finance such investments through borrowing or depleting their financial assets.

- This reduction still stimulates aggregate demand and output through the investment channel.

- Impact of Interest Rates

- An increase in interest payments, possibly due to higher interest rates, can contribute to lower net financial savings for households.

- To meet the increased burden, households may resort to borrowing or depleting their financial savings, resulting in a reduction in net financial savings.

- Consumption Expenditure Financing

- Implications for Aggregate Demand and Output

- While a decline in net financial savings may seem concerning from a savings perspective, it can provide a short-term stimulus to aggregate demand and output.

- By financing additional consumption or tangible investment, households contribute to economic activity, albeit at the expense of their financial reserves.

- Analysis of Factors Contributing to the Decline in Household Savings

- Limited Role of Consumption Expenditure

- The sharp reduction in gross financial savings in 2022-23 cannot be attributed to changes in consumption patterns, as the consumption to GDP ratio remained largely unchanged between 2021-22 and 2022-23, hovering around 60.95% and 60.93% respectively.

- Limited Influence of Tangible Investment

- While the decline in gross financial savings was accompanied by a slight increase in household physical investment to GDP ratio, the impact of tangible investment on the reduction in savings was minimal.

- The ratio increased only by 0.3 percentage points from 12.6% to 12.9%, compared to the 3 percentage point decline in gross financial savings to GDP ratio.

- Role of Higher Borrowing and Interest Payments

- The reduction in gross financial savings can largely be attributed to higher borrowing and increased interest payments by households.

- The spike in household borrowing to income ratio in 2022-23 reflects this trend, leading to a decline in the ratio between physical savings and gross financial savings.

- Implications of Higher Debt Burden

- Concerns about Debt Repayment and Financial Fragility

- The rise in household debt burden raises concerns about debt repayment and financial stability.

- Household debt sustainability depends on the difference between interest rates and income growth rates.

- Failure to meet debt repayment commitments could negatively impact the financial sector’s income and balance sheets, potentially leading to reduced credit disbursement and affecting the macroeconomy.

- Impact on Financial Sector and Macroeconomy

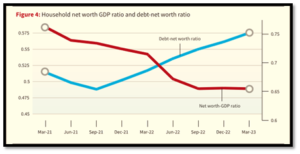

- Figure 3 illustrates the difference between the weighted average lending rate of scheduled commercial banks and the growth rate of gross national income.

- This metric provides insights into the sustainability of household debt repayment and its potential implications for the financial sector and macroeconomic stability.

- The indicator reflecting the difference between the weighted average lending rate of commercial banks and the growth rate of gross national income has shown a declining trend since 2021-22, turning negative in the 2023-24 period.

- This decline is primarily attributed to a lower income growth rate and a higher lending rate by commercial banks, driven by the tight monetary policy stance of the RBI and a sharp rise in the call money rate.

- Implications on Consumption Demand

- Impact of Household Wealth and Debt

- Consumption expenditure of households is influenced not only by disposable income but also by their wealth, debt, and interest rates.

- A reduction in household wealth may lead to lower consumption as households prioritize saving to preserve their wealth.

- Effect of Higher Household Debt

- Higher household debt can dampen consumption expenditure in two ways.

- Firstly, increased leverage may signal higher default risk, leading banks to reduce credit disbursement, thereby affecting consumption negatively.

- Secondly, higher debt burdens can directly reduce consumption due to increased interest payments, exacerbated by higher interest rates.

- Trends in Indian Economy

- The Indian economy has witnessed these trends in recent years, with a sharp decline in household financial wealth relative to GDP and a rise in household leverage, indicated by the debt to net worth ratio.

- Consequently, the growth rate in private final consumption expenditure during 2023-24 experienced a significant decline compared to the previous year.

- Impact of Household Wealth and Debt

- Concerns about Debt Repayment and Financial Fragility

- Limited Role of Consumption Expenditure

- Implications for Aggregate Demand and Output

- Macroeconomic Implications of Household Leverage

- Increasing Vulnerability of Households

- The trend of procyclical leverage by households, along with a shift in the composition of assets in their balance sheets, raises concerns about their vulnerability.

- Both flow indicators (liabilities to disposable income) and stock indicators (debt to net worth) demonstrate an increasing trend, indicating heightened vulnerability among households.

- Risks of Higher Interest Rates

- Policies advocating higher interest rates to counter inflation may exacerbate household debt levels, potentially leading to a debt trap.

- As households accumulate more debt on their balance sheets, higher interest rates could further strain their financial situation, impacting consumption and overall economic growth.

- Impact on Consumption and Aggregate Demand

- High interest rates can adversely affect household consumption, which in turn has implications for aggregate demand.

- As households grapple with increasing debt burdens, their ability to spend on goods and services may diminish, posing challenges for sustaining economic growth.

- Structural Changes in the Economy

- The changing composition of household balance sheets, particularly towards financial assets, reflects broader structural changes in the economy.

- This shift suggests a move towards financialization, transitioning from a production-based economy to one driven more by monetary or financial exchanges.

- However, this transformation may render the economy jobless and fragile, potentially undermining efforts to achieve a robust five-trillion-dollar economy.

- Increasing Vulnerability of Households