CURRENT AFFAIRS – 06/04/2024

CURRENT AFFAIRS – 06/04/2024

Parliaments past, a mirror to changing dynamics

(General Studies- Paper II)

Source : The Hindu

The 17th Lok Sabha concluded its proceedings on a Saturday, deviating from its usual working schedule, prompting reflection on historical parallels and anticipation for the upcoming general election.

Key Highlights

- Performance of Ministries:

- Reflecting on legislative activity, it’s evident that the nation’s polity is in flux.

- The Office of the Prime Minister faced a significant influx of questions from Rajya Sabha MPs, with only a fraction being answered.

- Interestingly, there’s a notable decline in queries directed at the Prime Minister’s Office in both houses, indicating diminishing interest in seeking answers from the executive office.

- Shift in Parliamentary Focus:

- Parliament’s focus has quietly shifted over the past three LokSabhas, revealing evolving interests and priorities among elected representatives.

- Notably, the Ministries of Health and Family, and Agriculture and Farmers’ Welfare have risen in prominence, becoming the top two Ministries with the highest number of questions.

- This underscores consistent monitoring of the country’s healthcare system, even preceding the COVID-19 pandemic.

- However, despite being the most questioned Ministries, there’s a marginal decline in the number of questions in the House of the People.

- Decline in National Security and Internal Affairs Focus:

- A significant revelation is the declining interest in matters of national security and internal affairs.

- The Ministry of Home Affairs, previously among the top two most questioned Ministries, has now faded into obscurity.

- It’s conspicuously absent from the top five most questioned Ministries in the Upper House, with a noticeable decline in notices.

- This shift raises concerns about the nation’s priorities, especially as crucial legislation awaits implementation.

- Ministry of Finance

- The Ministry of Finance, tasked with steering India’s fiscal destiny, has observed a decline in parliamentary interest, ranking fourth and fifth in the Rajya Sabha and Lok Sabha, respectively.

- Despite this, there’s a glimmer of hope with an increasing rate of questions admitted for deliberation, indicating a renewed focus on transparency and accountability in financial matters.

- Education Amidst COVID-19 Challenges:

- The COVID-19 pandemic has severely disrupted India’s educational landscape.

- However, amidst these challenges, a steadfast commitment to accountability and transparency remains.

- Education continues to be among the top five Ministries subjected to rigorous questioning, highlighting its enduring importance in parliamentary discourse.

- Despite education’s significant presence in parliamentary discourse, there’s a notable uptick in the number of questions disallowed, raising concerns about oversight efficacy in this vital sector.

- Trends in Question Disallowance:

- Delving into statistics, a pattern emerges. In the Lok Sabha, the percentage of disallowed questions has shown a downward trajectory across successive LokSabhas.

- However, in the Upper House, there’s a consistent growth in the percentage of disallowed questions.

- In the 17th Lok Sabha, Ministries such as Health and Family Welfare, Home Affairs, Defence, Agriculture and Farmers’ Welfare, and Finance accounted for a significant portion of disallowed questions in both houses, indicating systemic challenges in parliamentary oversight.

- Utilization of Parliamentary Interventions

- Surge in Usage of Zero Hour:

- One intervention that notably stands out amidst this transformation is the Zero Hour.

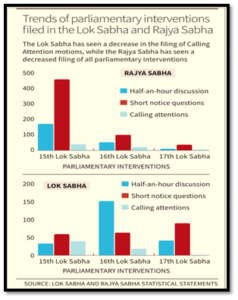

- Over the past 15 years, both the Rajya Sabha and Lok Sabha have witnessed a significant increase in its usage, with a remarkable 62% rise in the Rajya Sabha and a significant 34% increase in the Lok Sabha.

- This surge reflects a positive signal, indicating heightened focus on addressing pressing issues, grievances, and seeking clarifications from the government.

- Decline in Other Interventions:

- Concurrently, there has been a declining trend in the usage of interventions such as ‘Half-an-Hour Discussions’, ‘Short Notice Questions’, ‘Calling Attention’, ‘Short Duration Discussions’, and ‘Special Mentions’.

- Challenges and Limitations of Zero Hour:

- Despite its popularity and effectiveness in addressing key issues, Zero Hour has inherent limitations.

- To strike a balance, it is essential to leverage other interventions such as ‘Calling Attention’, ‘Short Duration’, and ‘Half-an-Hour’ discussions, which provide platforms for other members to participate, enhancing the quality of debate and facilitating amicable solutions.

- Performance of the 16th Lok Sabha:

- In summary, the 16th Lok Sabha demonstrated a relatively higher level of proactivity compared to other sessions.

- It exhibited notable performance in the admission of questions and discussions on various interventions within the House.

- Missed Opportunities in Parliamentary Oversight:

- Instances of oversight, such as the failure to raise privilege motions against misleading remarks, highlight a larger narrative urging accountability from the government.

- This lack of action underscores the need for a more robust mechanism to hold authorities accountable for their statements and actions.

- Missed Discussion on Sensitive Issues:

- During the Winter Session, 2023 of the Rajya Sabha, a crucial discussion on the sensitive issue of ‘Suicides among students due to competitive exams’ was missed.

- Despite the Chairman’s willingness to delve into legislative nuances on the topic, representatives failed to seize the opportunity to file for a half-hour discussion.

- Surge in Usage of Zero Hour:

Understanding the Parliamentary Procedures in the Indian Parliament

- Zero Hour:

- The Zero Hour is an informal parliamentary device available to members of the Indian Parliament.

- It occurs immediately after the Question Hour and extends until the regular agenda for the day commences.

- This period, known as zero hour, allows MPs to raise matters of urgent public importance without prior notice.

- Originating in 1962, it serves as an Indian innovation in parliamentary procedures, providing a platform for spontaneous discussions and clarifications.

- Calling Attention Motion:

- The Calling Attention Motion is a formal procedure mentioned in the Rules of Procedure of the Indian Parliament.

- Introduced by an MP, it aims to draw the attention of a minister to an urgent matter of public importance.

- The purpose is to solicit an authoritative statement from the minister regarding the matter raised.

- Unlike the Zero Hour, the Calling Attention Motion has a structured process and has been in existence since 1954.

- Half-an-Hour Discussion:

- Half-an-Hour Discussion is designed for deliberating on matters of significant public importance requiring clarification.

- The Speaker can allocate three days a week for such discussions, which do not involve formal motions or voting.

- It allows MPs to engage in detailed debates on topics that have undergone substantial public scrutiny.

- Short Duration Discussion:

- Short Duration Discussion, also known as a two-hour discussion, is another parliamentary procedure in the Indian Parliament.

- MPs can initiate these discussions on urgent matters of public importance.

- The Speaker can allocate two days a week for Short Duration Discussions, with a maximum time limit of two hours per discussion.

- Similar to Half-an-Hour Discussions, there are no formal motions or voting during Short Duration Discussions.

- Special Mention:

- Special Mention provides a platform for raising matters that do not fit into other parliamentary procedures.

- It is available in the Rajya Sabha, with its counterpart in the Lok Sabha known as ‘Notice (Mention) Under Rule 377’.

- Matters raised under Special Mention are not considered points of order and cannot be addressed during other parliamentary sessions.

- This procedural device allows MPs to highlight issues that may not have been addressed through other means, contributing to comprehensive parliamentary discussions.

Venky’s pushing antibiotics as poultry growth promoter

(General Studies- Paper III)

Source : The Hindu

The Bureau of Investigative Journalism (TBIJ) has uncovered troubling practices in the Indian poultry industry, specifically regarding the misuse of antibiotics by Venky’s, a major poultry producer.

Key Highlights

- Antibiotics for Growth Promotion:

- Venky’s is marketing antibiotics aimed at accelerating poultry growth, including drugs essential for human health.

- Additionally, the company is selling critically important antibiotics for “preventative use,” where healthy birds are administered drugs from a young age to prevent disease.

- Notably, its medicated poultry feed Tylomix contains tylosin, classified by the WHO as “critically important” to human medicine, though tylosin itself is purely for veterinary use.

- Another product, Amo-premix, contains amoxicillin, a drug commonly used to treat humans and also deemed highly important for human health by the WHO.

- Usage in Telangana Farms:

- Investigations by TBIJ revealed that at least two poultry farms in southern Telangana were using antibiotics as recommended by Venky’s, one for preventative purposes.

- This highlights the widespread adoption of these controversial practices.

- Previous Revelations and Government Response:

- In 2018, TBIJ exposed Venky’s for selling colistin as a growth promoter, prompting criticism and leading to a ban by the Indian government.

- Despite previous assurances from Venky’s that antibiotics were only used for therapeutic purposes, the latest investigation reveals a different reality.

- International Regulations and WHO Guidelines:

- The use of antibiotics for growth promotion is banned in the European Union and the U.S., while preventative use is restricted in the EU except in exceptional cases.

- The World Health Organization (WHO) has opposed both practices due to their potential to diminish the effectiveness of antibiotics in treating human infections.

- Overview of Venky’s Operations:

- Founded in 1971, Venky’s has expanded its presence significantly across India and supplies various fast-food restaurants, including KFC.

- The company operates in Punjab, Uttar Pradesh, Haryana, and other regions, engaging in multiple aspects of the poultry production chain.

- Venky’s slaughters tens of millions of birds annually and operates its hatcheries, feed mills, processing plants, and farms.

- It also sells birds to contract farmers who rear them for meat processing.

- Additionally, Venky’s supplies medicines, vaccines, and farm equipment.

- Concerns and Implications:

- The marketing of these products raises concerns about the potential misuse of critically important antibiotics in the poultry industry.

- While these drugs are intended for veterinary use, their inclusion in poultry feed for growth promotion and preventative purposes poses risks to human health by potentially diminishing the effectiveness of these antibiotics in treating bacterial infections.

- Also a concerning issue was that TBIJ was able to purchase Vendox and another antibiotic product containing “critically important” drugs from a specialized poultry pharmacist in south Telangana without veterinary prescriptions.

- Experts have continuously warned that unmonitored use of medically important antibiotics in the poultry sector for non-therapeutic purposes is a “recipe for disaster” and must be addressed promptly.

- Consequences of Antibiotic Overuse:

- The overuse of antibiotics in farms worldwide has led to the proliferation of drug-resistant food-borne pathogens like Salmonella, Escherichia coli, and Campylobacter.

- These pathogens can spread through contaminated meat and other food products.

- Impact of Antimicrobial Resistance (AMR):

- A significant study highlighted the global impact of AMR, estimating it caused at least 1.27 million deaths in 2019, surpassing HIV/AIDS and malaria.

- Antimicrobial-resistant infections were implicated in 4.95 million deaths, underscoring the urgency of addressing antibiotic overuse in agriculture.

What is Antimicrobial Resistance (AMR)?

- Antimicrobial Resistance (AMR) refers to the ability of microorganisms, such as bacteria, fungi, parasites, and viruses, to persist or grow in the presence of drugs designed to inhibit or kill them.

- This resistance develops when these microorganisms change or evolve in response to exposure to antimicrobial drugs, such as antibiotics, antifungals, antivirals, antimalarials, and anthelmintics.

- Microorganisms that develop AMR are sometimes referred to as “superbugs”.

- The development of AMR is a natural process that occurs over time due to genetic changes.

- However, the misuse and overuse of antimicrobials in both humans and animals have accelerated this process.

- Examples of misuse include taking antibiotics for viral infections like colds and flu, using antibiotics without professional oversight, and using antimicrobials in agriculture for growth promotion or disease prevention in healthy animals.

- AMR is a significant global public health threat, with at least 1.27 million people worldwide dying from resistant infections in 2019, and nearly 5 million deaths associated with antimicrobial resistance.

- In the United States, more than 2.8 million antimicrobial-resistant infections occur each year, resulting in over 35,000 deaths.

- The World Health Organization (WHO) has identified AMR as one of the most serious global public health threats of the 21st century.

- The consequences of AMR are far-reaching and severe. Resistant infections can be difficult, and sometimes impossible, to treat, leading to prolonged illness, disability, and death.

- Antimicrobial resistance also increases healthcare costs due to the need for more expensive drugs and prolonged care.

- In addition, AMR threatens medical advances dependent on the ability to fight infections using antibiotics, such as joint replacements, organ transplants, cancer therapy, and the treatment of chronic diseases like diabetes, asthma, and rheumatoid arthritis.

- Measures to control the emergence and spread of AMR include appropriate prescribing, community education, monitoring of resistance and healthcare-associated infections, and compliance with legislation on the use and dispensation of antimicrobials.

- The WHO has developed a global framework of interventions to slow the emergence and reduce the spread of AMR, including improving the use of antimicrobials in hospitals and communities, infection prevention and control, encouraging the development of appropriate new drugs and vaccines, and political commitment.

RBI to enable UPI for cash deposit

(General Studies- Paper III)

Source : The Hindu

The Reserve Bank of India (RBI) has proposed to enable Unified Payments Interface (UPI) for cash deposit facility, aiming to enhance customer convenience and reduce the cash-handling load on bank branches.

Key Highlights

- Benefits of UPI Integration:

- UPI, known for its popularity and convenience, has gained widespread acceptance among users.

- Following the success of UPI for card-less cash withdrawal at ATMs, RBI now aims to extend its benefits to cash deposit facilities.

- This move is expected to streamline cash deposit processes and improve overall banking efficiency.

- Current Cash Deposit Mechanism:

- Presently, cash deposit facilities are available only through the use of debit cards.

- However, with the proposed integration of UPI, customers will have an alternative method to deposit cash, thereby increasing flexibility and accessibility.

- Cash Deposit Machines (CDMs) deployed by banks play a vital role in enhancing customer convenience while reducing the burden of cash handling on bank branches.

- Integrating UPI into cash deposit facilities further improves accessibility and ease of use for customers.

- Proposal for PPIs and Third-Party UPI Applications:

- In addition to the UPI integration for cash deposits, RBI has proposed to permit linking of Prepaid Payment Instruments (PPIs) through third-party UPI applications.

- This move aims to provide more flexibility to PPI holders, allowing them to make UPI payments similar to bank account holders.

- Presently, UPI payments from bank accounts can be made through the bank’s UPI app or any third-party UPI application.

- However, this facility is not available for PPIs, which are restricted to using the issuer’s application for UPI transactions.

- The forthcoming instructions from RBI will address this limitation and provide guidance on linking PPIs through third-party UPI applications.

- RBI’s Measures to Facilitate Non-Resident Participation in Sovereign Green Bonds (SGrBs):

- The Reserve Bank of India (RBI) has taken steps to encourage wider non-resident participation in Sovereign Green Bonds (SGrBs).

- Eligible foreign investors in the International Financial Services Centre (IFSC) will now be permitted to invest in these bonds.

- A scheme for investment and trading in SGrBs by eligible foreign investors in IFSC is being notified separately in consultation with the Government and the IFSC Authority.

- This move aims to promote investment in green bonds and aligns with the government’s environmental objectives.

- Background on SGrBs Issuance:

- The issuance of Sovereign Green Bonds (SGrBs) by the Government of India was announced based on a directive in the Union Budget for FY 2022-23.

- These bonds were issued in January 2023 and were included in the government borrowing calendar for FY 2023-24.

- Introduction of Mobile App for RBI Retail Direct Scheme:

- The RBI has decided to introduce a mobile app for its RBI Retail Direct scheme, which was launched in November 2021.

- This scheme allows individual investors to maintain gilt accounts with the RBI and invest in government securities directly.

- The mobile app for the RBI Retail Direct scheme will provide investors with the convenience of managing their investments on-the-go.

- Investors will be able to buy and sell securities, participate in primary auctions, and trade securities through the NDS-OM platform via the mobile application.

- Distribution of Central Bank Digital Currencies (CBDCs)

- The Reserve Bank of India (RBI) has decided to distribute Central Bank Digital Currencies (CBDCs) through Non-bank Payment System Operators.

- This move aims to enhance accessibility and expand choices available to users, apart from testing the resiliency of the CBDC platform to handle multi-channel transactions.

- CBDC Pilots and Proposal for CBDC-Retail:

- Currently, CBDC pilots are underway in both the Retail and Wholesale segments, with more use-cases and participating banks.

- The RBI proposes to make CBDC-Retail accessible to a broader segment of users by enabling non-bank payment system operators to offer CBDC wallets.

- This approach seeks to sustainably increase access to CBDCs and assess the platform’s capability to handle transactions across multiple channels.

About Unified Payments Interface (UPI)

- Unified Payments Interface (UPI) is a real-time payment system in India that enables seamless money transfers from one bank account to another, using a unique UPI ID or a Virtual Payment Address (VPA).

- Developed by the National Payments Corporation of India (NPCI), UPI is designed to simplify the payment experience for individuals and businesses, allowing them to make online purchases, pay utility bills, and shop at brick-and-mortar stores through QR codes, VPAs, or UPI registered mobile numbers.

- UPI is a fast, real-time system that is available 24*7, 365 days a year, enabling money transfer and payments within seconds.

- It is one of the only payment systems that allows users or online merchants to request money by sending a message, requesting payment via the bank, a facility that is not available in old systems like NEFT & IMPS.

- UPI does not levy any extra charge for making payments or requesting money via UPI, making it an attractive option for peer-to-peer transactions.

- To send money, users use a UPI-enabled app and select the Pay or Send option, providing the recipient’s details such as UPI ID or mobile number, and the desired amount, then selecting the bank account or wallet from which the money is to be debited.

- To receive money, recipients log into the UPI-enabled app and select the collect or request money option, providing the payer’s Virtual Payment Address (VPA) and the desired amount, then selecting their bank account in which the money is to be credited.

What is Prepaid Payment Instruments (PPIs)?

- Prepaid Payment Instruments (PPIs) are a type of payment system that allows for the purchase of goods and services, financial services, and remittance facilities against the value stored within or on the instrument.

- PPIs can come in various forms, including payment wallets, smart cards, magnetic chips, vouchers, mobile wallets, and other instruments that can be used to access a prepaid amount.

- PPIs can be issued by banks and non-banks, with banks requiring approval from the RBI and non-banks being companies incorporated in India and registered under the Companies Act, 1956/2013.

- They can operate a payment system for issuing PPIs to individuals or organizations after receiving authorization from the RBI.

- PPIs offer several benefits, including greater financial inclusion, security, and convenience for users.

- They allow people to open digital accounts with minimal documentation and provide access to a wide range of financial services.

- PPIs also offer faster and smoother transactions, reducing waiting times and queues at banks and other financial institutions.

- However, they also pose risks, such as unauthorized transactions, and the RBI has issued guidelines to protect consumers and ensure the safety and security of financial transactions for consumers and businesses.

What are Sovereign Green Bonds (SGrBs)?

- Sovereign Green Bonds (SGrBs) are a type of government-issued bond in India that raise funds for green projects aimed at reducing carbon emissions and promoting environmental sustainability.

- The proceeds from these bonds are used to finance or refinance expenditure for eligible green projects that fall under predefined categories, such as renewable energy, energy efficiency, clean transportation, climate change adaptation, sustainable water and waste management, and pollution prevention and control.

- The Indian government issued its first tranche of SGrBs in January 2023, raising 80 billion worth of 10-year and 5-year green bonds.

- These bonds are classified as government securities and are similar to other debt instruments, with the key distinction being that the funds raised are specifically used for financing projects that contribute positively to the climate and environment

What are Central Bank Digital Currencies (CBDCs)?

- Central Bank Digital Currencies (CBDCs) are digital currencies issued and regulated by central banks.

- They are a virtual currency that is backed and issued by a central bank, and it is a claim on the central bank, similar to physical cash.

- In India, the Reserve Bank of India (RBI) has launched its CBDC, called the Digital Rupee or e₹.

- The Digital Rupee is a digital variant of physical currency, and it is issued by the RBI.

- The Digital Rupee is designed to provide a public option in the digital money and payments landscape, which is becoming increasingly digital.

- The Digital Rupee is issued by the RBI to financial entities called Token Service Providers (TSPs), which are the banks selected for the Digital Rupee Pilot Program.

- The TSPs then distribute the tokens to interested parties/customers.

- The digital Rupee tokens work in the same way as bank notes/coins, and you can use them in lieu of cash.

- You may store digital Rupees in your bank’s digital wallet CBDC-R app, and the digital wallet works in the same way as your cash wallet, except these transactions will be entirely paperless.

- Payments using CBDCs are final and thus reduce settlement risk in the financial system.

- The RBI has proposed to introduce an offline functionality in CBDC-R for enabling transactions in areas with poor or limited internet connectivity.

- Multiple offline solutions, both proximity and non-proximity-based, will be tested for this purpose across hilly areas, rural and urban locations.

- The Digital Rupee can be used for Person to Person (P2P) and Person to Merchant (P2M) transactions.

Prostate cancer cases in India set to double by 2040

(General Studies- Paper II)

Source : The Indian Express

A recent Lancet Commission paper highlights the alarming increase in prostate cancer cases in India, with projections indicating a sharp surge by 2040.

- The case of a 64-year-old general surgeon in Pune, diagnosed with an advanced stage of prostate cancer without early symptoms, underscores the challenges faced by many Indian men.

Key Highlights

- Projected Increase in Prostate Cancer Cases:

- According to projections by the International Agency for Research on Cancer, prostate cancer incidence in India is expected to double to approximately 71,000 new cases per year by 2040.

- Currently, prostate cancer accounts for three percent of all cancers in India, with an estimated 33,000-42,000 new cases diagnosed annually.

- Impact of Late Diagnosis:

- A significant proportion of prostate cancer patients in India are diagnosed in advanced stages, leading to poor prognosis and high mortality rates.

- About 65 percent of patients die due to the disease, emphasizing the urgent need for early detection and intervention.

- Global Projections and Impact:

- The Lancet Commission report projects a worldwide increase in prostate cancer cases, from 1.4 million per year in 2020 to 2.9 million per year by 2040, with low and middle-income countries experiencing the highest rise.

- Prostate cancer is identified as the fifth leading cause of cancer death among men globally, with around 375,000 deaths reported in 2020.

- Preventive Measures and Recommendations:

- Doctors advocate for preventive measures, suggesting that early testing for all men over 60, akin to breast screenings for women over 40, can significantly reduce mortality rates.

- Factors Contributing to Rising Cancer Cases in India:

- Several factors contribute to the increasing incidence of cancer in India.

- Ageing populations and longer life expectancy result in a higher number of older individuals, who are more susceptible to cancer.

- Additionally, corporate health checkups, which often include Prostate-Specific Antigen (PSA) tests, are leading to higher reported numbers of prostate cancer cases.

- Risk Factors for Prostate Cancer:

- The main risk factors for prostate cancer are age and genetics, which are further exacerbated by lifestyle factors such as smoking, obesity, poor diet, and sedentary lifestyles.

- Importance of Early Awareness and Detection:

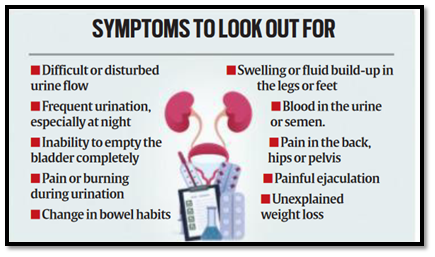

- Prostate cancer may not present noticeable signs or symptoms in its early stages, making early detection crucial.

- Symptoms typically appear in advanced stages, including trouble urinating, bone pain, and blood in semen or urine.

- Early screening, particularly for men over 60, is recommended to facilitate early intervention and treatment.

- While general population screening is not advised, older men experiencing symptoms like frequent urination, weak urine stream, or blood in the urine should seek medical attention and undergo a PSA blood test.

- This simple and affordable test can be easily accessed, even in smaller towns, and aids in the early detection of prostate cancer.

- Innovative Screening Initiatives:

- Initiatives such as pop-up clinics and mobile testing, like the Man Vans in the UK, offer free health checks, including PSA tests, to high-risk men aged 45 and over.

- These initiatives aim to increase awareness and facilitate early detection among at-risk populations.

- Additional Screening Methods:

- In addition to PSA tests, digital rectal examinations are recommended by experts.

- This examination helps detect an enlarged prostate gland, which can obstruct urine flow and lead to urinary symptoms.

- The Lancet authors recommend the use of MRI scans and PSA tests for screening high-risk men in high-income countries, emphasizing the importance of early detection strategies in combating prostate cancer.

- Challenges in Access to Radiotherapy:

- The World Health Organization (WHO) recommends one megavoltage radiotherapy unit per million people.

- However, India falls short of this recommendation, requiring an additional 600 units to adequately treat the 800,000 individuals diagnosed with cancer each year.

- While access to radiotherapy has increased, it remains predominantly available in urban areas.

- Although modern radiotherapy treatments are covered within government health schemes, accessibility for the poorest sections of society, even for palliative radiotherapy, remains limited.

- Issues with Opioid Use for Pain Relief:

- The regulation of opioid use for pain relief poses another challenge in India.

- In 1985, stringent legislation was enacted to control narcotic misuse and trafficking, leading to a drastic 97% decrease in medical morphine use.

- This decline severely limits access to effective pain management for cancer patients.

- Although an amendment to the Narcotic Drugs and Psychotropic Substance Act was made in 2014 to improve opioid access, implementation across the country has been slow, contributing to continued challenges in pain relief for cancer patients.

What is Prostate cancer?

- Prostate cancer is a type of cancer that forms in the tissues of the prostate, a gland in the male reproductive system found below the bladder and in front of the rectum.

- It is the second most common cancer affecting men, after skin cancer.

- Prostate cancer usually grows slowly and tends to stay in the gland, but some types can grow and spread quickly.

- The most common risk factors for prostate cancer include age, family history, and race.

- Men over the age of 50 are at an increased risk, and the risk increases with age.

- Men with a family history of prostate cancer, especially a first-degree relative, are also at an increased risk.

Army inducts indigenous Akashteer system

(General Studies- Paper III)

Source : The Hindu

The Indian Army has commenced the induction of control and reporting systems as part of ‘Project Akashdeep’ to enhance its air defence capabilities.

- The deployment of these systems began with the flagging off of the first batch of Control Centres from Bharat Electronics Limited (BEL) Ghaziabad.

Key Highlights

- Objective and Development:

- ‘Project Akashdeep’ is developed by Bharat Electronics Limited (BEL) with the objective of significantly improving the operational efficiency and integration of the Army’s air defence mechanisms.

- The project aims to modernize and streamline air defence control and reporting processes by digitizing the entire process.

- Enhanced Operational Efficiency (Akashteer Project):

- The Akashteer Project is a cutting-edge initiative designed to automate air defense control and reporting processes by digitizing the entire process.

- It is an automated air defense control and reporting system that will enable the army’s air defense units to work together more effectively.

- This cutting-edge initiative is designed to optimize air defence operations, ensuring swift and effective responses to potential threats.

- The project not only addresses current requirements but also caters to future needs, ensuring that the Army remains well-equipped to handle complex air defence operations effectively.

Can states levy excise duty on industrial alcohol?

(General Studies- Paper II)

Source : The Indian Express

Excise duty on alcohol serves as a crucial source of revenue for states, often supplemented by additional excise duties imposed on alcohol consumption.

- For instance, Karnataka raised the Additional Excise Duty (AED) on Indian Made Liquor (IML) by 20% in 2023, illustrating the significance of alcohol taxation for state finances.

Key Highlights

- Legal Challenge Regarding Industrial Alcohol:

- A significant legal question currently before the Supreme Court pertains to the regulatory authority of states over industrial alcohol.

- The nine-judge Bench, led by Chief Justice of India D Y Chandrachud, commenced hearings on April 2 to determine whether state governments possess the power to regulate various aspects of industrial alcohol, including its sale, distribution, pricing, and other related factors.

- Legal Framework and Jurisdictional Conflict:

- The debate revolves around the interpretation of constitutional provisions, particularly Entry 8 in the State List under the Seventh Schedule, which grants states the authority to legislate on intoxicating liquors’ production, manufacture, possession, transport, purchase, and sale.

- However, this is juxtaposed with Entry 52 of the Union List and Entry 33 of the Concurrent List, which pertain to industries and their regulation in the public interest.

- Concurrent List and Central Legislation:

- While subjects in the Concurrent List can be legislated upon by both states and the Centre, the supremacy of central law prevails where a conflict arises.

- Industrial alcohol falls under the Industries (Development and Regulation) Act, 1951 (IDRA), adding complexity to the jurisdictional debate.

- Central vs. State Authority:

- The crux of the legal dispute lies in determining whether states possess the autonomy to regulate industrial alcohol or if exclusive control rests with the central government.

- This case holds significant implications for regulatory frameworks, as well as the balance of power between state and central authorities.

- Previous Supreme Court Consideration:

- In 1989, the Supreme Court addressed the issue of state authority over industrial alcohol in the case of Synthetics & Chemicals Ltd v. State of Uttar Pradesh.

- A 7-judge Constitution Bench ruled on the matter, highlighting the distinction between “intoxicating liquors” regulated by states under Entry 8 of the State List and industrial alcohol.

- The Court recognized that states’ regulatory authority over consumable alcohol should extend to preventing industrial alcohol from being used as intoxicating or drinkable alcohol.

- However, it concluded that the taxes and levies imposed by states were primarily revenue-driven and not intended as measures to regulate industrial alcohol or prevent its conversion into drinkable alcohol.

- The Supreme Court’s decision affirmed that only the central government holds the authority to impose levies or taxes on industrial alcohol, explicitly stating that industrial alcohol is not intended for human consumption.

- Comparison with Previous Case:

- The decision in Synthetics & Chemicals Ltd v. State of Uttar Pradesh contrasts with the Court’s earlier ruling in ChTika Ramji v State of UP (1956).

- In the latter case, the Court upheld the validity of a Uttar Pradesh legislation regulating the sugar industry despite the existence of Section 18-G of the Industries (Development and Regulation) Act, 1951 (IDRA), which conferred exclusive jurisdiction over the sugar industry to the central government.

- The Court’s decision in ChTika Ramji v State of UP emphasized that Section 18-G did not cover the entire regulatory field, affirming the state’s authority to legislate on matters concerning the sugar industry under Entry 33 of the Concurrent List.

- Origins of the Current Case:

- In 1999, the Uttar Pradesh (UP) government issued a notification imposing a 15% fee on sales to license holders under the UP Excise Act, 1910 for alcohol used directly or as a solvent for vehicles, appearing in the final product to some extent.

- Challenge and High Court Decision:

- This notification was challenged by a motor oil and diesel distributor, asserting that the central government had exclusive jurisdiction over industrial alcohol under Section 18-G of the Industries (Development and Regulation) Act, 1951 (IDRA).

- In February 2004, the Allahabad High Court invalidated the 1999 notification, ruling that the state legislature lacked authority over the general regulation of denatured spirits, only having jurisdiction over drinkable alcohol.

- The High Court directed the state to refund collected fees with interest.

- Appeal to the Supreme Court:

- The decision was appealed to the Supreme Court, which stayed the Allahabad High Court judgment in August 2004.

- In 2007, the Supreme Court referred the case to a larger bench, noting that the precedent set by the Tika Ramji case had not been considered by the seven-judge Bench in the Synthetics and Chemicals case.

- Referral to Nine-Judge Bench (2010):

- To resolve the question of whether states can exercise their powers under Entry 33 of the Concurrent List or if Section 18-G grants exclusive jurisdiction to the Centre regarding industrial spirits, the case was referred to a nine-judge Bench in 2010.

- Interpretation of “Intoxicating Liquors”:

- Senior Advocate representing the UP govt. argued that the term “intoxicating liquors” in Entry 8 of the State List encompasses all liquids containing alcohol.

- He highlighted the historical use of terms like ‘liquor’, ‘spirit’, and ‘intoxicant’ in excise laws predating the Constitution.

- He contended that the Union’s authority under Entry 52 of the Union List does not extend to regulating “finished products” like industrial alcohol post the denaturation process.

- According to Dwivedi, such regulation falls under the purview of Entry 33 of the Concurrent List.

- He emphasized that for the Centre to exercise exclusive control over industrial alcohol regulation, it must issue an order under Section 18-G of the IDRA.

- Absent such an order, states retain jurisdiction.

- Senior advocate also invoked the SC’s stance that states are not subordinate to the Centre and their powers should not be infringed upon.

About the Seventh Schedule of the Indian Constitution

- The Seventh Schedule of the Indian Constitution is a significant feature that outlines the division of legislative powers between the Union and State governments.

- It is divided into three lists: the Union List, the State List, and the Concurrent List.

- Union List:

- This list contains 97 subjects over which the Union Government or Parliament of India has exclusive power to legislate.

- These subjects include defense, foreign affairs, banking, currency, communications, and other essential matters that require a uniform policy across the country.

- State List:

- This list contains 66 subjects over which the respective State governments have exclusive power to legislate.

- These subjects include public order, police, local government, public health, and other matters that are primarily of local concern.

- Concurrent List:

- This list contains 47 subjects over which both the Union and State governments have the power to legislate.

- However, in case of a conflict, the Union legislation prevails over the State legislation.

- These subjects include marriage and divorce, adoption, education, and other matters that require coordination between the Union and State governments.

- The Seventh Schedule also includes provisions for residuary powers, which are not contemplated in either of the Union or State lists.

- These powers are vested with the Union Parliament, which has exclusive power to make any law with respect to any matter not enumerated in the Concurrent List or the Constitution.