CURRENT AFFAIRS – 17/02/2024

CURRENT AFFAIRS – 17/02/2024

The clear message in the Court’s ‘no’ to electoral bonds

(General Studies- Paper II)

Source : The Hindu

In a significant development on February 15, 2024, the Supreme Court of India delivered a landmark judgment, striking down the controversial electoral bonds scheme.

- The ruling emphasized the critical need for transparency in a democracy and highlighted the opacity of the electoral bonds system, which had prevented voters from knowing the identity of political party funders and the amounts contributed.

Key Highlights

- Restoration of Transparency in Campaign Funding

- The Supreme Court’s decision is hailed as a pivotal moment for democracy, as it reinstates transparency in campaign funding, a fundamental principle in leading democracies worldwide.

- The electoral bonds scheme had shielded the source and extent of political funding, a departure from established norms of open disclosure.

- Removal of Funding Limits and Corporate Influence

- The judgment also addressed legal concerns related to funding limits imposed on corporate houses or organizations.

- The court noted that the primary motivation behind corporate funding of political parties was to influence the political process for potential business advantages.

- The electoral bonds had removed previous restrictions on the amount of funding by corporations, potentially paving the way for undue influence on the government.

- The ruling reinstates limits to prevent such corporate interference, aligning with international practices.

- Prevention of Shell Companies and Crony Capitalism

- The electoral bonds scheme had eliminated earlier constraints on the percentage of profits a company could donate to political parties, and remarkably, even allowed donations from loss-making companies.

- The court expressed concerns over the potential misuse of this provision, enabling the formation of shell companies solely for channeling funds to political parties.

- The judgment effectively curtails this possibility, safeguarding against the emergence of shell entities engaged in questionable political financing.

- Reversal of Amendment to the Finance Bill

- The Supreme Court also addressed a critical legal issue related to the amendment of the Reserve Bank of India (RBI) Act through the Finance Bill.

- The government had amended the RBI Act, allowing scheduled banks, authorized by the central government, to issue electoral bonds.

- However, the court struck down this amendment, asserting that only the central bank, as outlined in Section 31 of the RBI Act, possesses the authority to issue currency, including notes and bonds.

- This decision nullifies the alteration made through the Finance Act, reinstating the exclusivity of the central bank in issuing such financial instruments.

- The introduction of the amendment to the Reserve Bank of India (RBI) Act, embedded in a Finance Bill, raises questions about the transparency of the legislative process.

- By utilizing a Finance Bill, which circumvents the need for approval from the Rajya Sabha, the ruling party strategically avoided a vote in the Upper House, taking advantage of the circumstances when lacking a majority.

- However, the content of the Finance Bill, primarily designed for financial matters, seemed incongruent with the inclusion of provisions related to electoral bonds, pointing to potential misuse of legislative tools.

- Selective Amendment of Laws

- The electoral bonds scheme’s implementation involved a meticulous amendment of multiple laws, including the RBI Act 1934, the Representation of the People Act (RPA), 1951, the Income Tax Act 1961, and the Companies Act 2013.

- This deliberate and comprehensive legal maneuvering suggests a strategic effort to establish and protect the scheme, possibly in response to the Central Information Commission (CIC) ruling that mandated greater transparency in political party funding.

- The electoral bonds scheme itself emerged as a response to the CIC ruling, indicating an attempt to bypass the transparency requirements imposed on political parties.

- The complexity and multi-faceted nature of the amendments served to obscure the true implications of the scheme, creating layers of complexity that deterred ordinary citizens and voters from fully understanding its implications.

- Upholding Constitutional Values

- The recent Supreme Court judgment has delivered a decisive blow to the electoral bonds scheme, asserting that all Amendments to the Representation of the People Act (RPA) Act, the Finance Act 2017, and the Companies Act 2013 are in violation of fundamental constitutional principles.

- The essence of the judgment revolves around the infringement of Articles 19 and 14 of the Indian Constitution, safeguarding the right to information and the right to equality, respectively.

- These Fundamental Rights are deemed inviolable, and the court contends that any arbitrary aspects in legislation are impermissible.

- Key Points of the Judgment:

- Striking Down of Electoral Bonds Scheme: The Supreme Court’s ruling unequivocally strikes down the electoral bonds scheme, considering it incompatible with constitutional provisions.

- Constitutional Violations: The Amendments to the RPA Act, Finance Act 2017, and Companies Act 2013 are deemed unconstitutional, violating the rights enshrined in Articles 19 and 14.

- Fundamental Rights Protection: Articles 19 and 14, integral components of the Fundamental Rights in the Constitution, serve as the cornerstone of the judgment, emphasizing the significance of protecting citizens’ rights to information and equality before the law.

- Directive to State Bank of India (SBI): The Supreme Court directs the State Bank of India (SBI), the exclusive bank involved in the issuance of electoral bonds, to cease the issuance of these bonds.

- Transparency Mandate: The SBI is mandated to furnish comprehensive details of all previously issued electoral bonds to the Election Commission of India (ECI) by March 6, 2024. The ECI, in turn, is obligated to publish this information on its website within two weeks.

- Citizen Vigilance and Constitutional Safeguards: The judgment underscores the power of judicial review in protecting constitutional values and highlights the need for continuous vigilance by citizens to preserve democratic principles.

- Commendation for Constitutional Institutions:

- The judgment acknowledges the pivotal role played by two constitutional bodies, the Election Commission of India (ECI) and the Supreme Court, in safeguarding the democratic process.

- The power of judicial review, exercised by the court to scrutinize laws passed by Parliament against the yardstick of the Constitution, is hailed as a precious mechanism.

- Ongoing Challenges and Citizen Responsibility:

- While the judgment addresses the flaws in the electoral bonds scheme, it brings attention to persisting issues such as the influence of money in elections, including the use of black money and bribery.

- The call for eternal vigilance in protecting democracy resonates, with the Supreme Court’s decision serving as an outcome of such vigilance exercised by vigilant citizens.

ED probe finds no FEMA violations in Paytm case

(General Studies- Paper III)

Source : The Hindu

The Enforcement Directorate (ED) has concluded its inquiry into Paytm Payments Bank Limited (PPBL) transactions, finding no violations under the Foreign Exchange Management Act (FEMA).

- However, the Reserve Bank of India (RBI) retains authority to address other alleged non-compliance issues.

Key Highlights

- RBI’s Action and Extended Deadline:

- On January 31, the RBI issued a circular restricting PPBL from accepting further deposits, top-ups, or engaging in credit transactions after February 29.

- This action was based on audit reports revealing persistent non-compliance and supervisory concerns.

- The initial deadline for compliance was set for February 29, but it has been extended to March 15.

- The RBI’s decision stemmed from the Comprehensive System Audit report and subsequent compliance validation, indicating ongoing non-compliance issues in PPBL, necessitating further supervisory measures.

- ED’s Role and Scope:

- The ED was tasked with scrutinizing financial transactions under FEMA and the Prevention of Money Laundering Act (PMLA).

- However, as there were no scheduled PMLA offences involved in PPBL’s case, money laundering investigations were deemed inappropriate.

- Without evidence of a crime or proceeds of crime, the PMLA does not apply.

- The Enforcement Directorate (ED) scrutinized over 50 lakh wallets/accounts, primarily with small deposits, finding no contravention of foreign exchange rules.

- However, the focus shifted to alleged violations related to Know Your Customer (KYC) compliance and other issues, where the Reserve Bank of India (RBI) holds authority to take action.

- Areas of Concern:

- KYC Norms Adherence:

- The ED flagged issues related to KYC processes, encompassing user and merchant onboarding, document collection and authentication, anti-money laundering measures, merchant category code assignment, and compliance with National Payments Corporation of India’s regulations.

- Beneficial Ownership and Politically Exposed Persons:

- Concerns were raised about the identification processes for ultimate beneficial ownership and politically exposed persons.

- Virtual Accounts and Transaction Monitoring:

- KYC adherence concerning the setup of virtual accounts, as well as the strict monitoring and periodic reporting of suspect transactions to authorized agencies like the Financial Intelligence Unit, were highlighted.

- IT Audit Framework Recommendation:

- The report also recommended the adoption of a comprehensive Information Technology audit framework, as prescribed by relevant agencies. This suggestion aims to address vulnerabilities such as potential misuse of Application Programming Interfaces (API) keys and URL spoofing, which could lead to financial fraud.

- The RBI may take appropriate action based on the ED’s observations, indicating a regulatory response to ensure enhanced compliance in the digital payments ecosystem.

- The focus on KYC and related processes underscores the importance of robust regulatory measures in preventing financial irregularities and fraud in the digital financial landscape.

- KYC Norms Adherence:

About the Foreign Exchange Management Act (FEMA)

- The Foreign Exchange Management Act (FEMA) of India is a comprehensive legislation enacted in 1999 to regulate foreign exchange transactions and promote the country’s external trade and payments system.

- It replaced the Foreign Exchange Regulation Act (FERA) of 1973 and is administered by the Reserve Bank of India (RBI).

- FEMA aimed to align with the pro-liberalization policies of the Government of India, addressing the incompatibility of FERA with the evolving economic landscape.

- FEMA aims to facilitate external trade and payments, maintain the foreign exchange market, and prevent unauthorized foreign exchange transactions.

- It covers a wide range of activities, including import and export of goods and services, investment in foreign securities and assets, remittances and receipts of funds, and foreign currency transactions.

- The Act gives powers to the Central Government to regulate the flow of payments to and from a person situated outside India and empowers the RBI to place restrictions on transactions from the capital account, even if they are carried out through authorized channels.

- FEMA is applicable to all individuals, companies, and other entities residing in India or carrying out transactions in India.

- FEMA plays a pivotal role in fostering a liberalized foreign exchange management regime in line with the principles of the World Trade Organization (WTO).

- The enactment of FEMA also paved the way for subsequent legislation, including the Prevention of Money Laundering Act, 2002.

About the Prevention of Money Laundering Act (PMLA)

- The Prevention of Money Laundering Act (PMLA) is a comprehensive legislation enacted by the Government of India in 2002 to prevent and control money laundering.

- The Act defines money laundering as an act of concealing or disguising the proceeds of crime or possession, acquisition, or use of such proceeds, or projecting it as untainted property.

- The primary objective of the Act is to prevent and control money laundering and provide for the confiscation of property derived from or involved in money laundering.

- The Act imposes reporting obligations on various entities, including banks, financial institutions, and intermediaries, to maintain records of transactions and report suspicious transactions to the Financial Intelligence Unit (FIU).

- The Act provides for rigorous imprisonment for a term ranging from three to ten years and a fine for committing money laundering.

- The Act also allows for attachment and confiscation of property involved in money laundering and provides for international cooperation in the investigation and prosecution of money laundering offenses.

- The Act is enforced by the Director, FIU-IND, and Director (Enforcement), who have been conferred with exclusive and concurrent powers under relevant sections of the Act.

Torpedoes, refueller aircraft in new deals cleared by DAC

(General Studies- Paper III)

Source : The Hindu

The Defence Acquisition Council (DAC) has granted Acceptance of Necessity (AoN) for proposals totaling ₹84,560 crore.

- This marks the initial step in the procurement process for critical defense acquisitions.

Key Highlights

- Key Proposals Approved:

- Heavy Weight Torpedoes (HWT) for Navy’s Scorpene-class Submarines: The approval includes a long-pending deal for HWTs, enhancing the attacking capabilities of the Navy’s Kalvari class submarines.

- Flight Refueller Aircraft (FRA) for Indian Air Force (IAF): The DAC has approved the procurement of FRAs to bolster the operational capabilities and reach of the IAF.

- Medium Range Maritime Reconnaissance and Multi-Mission Maritime Aircraft: Deals for these aircraft, catering to the Navy and the Coast Guard, have received approval.

- New Generation Anti-Tank Mines, Air Defence Tactical Control Radar, and Software Defined Radios: The DAC has given the nod for acquisitions in these crucial areas.

- Active Towed Array Sonar for Indian Naval Ships: AoN has been granted for the procurement of active towed array sonar with capabilities to operate at low frequencies and various depths, ensuring long-range detection of adversary submarines.

- Defence Procurements in Detail:

- Medium Range Maritime Reconnaissance and Multi-Mission Maritime Aircraft:

- Category: Buy and Make

- Objective: Strengthen surveillance and interception capabilities of the Navy and Coast Guard in the expansive maritime region.

- Likely Development: Defence Research and Development Organisation (DRDO) is expected to base the aircraft on the Airbus C-295 transport aircraft.

- New Generation Anti-Tank Mines:

- Category: Buy (Indigenously Designed, Developed and Manufactured – IDDM)

- Features: Equipped with seismic sensors, remote deactivation, and additional safety features.

- Objective: Enhance operational efficiency in the tactical battle area for engaging non-line-of-sight targets by mechanized forces.

- Canister Launched Anti-Armour Loiter Munition System:

- Category: Buy (Indian-IDDM)

- Purpose: Strengthen mechanized forces’ capabilities for engaging targets beyond visual line of sight.

- Air Defence Tactical Control Radar:

- Objective: Enhance air defense capabilities, particularly in detecting slow, small, and low-flying targets, along with surveillance, detection, and tracking of various targets.

- Software Defined Radios for Coast Guard:

- Category: Buy (Indian)

- Objective: Fulfill communication requirements for high-speed, secure networking between the Indian Coast Guard and Navy units.

- Amendments in DAP 2020:

- Focus: Promoting procurement of advanced technologies from start-ups and Micro, Small, and Medium Enterprises (MSME).

- Changes: Amendments related to benchmarking, cost computation, payment schedule, and procurement quantity.

- Medium Range Maritime Reconnaissance and Multi-Mission Maritime Aircraft:

About the Defence Acquisition Council (DAC)

- The Defence Acquisition Council (DAC) is a high-level decision-making body in the Indian security and defense space, responsible for deciding on new policies and capital acquisitions for the three services—Army, Navy, and Air Force, as well as the Indian Coast Guard.

- The DAC was formed after the recommendations made by the Group of Ministers on ‘Reforming the National Security System’ in 2001, post-Kargil war.

- The DAC is chaired by the Defence Minister and includes the Chief of Army Staff, Chief of Air Staff, Chief of Naval Staff, Defence Secretary, and other members.

- The DAC’s functions include:

- Accord approval for Acceptance of Necessity (AoN) for Capital Acquisition Proposals.

- Categorizing acquisition proposals into ‘Buy,’ ‘Buy & Make,’ and ‘Make’ projects.

- In-principle approval of the 15-Year Long-Term Integrated Perspective Plan (LTPP) for Defence Forces.

- Monitoring the progress of major projects on feedback from the Defence Procurement Board.

- The DAC has been instrumental in approving capital acquisition proposals worth billions of rupees, with a strong emphasis on indigenous production and R&D.

- The DAC has also made amendments to the Defence Acquisition Procedure (DAP) 2020 to encourage start-ups and MSMEs participation in the defense ecosystem.

Coaching centres can’t use misleading ads: draft guidelines

(General Studies- Paper II)

Source : The Hindu

The Central Consumer Protection Authority (CCPA) has released draft guidelines aimed at preventing misleading advertisements in the coaching sector.

- These guidelines are open for public consultation.

Key Highlights

- Definition of “Coaching”:

- Description: Tuition, instructions, academic support, learning programs, or guidance provided by any person.

- Misleading Practices:

- Examples of Misleading Claims: False assertions about success rates, number of selections, or rankings of students.

- Prohibited Practices: Creating a false sense of urgency or fear of missing out that heightens anxieties.

- Considered Misleading: Concealing essential information, such as the name and duration of the course opted by successful candidates, in advertisements.

- Guidance: Coaching institutes should not falsely attribute students’ success solely to the coaching, without acknowledging individual efforts.

- Obligations for Coaching Institutes:

- Institutes must disclose the rank, course name, duration, and payment status of the course opted by successful candidates.

- Required to prominently display disclaimers, disclosures, and important information in advertisements, using the same font as the advertisement claims.

- Prohibited from using names, photos, or testimonials of successful candidates without consent.

- Coaching institutes must accurately represent facilities, resources, and infrastructure available to students in advertisements.

- Institutes should refrain from cherry-picking exceptional cases to create a skewed impression of success.

- Coaching institutes are prohibited from making false claims such as 100% selection, job guarantees, guaranteed preliminary/mains, or guaranteed admission to institutions.

- Use of false testimonials or fake reviews is explicitly disallowed.

About the Central Consumer Protection Authority (CCPA)

- The Central Consumer Protection Authority (CCPA) is a regulatory body established under the Consumer Protection Act, 2019, to protect the rights of consumers and promote, protect, and enforce consumer rights in India.

- The CCPA was established on July 24, 2020, and is headquartered in New Delhi.

- The CCPA is empowered to conduct investigations into violations of consumer rights, institute complaints or prosecution, order recall of unsafe goods and services, order discontinuation of unfair trade practices and misleading advertisements, and impose penalties on manufacturers, endorsers, publishers of misleading advertisements.

- The CCPA consists of a Chief Commissioner and two Commissioners, one each representing goods and services.

- The CCPA has the following powers:

- To inquire into violations of consumer rights or unfair trade practices.

- To order an investigation by the District Collector or Director General.

- To direct a trader, manufacturer, endorser, or advertiser to stop unfair practices or misleading advertisements and impose penalties up to Rs 10 lakhs.

- To prevent endorsers from making the same misleading advertisement for three years in case of subsequent contravention.

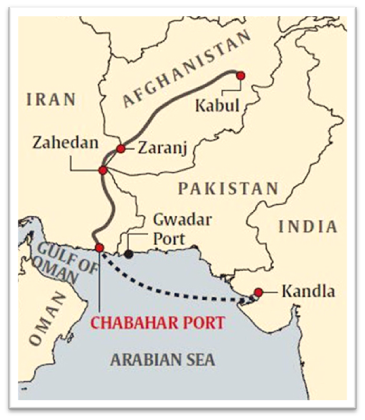

Use Chabahar port, India tells Central Asian countries

(General Studies- Paper II)

Source : The Hindu

India has urged Central Asian countries to leverage the Chabahar port in Iran for enhanced connectivity and trade.

- During the 6th Regional Dialogue of Secretaries of Security Councils/National Security Advisers on Afghanistan in Bishkek, Kyrgyzstan, India’s Deputy National Security Adviser VikramMisri emphasized the importance of an “inclusive and representative” government in Afghanistan.

- The dialogue in Bishkek covered topics such as terrorism, drug trafficking, and regional connectivity.

Key Highlights

- India encouraged Central Asian neighbors, including Iran, Russia, Kyrgyzstan, Kazakhstan, and Turkmenistan, to utilize the Chabahar port and the Shaheed Behesti terminal for maritime trade with India and other global partners.

- India’s Engagement with Afghanistan:

- India has not officially recognized the Taliban, which assumed power in Afghanistan in August 2021.

- India maintains consistency in its policy, emphasizing the need for an inclusive government in Afghanistan.

- India emphasized its legitimate economic and security interests in Afghanistan, underscoring its commitment to peace, security, and stability in the region.

- India’s proposals highlight the importance of regional cooperation and a consensus-based strategy for dealing with Afghanistan.

- Despite concerns over the Taliban’s human rights record, India has provided scholarships to around 600 Afghan girls for studies in India under the Indian Council for Cultural Relations (ICCR) program.

- Commercial ties between India and Afghanistan continue, emphasizing the importance of creating economic opportunities for the Afghan people.

- Immediate Priorities and Ongoing Projects:

- India, participating in the 6th Regional Dialogue on Afghanistan in Bishkek, highlighted its immediate priorities, including providing humanitarian assistance, supporting the formation of an inclusive government, combating terrorism and drug trafficking, and safeguarding the rights of women, children, and minorities.

- India has around 500 projects across all 34 provinces of Afghanistan, covering critical sectors such as power, water supply, road connectivity, healthcare, education, agriculture, and capacity building.

About the Chabahar port in Iran

- Chabahar Port is a seaport located in southeastern Iran, on the Gulf of Oman.

- It serves as Iran’s only oceanic port and consists of two separate ports named Shahid Kalantari and ShahidBeheshti, each of which has five berths.

- The port was opened in 1983 and is operated by India through India Ports Global Limited, while being owned by Iran through the Ports and Maritime Organization.

- The port has a land area of 440 hectares and a size of harbor of 480 hectares.

- The port plays a crucial role in the International North-South Transit Corridor (INSTC) and serves as a gateway to the eastern development route of the country.

- The development of Chabahar Port is of strategic importance, as it provides India with access to Afghanistan and Central Asia, bypassing Pakistan.

- It also serves as a key transit point for trade between India, Iran, Afghanistan, and other countries.

- The port has been the focus of significant investment and development, with plans for expansion and the construction of new berths and terminals.

- The expansion project is being carried out in multiple phases, with the aim of increasing the port’s handling capacity to 82 million tonnes.