CURRENT AFFAIRS – 17/04/2024

CURRENT AFFAIRS – 17/04/2024

Navigating life as a consumer with disability

(General Studies- Paper II)

Source : The Hindu

Every year on March 15, World Consumer Rights Day is celebrated to raise awareness about consumer rights.

- However, the rights of consumers with disabilities often remain overlooked in these discussions.

Key Highlights

- Challenges Faced by Consumers with Disabilities:

- Consumers with Disabilities encounter various challenges such as inaccessible transportation booking apps, lack of tactile pavements in the supermarket, and difficulty contacting customer support due to inaccessible contact details.

- These challenges lead to a loss of dignity, independence, and privacy for persons with disabilities.

- Pervasive inaccessibility not only undermines their right to lead an independent life but also hinders their equal participation in society.

- Responsibility and Capacity for Change:

- Businesses play a crucial role in addressing the accessibility issues faced by consumers with disabilities.

- Currently, many businesses do not perceive persons with disabilities as their target consumers, resulting in inaccessible offerings designed for mainstream consumers.

- However, considering that persons with disabilities make up a significant portion of the population (5-8% in India), businesses have the opportunity to broaden their customer reach by making their offerings accessible.

- Government Initiatives for Accessibility:

- The government plays a crucial role in bridging the gap in sensitization among businesses through effective policy measures.

- For instance, the Food Safety and Standards Authority of India (FSSAI) issued an advisory in October 2023, requiring all food products to incorporate QR codes containing product information.

- This step enables people with visual impairment to access crucial product information independently.

- However, broader accessibility guidelines for all goods and services could be beneficial, drawing inspiration from initiatives in countries like Australia, the U.S., and Canada.

- Legal Safeguards for Consumers with Disabilities:

- Rights of Persons with Disabilities Act (RPWDA), 2016:

- The RPWDA grants various rights, including equality, accessibility, and reasonable accommodation.

- It includes provisions for universally designed consumer goods and accessible services.

- Violations can be addressed through complaints filed with Disability Commissions, although their recommendations may not always result in effective redress.

- Consumer Protection Act (CPA), 2019:

- The CPA empowers Consumer Commissions to impose penalties and award compensation for consumer complaints.

- Consumers with disabilities have obtained remedies through Consumer Commissions, such as compensation for encountering inaccessibility at a cinema hall.

- However, the CPA lacks dedicated rights for consumers with disabilities, unlike the RPWDA.

- Aligning Legal Frameworks:

- Aligning the CPA with the RPWDA is essential to ensure effective protection for consumers with disabilities.

- While the CPA offers robust enforcement and compliance mechanisms, incorporating dedicated rights for consumers with disabilities would encourage them to seek redress through Consumer Commissions.

- Rights of Persons with Disabilities Act (RPWDA), 2016:

About the Rights of Persons with Disabilities Act (RPWD Act), 2016

- The Rights of Persons with Disabilities Act (RPWD Act), 2016, is a legislation that promotes and protects the rights and dignity of people with disabilities in various aspects of life, including educational, social, legal, economic, cultural, and political spheres.

- The Act applies to government, non-government, and private organizations, and it has mandates and timelines for ensuring accessibility of infrastructure and services.

- Types of Disabilities:

- The act recognizes 21 types of disabilities, including blindness, low vision, leprosy cured persons, hearing impairment, locomotor disability, dwarfism, intellectual disability, mental illness, autism spectrum disorder, cerebral palsy, muscular dystrophy, chronic neurological conditions, specific learning disabilities, multiple sclerosis, speech and language disability, thalassemia, hemophilia, sickle cell disease, multiple disabilities including deaf blindness, acid attack victims, and Parkinson’s disease.

- Disability Definition:

- The act defines disability based on an evolving and dynamic concept, emphasizing the interaction between long-term physical, mental, intellectual, or sensory impairments and barriers that hinder effective and equal growth in society.

- Benchmark Disabilities:

- The act provides additional benefits for persons with benchmark disabilities and those with high support needs.

- All children with benchmark disabilities between 6 and 18 years shall have the right to free education.

- Accessibility:

- The act stresses ensuring accessibility in public buildings within a prescribed time frame, aligning with the Accessible India campaign.

- Guardianship:

- The act introduces a joint decision-making provision for guardianship, with district courts or any authority designated by the state government making decisions.

- Penalties:

- The act imposes penalties for violating its provisions, with fines of up to Rs. 10,000 for the first offense and up to Rs. 5,000 for each subsequent offense.

- Implementation Mechanisms:

- The act establishes implementing mechanisms like Disability Commissioner’s Offices at the Centre and State level, District Committees, Boards and Committees for planning and monitoring the implementation of the Act, and Special Courts at the District level.

- Reservation:

- The act increases the reservation for people with benchmark disabilities from 3% to 4% in government jobs and from 3% to 5% in higher education institutions.

- Central and State Advisory Boards on Disability:

- These boards are set up as policy-making bodies to ensure the rights of people with disabilities.

Reforms needed in the voting process

(General Studies- Paper II)

Source : The Hindu

The Supreme Court’s decision to hear petitions seeking 100% cross-verification of VVPAT slips with the vote count as per EVMs reflects ongoing concerns about the integrity and transparency of the electoral process in India.

- This move underscores the importance of addressing these issues to ensure public confidence in the electoral system.

Key Highlights

- The initial voting process in India, during the first two general elections of 1952 and 1957, involved placing a separate box for each candidate with their election symbol.

- However, from the third election onwards, the introduction of ballot papers with candidate names and symbols allowed voters to stamp their choice on the ballot paper.

- The Electronic Voting Machine (EVM) was introduced on a trial basis in 1982 in the Paravur Assembly constituency in Kerala.

- Over time, EVMs were gradually deployed in more regions, with a significant expansion during the Assembly elections of Tamil Nadu, Kerala, Puducherry, and West Bengal in 2001.

- Subsequently, EVMs were used in all 543 constituencies during the 2004 general elections to the Lok Sabha.

- Legal Framework and Paper Trail:

- The Supreme Court has consistently upheld the validity of using EVMs in elections through various judgments.

- Notably, in the case of Subramanian Swamy versus Election Commission of India (2013), the Supreme Court emphasized the necessity of a paper trail for ensuring free and fair elections.

- Consequently, the 2019 elections witnessed the use of EVMs backed with 100% Voter Verifiable Paper Audit Trail (VVPAT) in all constituencies.

- International Practices:

- Several western democracies, including England, France, The Netherlands, and the U.S., have reverted to paper ballots for their elections after trials with EVMs in the last two decades.

- For instance, Germany’s Supreme Court declared the use of EVMs in elections unconstitutional in 2009.

- Brazil is among the countries that continue to use EVMs for their elections.

- Among India’s neighbors, Pakistan does not use EVMs, while Bangladesh experimented with EVMs in a few constituencies in 2018 but reverted to paper ballots for the general elections in 2024.

- Features of EVMs:

- Electronic Voting Machines (EVMs) have revolutionized the electoral process, offering several advantages.

- Firstly, they have significantly reduced the risk of booth capturing by limiting the rate of vote casting, making it more difficult to stuff false votes.

- Secondly, EVMs have eliminated the issue of invalid votes that was prevalent with paper ballots, streamlining the counting process.

- Thirdly, the eco-friendly nature of EVMs, by reducing paper consumption, is particularly beneficial in a country with a massive electorate like India.

- Lastly, EVMs provide administrative convenience to polling officers and expedite the counting process, ensuring accuracy and efficiency.

- Mechanisms to Uphold Integrity:

- To maintain the integrity of the electoral process, several mechanisms are in place.

- These include random allocation of EVMs to booths before polls, conducting mock polls to verify the correctness of EVMs and Voter Verifiable Paper Audit Trail (VVPAT) systems, and sharing the serial numbers of EVMs and total votes polled with agents of candidates for verification during vote counting.

- Challenges and Doubts:

- Despite its benefits, doubts about the functioning of EVMs have been raised by political parties and civil society activists.

- The most common allegation is their susceptibility to hacking due to their electronic nature.

- However, the Election Commission of India (ECI) has reiterated that EVMs are standalone devices without external connectivity, making them secure from hacking.

- Way Forward:

- In order to enhance the transparency and robustness of the electoral process, certain measures can be adopted.

- Firstly, the sample size for matching EVM count with VVPAT slips should be determined scientifically, possibly by dividing each state into larger regions.

- Any error detected in this process should prompt a full counting of VVPAT slips for the concerned region.

- Additionally, the introduction of “totaliser” machines could aggregate votes from multiple EVMs before revealing candidate-wise counts, providing greater anonymity and security for voters at the booth level.

- These measures would bolster confidence in the integrity of the electoral process while ensuring transparency and fairness.

About the Voter Verifiable Paper Audit Trail (VVPAT)

- The Voter Verifiable Paper Audit Trail (VVPAT) is a method used during elections to provide a paper trail for votes cast electronically.

- It is employed in conjunction with Electronic Voting Machines (EVMs) to enhance the transparency and credibility of the electoral process.

- VVPAT allows voters to verify that their vote has been accurately recorded by the EVM by providing them with a physical paper receipt of their vote.

- The VVPAT system consists of two parts:

- the VVPAT Printer and the VVPAT Status Display Unit (VSDU).

- Voter Verification:

- When a voter casts their vote using an EVM, a paper slip containing the details of the candidate and the symbol chosen by the voter is printed out by the VVPAT printer attached to the EVM.

- This paper slip is displayed behind a transparent window for a few seconds (typically around 7 seconds) for the voter to verify.

- Verification by Voter:

- The voter is expected to visually inspect the printed paper slip to ensure that the details match their chosen candidate.

- If the printed details are accurate, the voter can be assured that their vote has been correctly registered by the EVM.

- Paper Trail:

- Once the verification process is complete, the paper slip is automatically cut and dropped into a sealed container attached to the EVM, creating a physical record of the vote.

- These paper slips serve as a paper trail that can be used for audit and verification purposes in case of disputes or recount requests.

- Counting and Verification:

- After the voting process is concluded, the paper slips stored in the sealed containers are used for cross-verification during the counting process.

- Election officials can manually tally the paper trail with the electronic vote count recorded by the EVMs to ensure the accuracy of the results.

Why has India allowed FIIs to invest in its green bonds?

(General Studies- Paper III)

Source : The Hindu

The Reserve Bank of India (RBI) has granted approval for Foreign Institutional Investors (FIIs), including entities such as insurance companies, pension funds, and sovereign wealth funds, to invest in India’s Sovereign Green Bonds (SGrBs).

- These bonds are a form of government debt specifically allocated to finance projects aimed at accelerating India’s transition to a low carbon economy.

Key Highlights

- Contribution to Green Transition:

- This move expands the capital pool available to fund India’s ambitious goals of achieving net zero emissions by 2070, as pledged by Prime Minister Narendra Modi at COP26 in Glasgow in 2021.

- These goals include ensuring that 50% of India’s energy comes from non-fossil fuel sources and reducing the carbon intensity of the nation’s economy by 45%.

- Previous Issuance of SGrBs:

- The RBI had previously issued Sovereign Green Bonds worth ₹16,000 crore in two tranches in January and February of the previous year.

- These bonds, with maturities in 2028 and 2033, were oversubscribed on both occasions.

- However, the primary participants were domestic financial institutions and banks, limiting the avenues for government borrowing.

- Additionally, these green Government-Securities (G-Secs) were classified under the Statutory Liquidity Ratio (SLR), further restricting their accessibility.

- Encouragement of Green Investments:

- SGrBs typically yield lower interest rates compared to conventional G-Secs, resulting in what is termed as a “greenium.”

- Despite this, central banks and governments worldwide are urging financial institutions to embrace green investments to expedite the transition to a sustainable future.

- Climate finance experts believe that allowing FIIs to invest in India’s green G-Secs would be beneficial.

- FIIs are seeking to diversify their green investment portfolios, especially with considerable regulatory support in developed countries.

- Opportunities for FIIs and India:

- This move presents an opportunity for FIIs to invest in India’s green G-Secs, potentially gaining green credentials, especially when such investments may not be readily available in their home markets.

- India’s successful implementation of the Sovereign Green Bonds Framework in late 2022 has addressed concerns regarding greenwashing, further enhancing the appeal of these investments to FIIs.

- Introduction to the Green Taxonomy Gap:

- In the 2022-23 Union Budget, Finance Minister Nirmala Sitharaman announced the issuance of Sovereign Green Bonds (SGrBs) to fund various government projects aimed at promoting sustainability, such as offshore wind harnessing, grid-scale solar power production, and the transition to battery-operated Electric Vehicles (EVs).

- However, a significant gap existed in the absence of a green taxonomy, a system for evaluating investments based on their environmental or emissions credentials, to ensure that projects funded through SGrBs genuinely contribute to sustainability objectives and avoid greenwashing.

- Addressing the Gap: India’s SGrB Framework:

- To bridge this gap, the Finance Ministry introduced India’s first Sovereign Green Bond Framework on November 9, 2022.

- This framework outlined the types of projects eligible for funding through SGrBs, including investments in renewable energy projects (such as solar, wind, biomass, and hydropower), public lighting improvements (e.g., LED replacements), construction of low-carbon buildings, energy efficiency retrofits for existing buildings, initiatives to reduce electricity grid losses, promotion of public transport, subsidies for EV adoption, and the development of EV charging infrastructure.

- Validation and Assessment:

- To ensure credibility and alignment with international standards, the government sought validation of India’s SGrB Framework from Norway-based validator Cicero, which compared it with the green principles outlined by the International Capital Market Association (ICMA).

- Cicero rated India’s framework as “green medium” with a score indicating “good governance.”

- This validation underscores the importance of establishing robust frameworks to guide green investments and prevent greenwashing.

- Importance of Identifying New Green Projects:

- According to the World Resources Institute (WRI), it is crucial to identify new green projects with credible audit trails and significant impact to effectively utilize the proceeds from SGrBs.

- These projects should focus on areas that have received limited private capital, such as Distributed Renewable Energy and clean energy transition finance for Micro, Small, and Medium Enterprises (MSMEs).

- This highlights the need for continuous identification and promotion of high-impact green initiatives to maximize the positive environmental outcomes of SGrB-funded projects.

What is greenium?

- When investors are willing to accept lower yields for green bonds compared to conventional bonds issued by the same issuer, it reflects a preference for investments that contribute to environmental sustainability and social responsibility.

- This lower yield indicates a premium or “greenium” that investors are willing to pay for the environmental and social benefits associated with green bonds.

What is greenwashing?

- Greenwashing is a deceptive marketing practice where a company, organization, or entity falsely claims to be environmentally friendly or to engage in sustainable practices to appeal to environmentally conscious consumers.

- Essentially, it involves misleading or exaggerated claims about the environmental benefits of a product, service, or business process.

About India’s first Sovereign Green Bond Framework

- India’s first Sovereign Green Bond Framework was approved by the Government of India on November 9, 2022, marking a significant step towards sustainability and climate action.

- The framework outlines the categories of projects for which the proceeds from green investments will be utilized, focusing on environmental objectives like increasing energy efficiency, clean transportation, reducing carbon emissions, promoting climate change adaptation, sustainable water and waste management, and pollution prevention and control.

- These projects aim to significantly reduce the economy’s carbon footprint and contribute to India’s environmental sustainability goals.

Imported inflation

(General Studies- Paper III)

Source : The Hindu

Imported inflation refers to the phenomenon where the prices of goods and services in a country rise due to an increase in the price or cost of imports into the country.

- This rise in imported prices can contribute to overall inflation within the economy.

Key Highlights

- Factors Contributing to Imported Inflation:

- Fall in the Rupee:

- A significant factor contributing to imported inflation is a depreciation in the value of the country’s currency.

- When a country’s currency depreciates, its residents need to exchange more of their local currency to purchase the necessary foreign currency for importing goods and services.

- As a result, the cost of imported items increases, leading to higher prices for consumers.

- Rise in Import Costs:

- Even without a depreciation in the currency, a rise in the costs of imports can lead to imported inflation.

- For example, an increase in international crude oil prices due to a decrease in oil output can raise costs for countries that rely on imported oil.

- This increase in input costs can then cause prices to rise across the economy.

- Relation to Cost-Push Inflation:

- The concept of imported inflation is closely related to cost-push inflation, where rising input costs result in higher prices for final goods and services.

- In the case of imported inflation, the increase in import costs acts as a driver for overall inflation within the economy.

- Impact of Global Factors:

- The Asian Development Bank recently warned that India could face imported inflation due to the potential depreciation of the rupee amidst rising interest rates in the West.

- When interest rates increase in developed countries, it often leads to currency depreciation in developing nations, making imports more expensive and contributing to inflation.

- Critique of the Relationship Between Input Costs and Prices:

- Critics argue against the idea that rising input costs inevitably lead to higher prices for goods and services.

- While it may seem intuitive that businesses adjust prices in response to increased costs, critics assert that this perspective overlooks the dynamics of consumer demand in determining prices.

- Customer Demand Determines Prices:

- From an economic standpoint, critics argue that it’s not input costs that determine prices, but rather the prices customers are willing to pay for final goods and services.

- Businesses set prices based on what they believe consumers will pay, rather than simply reflecting increases in input costs.

- Imputation of Value:

- The concept of imputation of value suggests that the value of inputs is determined by the demand for final consumer goods and services.

- Austrian economist Carl Menger elaborated on this idea in his book “Principles of Economics” in 1871.

- In essence, the value of inputs is derived from the value of the final output.

- Role of Currency Depreciation:

- Even in the case of import costs rising due to currency depreciation, critics argue that this phenomenon is driven by changes in consumer demand rather than simply reflecting higher input costs.

- Currency depreciation occurs when there is a greater demand for foreign currency relative to the local currency.

- Therefore, the resulting increase in import costs can be attributed to changes in nominal demand for imported goods.

- Fall in the Rupee:

Understanding Inflation

- Inflation refers to the rate at which the general level of prices for goods and services in an economy rises over a period of time.

- It indicates a decrease in the purchasing power of money, meaning that each unit of currency buys fewer goods and services than it did before.

- Types of Inflation:

- Demand-Pull Inflation:

- This type of inflation occurs when demand for goods and services exceeds their supply.

- When demand outstrips supply, businesses may increase prices to capitalize on the situation, leading to a general rise in the price level across the economy.

- Cost-Push Inflation:

- Cost-push inflation occurs when the cost of production increases, leading to higher prices for goods and services.

- This can happen due to factors such as rising wages, increased production costs (e.g., raw materials, energy), or supply chain disruptions.

- Built-in Inflation:

- Built-in inflation is a result of past inflationary pressures.

- It occurs when workers demand higher wages to keep up with rising prices, leading to increased production costs for businesses.

- In turn, businesses raise prices to maintain profit margins, fueling further inflation.

- Structural Inflation:

- Structural inflation is caused by long-term imbalances in an economy, such as supply constraints, inefficiencies, or market distortions.

- These structural factors can lead to persistent inflationary pressures even in the absence of excessive demand.

- Demand-Pull Inflation:

India’s reliance on oil imports hits fresh full-year high in FY24

(General Studies- Paper III)

Source : The Indian Express

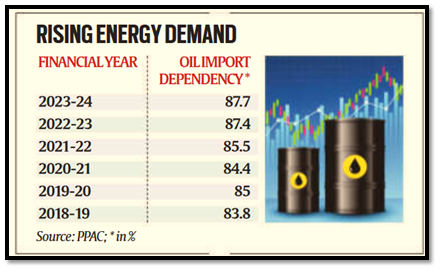

India’s dependence on imported crude oil reached a record high in the financial year 2023-24, with imports accounting for 87.7% of the country’s oil consumption.

- This trend has been on the rise due to escalating demand for fuel and petroleum products coupled with a decline in domestic oil production.

Key Highlights

- Historical Trends:

- Over the past few years, India’s reliance on oil imports has steadily increased, except for the financial year 2020-21 when demand was subdued due to the COVID-19 pandemic.

- The dependency stood at 85.5% in FY22, 84.4% in FY21, 85% in FY20, and 83.8% in FY19.

- Impact and Vulnerabilities:

- Heavy reliance on imported crude oil poses several challenges for the Indian economy.

- It makes the country vulnerable to fluctuations in global oil prices, which can impact trade deficit, foreign exchange reserves, the value of the rupee, and inflation rates.

- Government Efforts and Challenges:

- The Indian government has aimed to reduce the nation’s dependence on imported oil, setting targets to decrease reliance to 67% by 2022.

- However, sluggish domestic oil production has hindered progress toward this goal.

- Despite government initiatives and mentions in political manifestos, the dependency on oil imports has continued to grow.

- Efforts to Boost Domestic Crude Oil Output:

- The government has intensified efforts to increase domestic crude oil production by incentivizing exploration and production contracts and opening vast acreages for oil and gas exploration.

- However, the growth in domestic output has been modest compared to the surge in demand for petroleum products.

- Calculation of Import Dependence:

- The level of import dependence is computed based on domestic consumption of petroleum products, excluding exports.

- India’s refining capacity of over 250 million tonnes per annum positions it as a net exporter of petroleum products despite being one of the world’s largest crude oil consumers and importers.

- Domestic Consumption and Output Statistics:

- In the financial year 2023-24, India’s domestic consumption of petroleum products reached a record high of 233.3 million tonnes, indicating robust demand, particularly for transportation fuels like petrol and diesel.

- Extent of Self-Sufficiency:

- India’s self-sufficiency in crude oil stood at a mere 12.3% in FY24, down from 12.6% in FY23.

- Total petroleum product production from domestic crude oil amounted to 28.6 million tonnes, while consumption of products sourced from indigenous crude oil was 28.2 million tonnes, against a total domestic consumption of 223 million tonnes.