CURRENT AFFAIRS – 27/07/2023

Shedding more light on the debt dilemma

is a former Member of the Fourteenth Finance Commission. He is currently Chief Economic Adviser, Brickwork Ratings

The elevated levels of India’s fiscal deficit and public debt have been a matter of concern for a long time in India. Even before the COVID-19 pandemic, debt levels were among the highest in the developing world and emerging market economies. The pandemic pushed the envelope further and relative to GDP, the fiscal deficit in 2020-21 increased to 13.3% and the aggregate public debt to 89.6%. As the economy recovered after the pandemic, the deficit and debt ratios have receded to 8.9% and 85.7%, respectively.

The projections show that even without any serious disruptions to the economy, the debt level is unlikely to return to the pre-pandemic trajectory in the medium term. With elections to a number of States scheduled in 2023 and with the general election for 2024, the electoral budget cycle could push the debt ratio further. And, there can be serious questions about its sustainability unless targeted interventions are made to reduce the debt burden, which may not be politically easy with elections on the horizon.

Financial repression

The debt-dynamics equation states that when there is no primary deficit (fiscal deficit in the year excluding the past legacy of interest payments), if the growth rate of GDP exceeds the effective interest rate paid on government bonds, the overall debt will decline. However, what is missed in these discussions are the distortions caused by financial repression to keep the interest rates on government borrowing low to reduce the cost. The statutory liquidity ratio (SLR) stipulated by the Reserve Bank of India (RBI) requires the banking system to hold 18% of their demand and time liabilities in government securities. Besides, the RBI intervenes in the market through open market operations around the time when government borrowing is taken up to keep the interest rates on government borrowing repressed. When the interest rate on government debt is lower than the growth of GDP, the debt may decline but the financial market gets distorted.

Thus, even when the sustainability of debt may not be threatened in the medium term, the costs of carrying high deficits and debt to the economy are heavy. First, on average, interest payments constitute over 5% of GDP and 25% of the revenue receipts, this is more than the government expenditure on education and health care put together. Large interest payments crowd out the much-needed expenditures on physical infrastructure and human development and emerging priorities to make the green transition. The issue is of concern in Punjab, Kerala, Rajasthan, and West Bengal. In Punjab, the Debt to GSDP ratio is 48.9%, in West Bengal, 37.6%, Rajasthan 35.4%, and in Kerala close to 33%.

Second, high levels of debt make it difficult to calibrate counter-cyclical fiscal policy and constrain the ability of the government to respond to shocks.

Third, the debt market in India is largely captive with mainly the commercial banks and insurance companies participating in it to meet SLR requirements. With a cash reserve ratio (CRR) of 4.5% and SLR of 18% of net demand and time liabilities, and 40% of the credit by the commercial banks earmarked for the priority sector, the resources available for lending to the manufacturing sector gets squeezed, driving up the cost of borrowing of the sector. Furthermore, the rating agencies keep the sovereign rating low when deficits and debt are higher, and this increases the cost of external commercial borrowing. Finally, ‘today’s borrowing is taxing tomorrow’ and the burden of large deficits and debt will have to be borne by the next generation.

On the debt burden

It is clear that in the present fiscal environment, even achieving a consolidated debt-to-GDP ratio of 58.2 recommended by the 14th Finance Commission for 2019-20 would be unfeasible in the medium term. The Finance Commission had recommended that the Union government bring down its deficit relative to GDP from 43.6% in 2015-16 to 36.3%, and the States maintain their deficit at about 22%. Even before the pandemic, the aggregate public debt had slipped to 74.3% in 2019-20, and the pandemic pushed it to 89.7% in 2020-21. With the nominal GDP recovering to grow at 18.5% in 2021-22 after the pandemic, the debt ratio declined only marginally to 85.7%. This implies that every individual in the country bears a debt burden of ₹ 1,64,000. With the high primary deficit of 3.7% of GDP in 2022-23 and budgeted at over 3% in 2023-24, we will have to contend with elevated debt levels in the medium term.

The issue is of critical importance; therefore, the fast pacing of fiscal consolidation is imperative. Fortunately, after six years, Goods and Services Tax (GST) has stabilised and has shown high growth potential. As the technology platform has stabilised, it is expected to maintain high buoyancy in the medium term. The technology has helped to improve tax administration and improved compliance. With the cross-matching of GST returns with income-tax returns, income-tax compliance too is expected to improve. In the medium term, the aggregate tax-GDP ratio is likely to increase by 1.5 percentage to 2 percentage points.

In terms of policy interventions, this is the time to rethink the role of the state and vacate activities that should really belong to the market rather than competing with it. At the central level, even after much talk about disinvestment, progress has been slow. Rather than dispensing with activities such as telecom to the private sector, the government continues to pour money into Bharat Sanchar Nigam Limited. Equally disturbing are the employment melas to fill so-called vacant posts which have been found to be redundant. At the State level, it is important to guard against the return to the old pension scheme and indulge in large-scale giveaways for electoral reasons. Of course, redistribution is a legitimate government activity, and that is best done through cash transfers rather than subsidising commodities and services. Giving subsidies alters relative prices, resulting in unintended resource distortions. Equally important is the need to impose hard budget constraints by enforcing Fiscal Responsibility and Budget Management rules in allowing States to borrow. Macroeconomic stabilisation is predominantly a Union government responsibility. Therefore, the Union government should follow the rules it makes, and enforce the rules on the States effectively.

The views expressed are personal

‘Today’s borrowing is taxing tomorrow’ and the burden of large deficits and debt will have to be borne by the next generation.

Facts about the News

The Debt Dilemma

(General Studies- Paper III)

- Even before the COVID-19 pandemic, debt levels were among the highest in the developing world and emerging market economies.

- The pandemic pushed the fiscal deficit in 2020-21 to 13.3% and the aggregate public debt to 89.6%.

- As the economy recovered after the pandemic, the deficit and debt ratios have eased to 8.9% and 85.7%, respectively.

- The RBI intervenes uses open market operations to keep the interest rates in checks.

- The country’s interest payments constitute over 5% of GDP and 25% of the revenue receipts.

- Cash reserve ratio (CRR) is 4.5% and SLR is 18% of net demand and time liabilities.

- 40% of the credit by the commercial banks is earmarked for the priority sector.

- All these factors squeezes the resources available for lending to the manufacturing sector.

- This drives up the cost of borrowing of the sector.

- Furthermore, the rating agencies keep the sovereign rating low when deficits and debt are higher, and this increases the cost of external commercial borrowing.

Finance Commission recommendations

- 14th Finance Commission had recommended a consolidated debt-to-GDP ratio of 58.2 for 2019-20.

- The Finance Commission had recommended that the Union government bring down its deficit relative to GDP from 43.6% in 2015-16 to 36.3%, and the States maintain their deficit at about 22%.

- Even before the pandemic, the aggregate public debt had slipped to 74.3% in 2019-20, and the pandemic pushed it to 89.7% in 2020-21.

- With the high primary deficit of 3.7% of GDP in 2022-23 and budgeted at over 3% in 2023-24, we will have to contend with elevated debt levels in the medium term.

Understating the economy- Various Deficits

- It refers to the excess of total revenue expenditure of the government over its total revenue receipts.

- Revenue deficit = Total Revenue expenditure – Total Revenue receipts.

- Fiscal deficit is defined as the difference between the total revenue and total expenditure of the government.

- It helps indicate the total borrowing that the government would need a particular financial year.

- The government’s leading source of revenue is through GST and taxes like income tax, customs duties, corporate tax, etc., along with non-tax income from disinvestment, interest, dividends, and so on.

- On the other hand, the government’s expenditure consists of capital expenditure, interest payments, and revenue payments, among others.

- Thus, Fiscal Deficit = Government Revenue – Government Expenditure

- Primary deficit is defined as fiscal deficit minus interest payments on previous borrowings.

- Primary deficit shows the borrowing requirements of the govt. for meeting expenditure excluding interest payment.

- Gross Primary deficit = Fiscal deficit – Interest payments.

India’s Fiscal Targets for 2023-24

- Union Budget for 2023-24, the government projected a decline in fiscal deficit to 5.9% of gross domestic product (GDP) in FY24, compared with 6.4% in FY23.

- The government planned to reach a fiscal deficit below 4.5% by 2025-26.

- In the revenue budget, the deficit was 4.1% of GDP in 2022-23 (revised estimate).

- In Union Budget 2023-24, revenue deficit is 2.9% of GDP.

- If interest payments are deducted from fiscal deficit, which is referred to as primary deficit, it stood at 3% of GDP in 2022-23 (RE).

- The primary deficit, which reflects the current fiscal stance devoid of past interest payment liabilities, is pegged at 2.3% of GDP in Union Budget 2023-24.

15th Finance Commission- Role and Recommendations

– The Finance Commission is a constitutional body formed by the President of India to give suggestions on centre-state financial relations.

– The 15th Finance Commission Chairman is Mr. N. K. Singh.

– Key recommendations:

- The share of states in the central taxes for the 2021-26 period is recommended to be 41%, same as that for 2020-21.

- This is less than the 42% share recommended by the 14th Finance Commission for 2015-20 period.

- The adjustment of 1% is to provide for the newly formed union territories of Jammu and Kashmir, and Ladakh from the resources of the centre.

- The Commission suggested that the Centre bring down fiscal deficit to 4% of GDP by 2025-26.

- For states, it recommended the fiscal deficit limit (as % of GSDP) of: (i) 4% in 2021-22, (ii) 3.5% in 2022-23, and (iii) 3% during 2023-26.

Measuring well-being in India

Raghav Gaiha

is Research Affiliate, Population Aging Research Center, University of Pennsylvania

Vidhya Unnikrishnan

is Lecturer in Development Economics, GDI, University of Manchester

Vani S. Kulkarni

is Research Affiliate, Population Studies Centre, University of Pennsylvania

An analysis of the Gallup World Poll Surveys for India shows that any signs of reversal of policies are weak, if not missing altogether.

There has been euphoria over India’s economic growth accelerating to 6.1% in the March quarter, as it confirmed that the country remains one of the fastest growing emerging economies. Counterclaims followed in quick succession drawing attention to fall in private consumption, high inflation, rise in poverty, and income and wealth inequality. The rhetoric on either side has continued with growing intensity. What is missed in this debate, however, is that income is a narrow measure of well-being, as argued by Amartya Sen (1999), Angus Deaton (2008), and others. Although Sen and Deaton differ in their approach, they concur that we must look beyond income to measure well-being.

Life satisfaction and income

A close scrutiny of the relationship between life satisfaction and income based on Gallup World Poll (GWP) Surveys confirms a positive relationship between them with a slightly stronger effect in developed countries. But it is intriguing that growth of income has a negative effect on life satisfaction. It is plausible that there is a “threshold” income effect beyond which increases in income do not matter, or that there is no long-run relationship between the two. But this awaits empirical validation.

Trust in government represents the confidence of citizens in the actions of a “government to do what is right and perceived fair”. Citizen expectations influence trust in government. If citizens’ expectations rise faster than the actual performance of governments, trust and satisfaction could decline. These changes in expectations may explain more the erosion of political support rather than real government performance. Besides, citizens’ trust towards government is influenced by whether they have a positive or negative experience with service delivery. A negative experience has a much stronger impact on trust in government than a positive one (OECD, 2013).

Our analysis of the relationship between life satisfaction is based on GWP Surveys for India in 2018, 2019, 2020 and 2021. Life satisfaction is measured as suffering, struggling, and thriving. The measures of affluence used are income per capita and its growth. Trust in government is measured as whether the respondent has confidence in the government. Individual demographic and economic characteristics include age, gender, religion, caste and whether the respondents live in rural or urban areas, and income and its growth. Overall income inequality is measured along the lines of Piketty, 2014.

Several results conform with global and regional studies (notably Deaton, 2008). There is a strong negative correlation between life satisfaction and age. Among those thriving, the proportion of those aged 55 and above was barely 9% compared to the over 43% of those aged 25-45, in 2021. There is a negative correlation between life satisfaction and women. This is not surprising as women face greater discrimination when employment is sluggish and are also subject to greater male violence when law enforcement is weak. There is a consistent negative correlation between life satisfaction and minorities. The share of Hindus among the thriving rose from 85% in 2019 to 89.6% while that of Muslims fell from about 7% to 2.3%. While the share of the unreserved (including Brahmins and ‘high’ castes) among the thriving rose from over 26.2% in 2019 to 38.7% in 2021, that of OBCs declined slightly from 33% to 31.5% and that of Scheduled Castes and Scheduled Tribes declined sharply from about 41% to just under 30%.

Turning to the measures of affluence, life satisfaction has a positive correlation with per capita income, but with a marked weakening in 2020, presumably due to COVID-19, and a rebound in 2021. Life satisfaction is unrelated to growth of income.

The Piketty measure of income inequality is a ratio of the share of the top 1% of individuals in total income to that of the bottom 50%. Life satisfaction is negatively correlated with this measure of inequality over 2019-21, with a slight strengthening of the correlation (in absolute value) in 2021. The correlation (in absolute value) was lowest in 2020 presumably because life satisfaction suffered due to the COVID-19 pandemic.

Trust in government

Finally, we examine the relationship between life satisfaction and trust in government. As perceptions matter more than performance, aggressive pursuit of Hindu nationalism, promulgation of the Citizenship (Amendment) Act and subsequent outbursts of violence, lynching of Muslim and Dalit cattle traders, excessive centralisation, and suppression of media independence have left deep scars on the national psyche. A detailed analysis of the association between life satisfaction in 2019 and trust in the NDA government in 2018 (controlling for the confounders) reveals that there is a positive association between them. Among the thriving, the share of those who trusted the government fell from about 83% in 2019 to 79% in 2021. This may seem intriguing, but it is not if the thriving are more sensitive to attacks on minorities, journalists and other liberals, encounter killings, high inflation and unemployment. Among the suffering, the loss of trust was moderate. If these include mostly minorities and Dalits, their negative experiences and perceptions could lower their trust in the NDA government. In fact, trust in the NDA fell and so did well-being. In sum, any signs of reversal of policies are weak, if not missing altogether.

The SCO is a success story that can get better

is Chargé d’Affaires a.i. of the Embassy of China in India

On July 4, 2023, India successfully hosted the 23rd Meeting of the Council of Heads of State of the Shanghai Cooperation Organization (SCO). The world witnessed another “SCO moment”. Leaders of the SCO member-states signed the New Delhi Declaration, and issued the statements on countering radicalisation and exploring cooperation in digital transformation. The summit granted Iran full SCO membership, signed the memorandum of obligations of Belarus to join the SCO as a member-state, and adopted the SCO’s economic development strategy for the period until 2030. These significant outcomes have demonstrated the vitality of the “SCO family”.

A changing world

Our world, our times and history are changing in ways like never before. The world is grappling with geopolitical tensions, an economic slowdown, energy crises, food shortage and climate change. These challenges require the joint response of all countries. The major risks to world peace and development are power politics, economic coercion, technology decoupling and ideological contest. The central questions revolve around unity or split; peace or conflict; cooperation or confrontation. The international community must answer them.

Over the years, the SCO has been committed to becoming a community with a shared future for mankind, firmly supporting each other in upholding their core interests, and synergising their national development strategies and regional cooperation initiatives. Member-states have carried forward the spirit of good neighbourliness and friendship, and built partnerships featuring dialogue instead of confrontation, and cooperation instead of alliance. The SCO has been a guardian of and contributor to regional peace, stability and prosperity. These achievements manifest the common aspirations of all countries so that there is peace, development and win-win cooperation. The SCO’s leading and exemplary role can help strengthen unity and cooperation, seize development opportunities, and address risks and challenges. Going forward in a new era, the SCO member-states should strengthen strategic communication, deepen practical cooperation, and support each other’s development and rejuvenation. As we build a better homeland together, more certainty and positive energy will be brought to the world.

We should enhance solidarity and mutual trust for common security. There are some external elements that are orchestrating a new Cold War and bloc confrontation in our region. These developments must be addressed with high vigilance and firm rejection. SCO member-states need to upgrade security cooperation, and crack down in a decisive manner on terrorism, separatism and extremism, and transnational organised crimes. We need to pursue cooperation in digital, biological and outer space security, and facilitate political settlement when it comes to international and regional hot-spot issues.

We should embrace win-win cooperation to chart a path to shared prosperity. Protectionism, unilateral sanctions and decoupling undermine people’s well-being all over the world. It is imperative for the SCO to generate stronger momentum for collaboration in trade, investment, technology, climate actions, infrastructure and people-to-people engagement. To contribute to high-quality and resilient economic growth of the region, there need to be collective efforts to scale up local currency settlement between SCO members, expand cooperation on sovereign digital currency, and promote the establishment of an SCO development bank.

Need for multilateralism

We should advocate multilateralism to shape our common destiny. The SCO needs more engagements with its observer states, dialogue partners and other regional and international organisations such as the United Nations, to uphold the UN-centered international system and the international order based on international law. Together, we are united in promoting world peace, driving global development and safeguarding the international order.

The SCO’s success story is part of the broader global partnership of emerging economies and developing countries. As changes to the global landscape unfold, emerging economies and developing countries continue their collective rise with greater cohesion and global weight. We are increasingly acting as a progressive force for world fairness and justice. Over the next two months, South Africa and India will preside over the BRICS (Brazil, Russia, India, China and South Africa) and G-20 summits, respectively. These will be significant moments to shape a multi-polar world order, promote inclusive global development, and improve international governance architecture.

China’s commitment

China is committed to working with India, South Africa and other partners from the South to put into action the Global Security Initiative, Global Development Initiative and Global Civilization Initiative, to contribute to world peace, security and prosperity. We need to pursue common, comprehensive, cooperative and sustainable security, respect each country’s independent choice of the path to development and social system, and abide by the purpose and principles of the UN Charter. The reasonable security interests of all countries deserve consideration. Dialogue and diplomacy offer the best hope to address international disputes by peaceful means. And, security challenges in conventional and non-conventional domains should be dealt with in a holistic manner.

We need to forge a united, equal, balanced and inclusive global development partnership, promote humanity’s common values of peace, development, equity, justice, democracy and freedom, and get global governance to evolve in a fairer and more reasonable direction. Our voice should be loud and clear against hegemony, unilateralism, a Cold War mentality and bloc confrontation. And, illegal unilateral sanctions and long-arm jurisdiction measures must be rejected. In doing so, we will lead by example in safeguarding the development rights and legitimate interests of the developing world.

Shanghai Cooperation Organization member-states should strengthen strategic communication, deepen practical cooperation, and support each other’s development.

Facts about the News

Shanghai Cooperation Organisation

(General Studies- Paper II)

- India successfully hosted the 23rd Meeting of the Council of Heads of State of the Shanghai Cooperation Organization (SCO) recently in July.

- Leaders of the SCO member-states signed the New Delhi Declaration.

- The summit granted Iran full SCO membership, signed the memorandum of obligations of Belarus to join the SCO as a member-state.

- The SCO’s economic development strategy for the period until 2030 was also adopted.

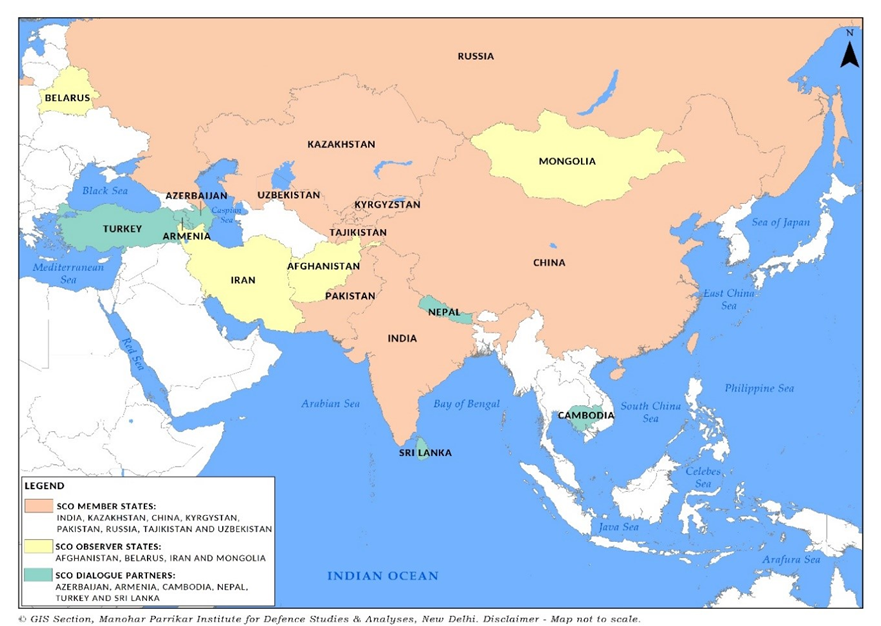

About SCO

– The Shanghai Cooperation Organization (SCO) is an intergovernmental organization founded in Shanghai on 15 June 2001.

– The SCO currently comprises eight Member States: China, India, Kazakhstan, Kyrgyzstan, Russia, Pakistan, Tajikistan and Uzbekistan.

- Four Observer States interested in acceding to full membership: Afghanistan, Belarus, Iran, and Mongolia.

- Six ‘Dialogue Partners’: Armenia, Azerbaijan, Cambodia, Nepal, Sri Lanka and Turkey.

- In 2021, the decision was made to start the accession process of Iran to the SCO as a full member, and Egypt, Qatar as well as Saudi Arabia became dialogue partners.

– The SCO has been an observer in the UN General Assembly since 2005.

– SCO Secretariat has also established partnerships with UNESCO, WTO, and ESCAP among others.

Aims and Objective of SCO

- Strengthening mutual trust, friendship and neighbourly relations among the member states.

- Promoting effective cooperation in political, trade, economic, scientific, technical, and cultural sphere.

- Jointly maintaining and safeguarding of peace, security and stability in the region.

- Fostering creation of democratic, fair and rational new international political and economic order.

Note: Iran has been granted full SCO membership at this year’s summit.

Background and India’s Accession

- Shanghai Five group, formed on 26 April 1996 with the signing of the Treaty on Deepening Military Trust in Border Regions.

- The initial members of Shanghai Five were: China, Kazakhstan, Kyrgyzstan, Russia, and Tajikistan.

- In 2001, during the annual summit in Shanghai, the five member nations first admitted Uzbekistan in the Shanghai Five mechanism (thus transforming it into the Shanghai Six).

- Thereafter, on 15 June 2001 the Declaration of Shanghai Cooperation Organization, was signed and in June 2002.

- At the July 2005 Astana Summit, India was granted Observer status.

- In July 2015 in Ufa, Russia, the SCO decided to admit India as full member.

- India signed the memorandum of obligation in June 2016 in Tashkent, Uzbekistan, thereby starting the formal process of joining the SCO as full member.

- On 9 June 2017, at the historic summit in Astana, India officially joined SCO as full- member.

- At the same summit, Pakistan was also inducted as a full member to the organisation.

Bill proposes birth record digitisation

India has taken the first step to generate digital birth certificates, which will be an all-encompassing document that can be used for admission to educational institutions, jobs, passports or Aadhaar, voter enrolment, registration of marriage, and others.

This will “avoid multiplicity of documents to prove date and place of birth”, according to the Registration of Births and Deaths Amendment Bill, 2023, tabled in the Lok Sabha on Wednesday.

Centralised register

The Bill proposes to make it obligatory for States to register births and deaths on the Centre’s Civil Registration System portal, and to share the data with the Registrar General of India, which functions under the Union Home Ministry.

It said a centralised register “would help in updating other databases resulting in efficient and transparent delivery of services and social benefits.” The Bill would “insert provisions for digital registration and electronic delivery of certificate of births and deaths for the benefit of public.” The new rules will apply to all those born after the Bill becomes law.

It proposes to “collect Aadhaar numbers of parents and informant, if available, for birth registration”. It will also “facilitate registration process of adopted, orphan, abandoned, surrogate child and child of single parent or unwed mother”.

Facts about the news

Registration of Births and Deaths (RBD) Amendment Bill, 2023

(General Studies- Paper III)

- The digital birth certificate will be a single document used to prove a person’s date and place of birth in the country.

- The Bill mandates all births and deaths to be registered on a centralised portal.

What does the New Bill do?

– The bill will allow the use of birth certificates as a single document for various purposes such as:

- admission to an educational institution,

- issuance of a driving licence,

- preparation of a voter list,

- Aadhaar number,

- registration of marriage, and

- appointment to a government job.

– A National Database:

- The Registration of Births and Deaths (Amendment) Bill, 2023 will also help create a national and state-level database of registered births and deaths.

- This will eventually ensure efficient and transparent delivery of public services and social benefits and digital registration.

– The database can also be used to update the National Population Register (NPR), ration cards, and property registration records.

– The bill will also facilitate electronic delivery of certificate of births and deaths for the benefit of public at large.

– The Bill amends 14 sections of the Registration of Births and Deaths Act, 1969.

- The Act has never yet been amended since its inception 54 years ago.

What is National Population Register (NPR)?

- The National Population Register (NPR) is a Register of usual residents of the country.

- It is being prepared at the local (Village/sub-Town), sub-District, District, State and National level.

- It is done so under provisions of the Citizenship Act 1955 and the Citizenship (Registration of Citizens and issue of National Identity Cards) Rules, 2003.

- It is mandatory for every usual resident of India to register in the NPR.

Note: A usual resident is defined for the purposes of NPR as a person who has resided in a local area for the past 6 months or more or a person who intends to reside in that area for the next 6 months or more.

- Objective: The objective of the NPR is to create a comprehensive identity database of every usual resident in the country. The database would contain demographic as well as biometric particulars.

LS passes Forest Conservation (Amendment) Bill

Amidst pandemonium, the Lok Sabha passed the Forest Conservation (Amendment) Bill on Wednesday, without any changes from the first version introduced on March 29. The contentious Bill was introduced to amend the Forest Conservation Act, 1980.

The 1980 legislation has empowered the Centre for the past four decades, to ensure that any forest land diverted for ‘non-forestry’ purposes is duly compensated. It extends its remit to land even beyond what is officially classified as ‘forest’ in State and Central government records.

The amendments made by the Bill and now passed by the Lok Sabha encourage the practice of cultivating plantations on non-forest land, which can increase tree cover over time, act as a carbon sink and aid India’s ambitions of having ‘net zero’ carbon emissions by 2070.

They also seek to remove restrictions imposed by the original Act in creating infrastructure that would aid national security and create livelihood opportunities for those living on the periphery of forests.

1,300 appeals

Objections were raised on various aspects of the Bill when it was first introduced, prompting a Joint Parliamentary Committee (JPC) to investigate it threadbare. Nearly 1,300 representations from a multitude of groups — including tribal rights groups and independent think-tanks — were sent to the JPC, objecting to clauses of the Bill. However, these objections were deliberated upon but ultimately dismissed by the JPC.

There were objections that the amendments “diluted” the Supreme Court’s 1996 judgement in the Godavarman case that extended protection to wide tracts of forests, even if they were not recorded as forests. There were objections to the Act’s new name — Van (Sanrakshan Evam Samvardhan) Adhiniyam, translated as Forest (Conservation and Augmentation) Act, instead of the existing Forest (Conservation) Act — saying it was “non-inclusive” and left out many among the “(non-Hindi speaking) population in south India and in the northeast”. There were also fears that large parcels of forest land near the borders would no longer be protected.

“We have made provisions in the Bill that would enable our soldiers stationed in sub-zero temperatures at Ladakh to access better roads and infrastructure,” Environment Minister Bhupender Yadav said in reply to questions raised in Parliament.

Facts about the News

The Forest (Conservation) Amendment Bill 2023

(General Studies- Paper II and III)

- The Lok Sabha passed the Forest Conservation (Amendment) Bill on July 26, without any changes from the version first introduced on March 29.

- The contentious Bill was introduced to amend the Forest Conservation Act, 1980.

What are the changes?

- The new bill exempts certain kinds of infrastructure or development projects from the need to get forest clearance, which is mandatory at present.

– These include “strategic linear projects of national importance and concerning national security” situated within 100 km of international borders.

- Even non-linear projects involving the creation of “security related infrastructure” would remain exempt.

- In Naxal-affected areas, projects involving diversion of up to five hectares of land for “defence related” infrastructure or public utilities would no longer be covered by the provisions of the Forest (Conservation) Act.

- But all these projects would still have to carry out compensatory afforestation, mandated by another law.

Note: The amendment Bill also renames the parent legislation, the Forest (Conservation) Act, 1980, to Van (Sanrakshan Evam Samvardhan) Adhiniyam, which translates to Forest (Conservation and Augmentation) Act.

– The new name is a reflection of a new focus on afforestation and reforestation activities.

- The objective is to increase India’s forest cover and fulfilling its international commitment of creating an additional carbon sink of 2.5-3 billion tonnes by 2030.

-These objectives have been included in the preamble to the proposed amended Act.

- The original Act did not have any preamble.

– A major feature of the Bill is the encouragement provided for private forests and agro-forestry projects.

- The amendment ensures that private forests and agro-forestry would not be considered forests in the traditional sense.

- This means that these too would be exempt from the provisions of the original Act.

- That would ensure that farmers or owners of these private forests can harvest their lands, for commercial or other uses, without the need for acquiring forest clearance.

– The amendment also allows small constructions, up to a maximum area of 0.1 hectares, on forest land situated alongside a railway line or a highway.

- This is done to provide access to a habitation, or to a railway or roadside facility.

Citing FATF, Centre urges SC to let Mishra continue as ED chief

The Supreme Court on Wednesday agreed to hear on July 27 an urgent application moved by the Centre to allow Enforcement Directorate (ED) Director Sanjay Kumar Mishra to continue in office till October 15. A Supreme Court judgment on July 11 directed Mr. Mishra, who is in his fifth year as ED Director, to quit office by July 31.

The top court had concluded that Mr. Mishra’s continuance at the helm of the ED on his third consecutive extension, till November 2023, was illegal.

However, the court, on July 11, gave the government time till July 31 to find a replacement for Mr. Mishra. The leeway was given by the court, taking into consideration the government’s submission that Mr. Mishra’s presence was necessary for the ongoing evaluation by the Financial Action Task Force (FATF).

On Wednesday, appearing before a Bench headed by Justice B.R. Gavai, Solicitor-General Tushar Mehta, for the Centre, sought an urgent listing of its application seeking the extension of Mr. Mishra’s tenure from July 31 to mid-October, 2023 “in view of the ongoing FATF review which is at a critical stage”.

Allow Mishra to remain ED chief, govt. urges SC

The submissions on effectiveness of the anti-money laundering regime in India were made on July 21 and an on-site visit by an FATF assessment team was scheduled in November, said the Centre in its 12-page application filed on Wednesday.

“At such a critical juncture, it is essential to have an individual who is well-acquainted with the overall status of money laundering investigations and proceedings across the country and also of the intricacies of the procedures, operations and activities of the investigating agency, at the helm of affairs at the ED,” the Centre’s application submitted.

It said Mr. Mishra’s continuation would be pivotal to ably assist the assessment team with “necessary reports, information, statistics, etc”. “Any transition in leadership at the ED at this stage would significantly impair the ability of the agency to provide necessary assistance to the assessment team and thereby adversely impact India’s national interests,” the Centre urged.

The Centre had earlier argued that the ED Director was not a promotional post, so nobody was losing a career opportunity due to the extension of Mr. Mishra’s tenure.

Facts about the News

The Matter of Enforcement Directorate Chief

(General Studies- Paper II)

- Citing FATF, the Central government urged Supreme Court to let S.K. Mishra continue as Enforcement Directorate chief.

Background

- A Supreme Court judgment on July 11 had directed him to quit office by July 31.

- The top court had concluded that Mr. Mishra’s continuance at the helm of the ED on his third consecutive extension, till November 2023, was illegal.

- Government’s response: Mr. Mishra’s presence was necessary for the ongoing evaluation by the Financial Action Task Force (FATF).

- The Centre had earlier argued that the ED Director was not a promotional post, so nobody was losing a career opportunity due to the extension of Mr. Mishra’s tenure.

- The top court had however upheld amendments enacted in 2021 to the Central Vigilance Commission Act, the Delhi Special Police Establishment Act and the Fundamental Rules.

- These amendments allowed CBI and ED chiefs a maximum three annual extensions besides their two-year fixed tenures.

- About Enforcement Directorate

- The Directorate of Enforcement was established in the year 1956 with its Headquarters at New Delhi.

- It is responsible for enforcement of the Foreign Exchange Management Act, 1999 (FEMA) and certain provisions under the Prevention of Money Laundering Act.

- The Directorate is under the administrative control of Department of Revenue.

- Delhi Special Police Establishment Act

- The Central Bureau of Investigation traces its origin to the Special Police Establishment (SPE) which was set up in 1941 by the Government of India.

- The functions of the SPE then were to investigate cases of bribery and corruption in transactions with the War & Supply.

- Later, The Delhi Special Police Establishment Act was therefore brought into force in 1946.

- The CBI’s power to investigate cases is derived from this Act.

Central Vigilance Commission

Central Vigilance Commission is the apex vigilance institution monitoring all vigilance activity under the Central Government.

The CVC was set up by the Government in February, 1964 on the recommendations of the Committee on Prevention of Corruption, headed by Shri K. Santhanam.

In 2003, the Parliament enacted CVC Act conferring statutory status on the CVC.

The CVC is not controlled by any Ministry/Department.

It is an independent body which is only responsible to the Parliament.

It is empowered to inquire into offences under the Prevention of Corruption Act, 1988.

530 districts reported as free of manual scavenging: Centre

Ministry says manual scavenging is no longer practised in India; T.N., Chhattisgarh, Bihar among States with all districts reporting free status

Jammu and Kashmir, Manipur, Telangana, Andhra Pradesh, West Bengal, and Jharkhand are among the States and Union Territories that have the highest number of districts yet to declare themselves free of manual scavenging, showed data submitted by the Social Justice Ministry in the Rajya Sabha on Wednesday.

In response to multiple questions related to deaths caused by manual scavenging or hazardous cleaning of sewers, the Union government said that India had not reported deaths due to manual scavenging in the past five years, while 330 people had died during cleaning of sewers and septic tanks.

The Ministry said 530 districts had so far reported themselves to be free of manual scavenging, while the rest were yet to do so. The Ministry said manual scavenging was no longer carried out in the country.

While 100% of the districts in States such as Bihar, Rajasthan, Tamil Nadu, and a few others had declared themselves to be free of manual scavenging, 15% to 20% of the districts have reported so in several States and Union Territories.

In Manipur, just two of the 16 districts had reported as free of manual scavenging. In Jammu and Kashmir and Telangana, just 30% of the districts had declared themselves free. In Odisha and West Bengal, over 60% of the districts were yet to report their respective status.

Uttar Pradesh, which had the highest number of manual scavengers (32,473) in two surveys conducted till 2018, has nearly 90% districts reporting to be free of manual scavenging.

Top Ministry officials said that each district was being asked to either declare itself free of manual scavenging or point out locations of insanitary latrines and associated manual scavenging. “The district sanitation committees look at data of whether there are insanitary latrines and based on this extrapolate whether manual scavenging exists or not.”

Since the launch of the Swachata mobile app in 2016, more than 6,000 complaints have been examined by the Ministry for possible signs of manual scavenging. “But not one complaint was substantiated in all this time,” one senior official said.

As government data show that deaths due to hazardous cleaning of sewers and septic tanks continue, the Ministry has decided that its principal focus will be to address this problem, with officials saying the NAMASTE scheme had been launched for this purpose.

“This is why now the focus is to ask municipalities and civic bodies to ensure no hazardous cleaning takes place. And if it takes place, the responsibility should be placed on the employer,” another senior official said.

According to data released by the government in Parliament in 2021, over 90% of manual scavengers identified in the surveys till 2018, were from the Scheduled Caste communities.

Facts about the News

530 districts reported as free of manual scavenging

(General Studies- Paper II)

- Ministry of Social Justice said that a total of 530 districts across the country had so far reported themselves to be free of manual scavenging with the rest yet to do so.

What does the data say?

- 100% of districts in States like Bihar, Rajasthan, Tamil Nadu and a few others have declared themselves free of manual scavenging.

- Jammu and Kashmir, Manipur, Telangana, Andhra Pradesh, West Bengal, and Jharkhand are among the States and Union Territories that have the highest number of districts yet to declare themselves as manual scavenging free.

- The Ministry added that the practice of manual scavenging is no longer continued in the country.

The Prohibition of Employment as Manual Scavengers and their Rehabilitation Act 2012

- The act prohibits the employment of manual scavengers, the manual cleaning of sewers and septic tanks without protective equipment, and the construction of insanitary latrines.

- It seeks to rehabilitate manual scavengers and provide for their alternative employment.

- Each local authority, cantonment board and railway authority is responsible for surveying insanitary latrines within its jurisdiction.

- They shall also construct a number of sanitary community latrines.

- Each occupier of insanitary latrines shall be responsible for converting or demolishing the latrine at his own cost.

- If he fails to do so, the local authority shall convert the latrine and recover the cost from him.

- The District Magistrate and the local authority shall be the implementing authorities.

- Offences under the act are cognizable and non-bailable, and can be tried summarily.

Centre moves Bill to nominat 2 Kashmiri migrants to Assembly

Minister of State for Home Nityanand Rai on Wednesday tabled a Bill in the Lok Sabha to nominate two members from the ‘Kashmiri Migrants’ community, who “migrated” when militancy was at its peak in the 1989-90, as members of the Legislative Assembly of the Union Territory of Jammu and Kashmir. One of the members will be a woman.

It also proposes to nominate one member from ‘Pakistan-occupied Kashmir’ who was displaced in the 1947-48, 1965 and 1971 wars with Pakistan. The Bill aims “to preserve their political rights” and “overall social and economic development.”

The special status of Jammu and Kashmir under Article 370 was struck down by Parliament in August 2019 and the former State was bifurcated into two Union Territories — Jammu and Kashmir and Ladakh, the latter without an Assembly.

Jammu and Kashmir has been under Central rule since 2018 and the Assembly election is yet to take place.

The statement of objects and reasons of the Jammu and Kashmir Reorganisation (Amendment) Bill, 2023 states that “at the time of militancy in the erstwhile State of J&K in the late 1980s, particularly in the Kashmir [division] in 1989-90, a large number of people migrated from their ancestral places of residence in the Kashmir province, particularly the Kashmiri Hindus and Pandits, along with a few families belonging to the Sikh and Muslim communities.”

It also proposes to nominate one member displaced from PoK.

Centre moves Bill to nominate migrants

It said that initially “all the migrants were moved to Jammu” and later on some chose to move to other parts of the country, namely Delhi, Bengaluru and Pune. As per the data available with the Government of Jammu and Kashmir, there are currently 46,517 families having 1,58,976 persons who registered with the Relief Organisation over past three decades.

It said that in the wake of the 1947 Pakistani aggression, 31,779 families migrated from Pakistan-occupied Kashmir. Further, during the wars of 1965 and 1971, 10,065 more families were displaced from the Chhamb Niabat area.

“The Delimitation Commission received many representations from the two communities regarding reservation of seats in the Legislative Assembly to preserve their political rights and identity.” The commission recommended representation by way of nomination. It shall be given on lines of Section 15 of the 2019 Act, which provides for the representation of women. The commission increased total seats of the J&K Assembly from 107 to 114 with reservation of nine seats for the Scheduled Tribes for the first time.

Jammu and Kashmir Reorganisation (Amendment) Bill, 2023

(General Studies- Paper II)

- Minister of State for Home tabled a Bill in the Lok Sabha to nominate two members from the “Kashmiri Migrants” community, as members of the Legislative Assembly of the Union Territory of Jammu and Kashmir.

- It also proposes to nominate one member from “Pakistan-occupied Kashmir”, displaced in the 1947-48, 1965 and 1971 wars with Pakistan.

- The Bill is aimed “to preserve their political rights” and “overall social and economic development.”

- One of the nominated members will be a woman.

Other Highlights

- After the recent delimitation process, the number of seats in the Legislative Assembly of the Union Territory of Jammu and Kashmir has gone up from 107 to 114.

- Nine of these seats are reserved for Scheduled Tribes.

Note: The special status of Jammu and Kashmir under Article 370 was struck down by Parliament in August 2019. Jammu and Kashmir has been under Central rule since 2018.

About Delimitation Commission

– Delimitation literally means the act or process of fixing limits or boundaries of territorial constituencies in a country or a province having a legislative body.

– The job of delimitation is assigned to a high power body known as Delimitation Commission.

– In India, such Delimitation Commissions have been constituted 4 times –

- In 1952 under the Delimitation Commission Act, 1952,

- In 1963 under Delimitation Commission Act, 1962,

- In 1973 under Delimitation Act, 1972 and

- In 2002 under Delimitation Act, 2002.

– The Delimitation Commission orders have the force of law and cannot be called in for question before any court.

– These orders come into force on a date to be specified by the President of India in this behalf.

– When the orders of the Delimitation Commission are laid before the Lok Sabha or State Legislative Assembly, they cannot effect any modification in the orders.

– The Delimitation Commission is appointed by the President of India and works in collaboration with the Election Commission of India.

– Composition:

- Retired Supreme Court judge.

- Chief Election Commissioner.

- Respective State Election Commissioners.

Note: Under Article 82 of the Constitution, the Parliament passes a Delimitation Act after every census.

SOURCE : THE HINDU