CURRENT AFFAIRS – 11/08/2023

CURRENT AFFAIRS – 11/08/2023

Bill moved to remove CJI from panel to select Election Commissioners

(General Studies- Paper II)

The Union government introduced a Bill that removes the Chief Justice of India (CJI) from the panel selecting the Chief Election Commissioner and Election Commissioners.

Key Highlights

- The government introduced a Bill in the Rajya Sabha to modify the committee for selecting the Chief Election Commissioner (CEC) and Election Commissioners.

- The Bill proposes to replace the Chief Justice of India with a Cabinet Minister nominated by the Prime Minister in the selection committee.

- The Leader of Opposition in Lok Sabha will also become a member of the selection committee.

- This follows a recent Supreme Court ruling where the selection committee was to be headed by the Prime Minister and include the Chief Justice of India, until Parliament enacts a new law on appointments.

- The CEC and ECs are currently appointed by the government based on Article 324(2) of the Constitution.

- The Bill establishes a Search Committee to prepare a panel of candidates, and the Selection Committee, headed by the Prime Minister, will make the final decision.

- The terms of the CEC and ECs remain at six years or age 65, with salaries equivalent to the Cabinet Secretary.

- The Bill repeals the Election Commission (Conditions of Service of Election Commissioners and Transaction of Business) Act, 1991.

Introduction of the Bill:

- The Chief Election Commissioner and Other Election Commissioners (Appointment, Conditions of Service and Term of Office) Bill, 2023, was presented in the Rajya Sabha on August 10, 2023.

- This bill seeks to restructure the process of appointing and defining the roles of the Chief Election Commissioner (CEC) and other Election Commissioners (ECs) in India.

- Notably, it repeals the existing Election Commission (Conditions of Service of Election Commissioners and Transaction of Business) Act, 1991.

Continuity in Composition:

- The Bill maintains the existing composition of the Election Commission, which comprises the Chief Election Commissioner (CEC) and other Election Commissioners (ECs) as determined by the President.

- However, it introduces a significant change in the appointment process, stipulating that the CEC and ECs will now be recommended by a Selection Committee before being appointed by the President.

Selection Committee Structure:

- The Selection Committee, responsible for recommending candidates for the CEC and EC positions, is defined in the Bill.

The committee consists of the following:

- Prime Minister as the Chairperson,

- the Leader of the Opposition in Lok Sabha as a member, and

- a Union Cabinet Minister nominated by the Prime Minister as another member.

If there is no recognized Leader of the Opposition, the role is assumed by the leader of the single largest opposition party in Lok Sabha.

Inclusion of a Search Committee:

- A Search Committee is introduced in the Bill to facilitate the selection process.

- Chaired by the Cabinet Secretary, the Search Committee prepares a panel of five potential candidates for consideration by the Selection Committee.

- This committee also includes two additional members holding a rank not lower than that of a Secretary to the central government, possessing expertise in electoral matters.

- Furthermore, the Selection Committee has the flexibility to consider candidates beyond those presented by the Search Committee.

Qualification Criteria for CEC and ECs:

- The Bill sets specific eligibility criteria for candidates aspiring to be appointed as CEC and ECs.

- Individuals holding, or having held, positions equivalent to the rank of Secretary to the central government are eligible for consideration.

- Additionally, candidates must demonstrate expertise in the management and conduct of elections.

Uniformity in Salary and Allowances:

- Regarding remuneration, the Bill proposes that the salary, allowances, and service conditions of the CEC and other ECs be aligned with those of the Cabinet Secretary.

- This marks a departure from the Election Commission (Conditions of Service of Election Commissioners and Transaction of Business) Act, 1991, which equated the salary of ECs to that of a Supreme Court judge.

Consistency in Term of Office:

- The tenure of the CEC and other ECs remains unchanged in the Bill.

- The appointed officials can serve for a term of six years or until they attain the age of 65, whichever comes first.

- The Bill maintains the provision that if an EC is elevated to the position of CEC, their total term of office cannot exceed six years.

- Notably, the Bill also introduces a provision that bars re-appointment of the CEC and other ECs.

Decision-Making and Conduct of Business:

- In terms of decision-making within the Election Commission, the Bill emphasizes unanimous conduct of all business.

- In instances where a difference of opinion arises between the CEC and other ECs, the Bill stipulates that a majority decision will prevail.

Removal and Resignation Procedures Retained:

- The Bill preserves the existing process for removal and resignation of the CEC and ECs.

- Similar to Article 324 of the Constitution, the removal of the CEC mirrors the procedure for a Supreme Court judge.

- It mandates an order from the President, contingent upon a motion passed by both Houses of Parliament within the same session.

- An EC can only be removed on the recommendation of the CEC.

- Resignation provisions for the CEC and other ECs remain unchanged.

Articles in the Constitution

Article 324:

- Establishes the Election Commission of India and grants it the authority for superintendence, direction, and control over the preparation of electoral rolls and the conduct of elections.

Article 324(2):

- Empowers the President to appoint the Chief Election Commissioner and other Election Commissioners.

- The number of Election Commissioners is determined by the President.

Article 324(5):

- Authorizes the President to define the conditions of service and the term of office for the Election Commissioners.

Article 325:

- Ensures that no individual can be disqualified from voting or included in a special electoral roll based on factors like religion, race, caste, or sex.

- Upholds the principle of non-discrimination in electoral matters.

Article 326:

- Establishes the principle of adult suffrage, ensuring that elections to the House of the People (Lok Sabha) and State Legislative Assemblies are conducted on the basis of universal adult suffrage.

About Election Commission of India (ECI)

- The ECI is an independent constitutional body responsible for overseeing and conducting elections in India.

- It ensures the fair and transparent conduct of elections at various levels, including national, state, and local.

- Article 324 of the Constitution establishes the Election Commission of India and assigns it the superintendence, direction, and control of elections in the country.

Composition:

- The Election Commission is headed by the Chief Election Commissioner (CEC).

- It may also have other Election Commissioners (ECs), as determined by the President.

Powers and Functions:

- The ECI prepares and maintains electoral rolls.

- It supervises the conduct of elections to ensure fairness, transparency, and integrity.

- The ECI sets election dates, oversees polling, and announces results.

Delimitation:

- The ECI is responsible for the delimitation of constituencies for elections.

Model Code of Conduct:

- The ECI enforces the Model Code of Conduct to ensure fair campaign practices.

Electoral Reforms:

- The ECI proposes electoral reforms to enhance the democratic process.

Source : The Hindu

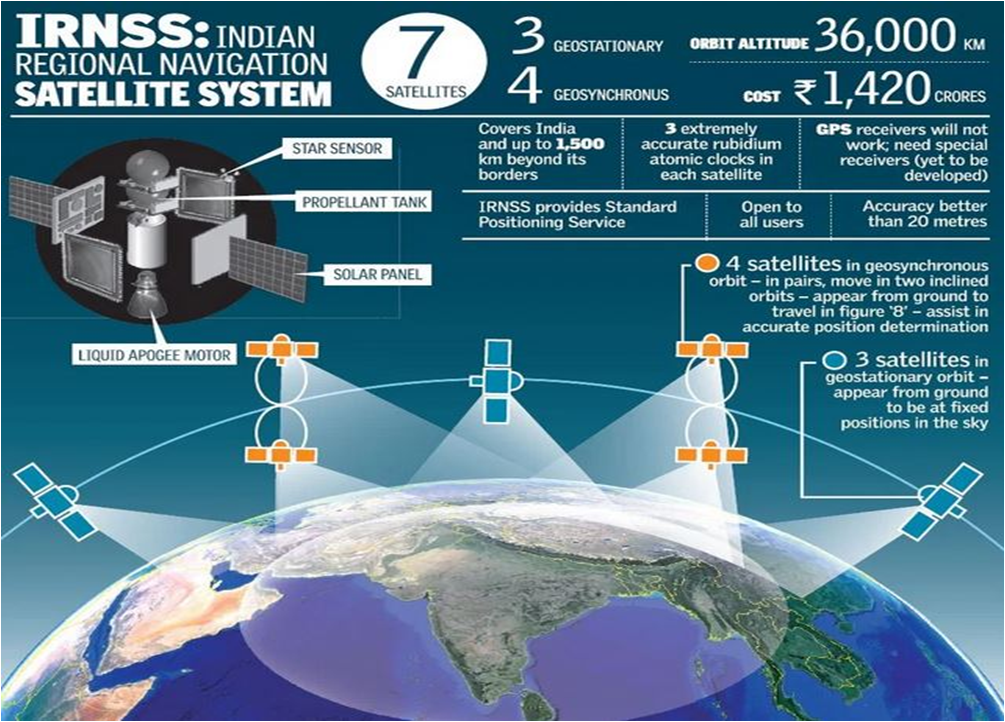

Indian GPS NavIC to link to Aadhaar enrolment devices

(General Studies- Paper III)

The Navigation with Indian Constellation (NavIC), India’s own global positioning system, is set to be integrated into Aadhaar enrolment devices.

Key Highlights

- The Department of Space (DoS) informed the Parliamentary Committee of Science and Technology about the integration.

- NavIC is an Indian version of GPS and consists of seven satellites.

- It offers Standard Position Service (SPS) for civilian users and Restricted Service (RS) for strategic users.

- Aadhaar enrolment kits, used for collecting and verifying personal details, currently use GPS.

- The integration of NavIC will enhance the accuracy and reliability of location-based services.

- The Centre has been encouraging cellphone manufacturers to make their devices compatible with NavIC, which may require hardware alterations.

- The National Disaster Management Agency (NDMA) utilizes NavIC for alert dissemination in natural disasters like landslips, earthquakes, floods, and avalanches.

- The Indian National Centre for Ocean Information System (INCOIS) uses NavIC to broadcast alerts about cyclones, high waves, and tsunamis to fishermen.

- Various bodies, such as the Bureau of Indian Standards (BIS), Telecom Standards Development Society (TSDSI), and International Standards Organisation (ISO), are actively involved in setting interoperability standards for NavIC.

- The DoS is providing technical expertise and facilitating trials to integrate NavIC into Aadhaar enrolment devices.

About Navigation with Indian Constellation (NavIC)

- NavIC, short for Navigation with Indian Constellation, is an independent regional satellite navigation system developed by the Indian Space Research Organisation (ISRO).

- The concept was proposed in the early 2000s to develop India’s own navigation system to reduce dependency on foreign systems like the Global Positioning System (GPS).

Satellite Constellation:

- NavIC consists of a constellation of seven satellites in geostationary and geosynchronous orbits.

- These satellites are named IRNSS (Indian Regional Navigation Satellite System) satellites.

Services:

NavIC provides two main services.

Standard Positioning Service (SPS):

- Designed for civilian use, providing accurate position, velocity, and timing information.

Restricted Service (RS):

- Intended for strategic and authorized users, offering enhanced accuracy and encrypted data.

Frequency Bands:NavIC operates in two frequency bands:

- L5 band (1176.45 MHz)

- S band (2498.028 MHz)

- These bands allow NavIC to provide accurate positioning and navigation information.

Coverage Area:

- NavIC covers India and a region extending approximately 1,500 kilometers beyond its boundaries.

- This coverage area includes neighboring countries and the surrounding ocean regions.

Uses:

- Navigation and Positioning: NavIC provides accurate positioning and navigation information for various sectors, including transportation, agriculture, and disaster management.

- Disaster Management: NavIC is utilized by the National Disaster Management Agency (NDMA) to disseminate alerts for natural disasters such as landslips, earthquakes, floods, and tsunamis.

- Ocean Information System: The Indian National Centre for Ocean Information System (INCOIS) employs NavIC to broadcast alerts about cyclones, high waves, and tsunamis to fishermen and ships in the Indian Ocean.

- Location-based Services: NavIC enhances the accuracy and reliability of location-based services, contributing to improved efficiency in various industries.

- Defense and Strategic Applications: The Restricted Service (RS) of NavIC is designed to serve defense and strategic applications that require high accuracy and secure navigation.

About the Indian National Centre for Ocean Information System (INCOIS)

- INCOIS was established in 1999 as an autonomous institution under the Ministry of Earth Sciences (MoES) of the Government of India.

- Its primary mandate is to provide ocean information and advisory services to various stakeholders, including coastal communities, marine industries, and policymakers.

Oceanographic Services:

- INCOIS collects, analyzes, and disseminates oceanographic data and information to support various sectors like fisheries, shipping, disaster management, and scientific research.

Data Collection and Forecasting:

- It operates a network of observation buoys, tide gauges, and high-frequency coastal radars to monitor ocean parameters such as sea level, tides, currents, and temperature.

- INCOIS develops ocean models and conducts numerical simulations to provide short-term and medium-term ocean forecasts, including predictions for cyclones, tsunamis, and other ocean-related phenomena.

Tsunami Warning System:

- One of its key contributions is the development and operation of the Indian Tsunami Early Warning System (ITEWS).

- ITEWS uses real-time seismic and sea-level data to rapidly detect and assess the potential for tsunamis, issuing alerts to vulnerable coastal areas.

Ocean Services for Fisheries:

- INCOIS provides specialized ocean information services to support fisheries management.

- This includes information on potential fishing zones, oceanographic conditions, and advisories to enhance the safety and efficiency of fishing activities.

INCOIS plays a crucial role in disaster management by providing timely information and alerts related to oceanic events such as cyclones, tsunamis, and storm surges.

INCOIS engages in public awareness campaigns and educational programs to promote ocean literacy and raise awareness about the importance of ocean health and safety.

Source : The Hindu

The Situation in Myanmar and its Relation with India

(General Studies- Paper III)

July 31 and August 1 marked significant events in Myanmar’s ongoing tragedy.

- Acting President MyintSwe extended the ’emergency’ violating the 2008 Constitution.

- The military regime released political prisoners, reduced sentences for Aung San Suu Kyi and Win Myint.

Key Highlights

Emergency Extension and Elections:

- The extension delays military-proposed elections due to the failure to establish ‘normalcy’.

- Pursuit of ‘normalcy’ led to civilian suffering, with ACLED (the Armed Conflict Location & Event Data Project )reporting high violence levels.

Military Control and Elections:

- Tatmadaw (Myanmar’s military) controls only 30%-40% of Myanmar’s territory despite a relentless campaign.

- Holding a nationwide election in just a third of the country could undermine credibility.

- Reshuffling in the military-backed USDP raises concerns about commitment to democracy.

Suu Kyi’s Release and Its Implications:

- Reduction of Suu Kyi’s sentence and house arrest perplex observers.

- Suu Kyi’s return may impact the NUG-led (National Unity Government) resistance and cooperation with ethnic groups.

Symbolic Gestures and India’s Policy:

- India initially aided Myanmar during the pandemic and coup but shifted focus to Manipur violence.

- Concerns over trafficking and drug smuggling led India to suspend the Free Movement Regime.

- India’s policy reflects a paradox between democracy commitment and security concerns.

- Reports suggest India increased arms supply to the military post-coup.

- Engaging with Suu Kyi and pro-democracy actors, avoiding blanket securitization of refugees, and fostering compassion could be a positive approach.

About India- Myanmar Relations

- India and Myanmar share a significant economic relationship, marked by trade, investment, and developmental cooperation.

- Myanmar holds a pivotal geopolitical position for India, situated at the heart of the India-Southeast Asia region.

- It is the sole Southeast Asian nation sharing a land border with India’s northeastern states, fostering direct connectivity.

- Myanmar uniquely bridges India’s “Neighborhood First” and “Act East” policies, forming a crucial junction.

Indian Investment in Myanmar:

- India has undertaken various investment projects in Myanmar, contributing to infrastructure development and economic growth.

- Kaladan Multimodal Transit Transport Project: A significant connectivity project that aims to link India’s northeastern states to the Bay of Bengal through Myanmar’s Sittwe port.

- Energy Sector: Indian companies have invested in Myanmar’s energy sector, including oil and gas exploration and power generation.

- Under India’s SAGAR Vision, the Sittwe port was developed in Myanmar’s Rakhine state.

Sittwe port counters China’s Kyaukpyu port, diminishing China’s geostrategic influence in Rakhine.

Bilateral Agreements: Both countries have signed agreements to enhance economic cooperation and facilitate trade and investment.

- Bilateral Trade Agreement

- Double Taxation Avoidance Agreement

- Agreement on Land Border Crossing

About Kaladan Multimodal Transit Transport Project

- The Kaladan Multimodal Transit Transport Project seeks to establish a transit route connecting the eastern Indian seaport of Kolkata with Sittwe Port in Myanmar, and then extending further via river and road to Mizoram in northeastern India.

- The project involves the integration of multiple modes of transportation, including sea, river, and road transport.

- The project includes the development of Sittwe Port in Myanmar’s Rakhine State.

- A significant aspect of the project is the use of the Kaladan River in Myanmar to facilitate inland water transport, connecting Sittwe Port to the northeastern Indian state of Mizoram.

- The project involves the construction of roads and highways to link the ports and facilitate efficient overland transport within Myanmar and India.

Source : The Hindu

India-Japan look to restart trilateral cooperation with Sri Lanka

(General Studies- Paper III)

India, Japan, and Sri Lanka are exploring ways to restart trilateral cooperation in infrastructure projects after the cancellation of a joint India-Japan MoU for the East Container Terminal (ECT) project in Colombo, Sri Lanka.

Key Highlights

Background: The cancellation of the ECT MoU and suspension of a Japanese-funded light rail transit (LRT) project by the previous Gotabaya Rajapaksa government strained ties between Japan and Sri Lanka.

India and Japan’s Assistance:

- India and Japan extended economic assistance to Sri Lanka during an economic crisis, leading to improved ties.

- The Sri Lankan government seeks the return of infrastructure project plans and investments from both countries.

Joint Vision Statement:

- A “Joint Economic Vision Statement” was released by Sri Lankan President RanilWickremesinghe and Indian Prime Minister Narendra Modi, suggesting collaboration on various projects.

Proposed Projects:

- Suggestions include working together on renewable energy, grid connectivity, Trincomalee as an oil pipeline hub, tourism, and education.

Private Sector Involvement:

- While the governments will catalyze projects, the private sector is encouraged to lead investment and execution.

vPartnership with Japan:

- Sri Lanka hopes to involve Japan to work alongside India, especially in projects that require significant investment, emphasizing a partnership approach.

China’s Role:

- India and Japan are keen to involve China in the creditors’ platform for Sri Lanka’s foreign debt restructuring process, although China has chosen to remain an observer.

Positive Outlook: Trilateral cooperation could help enhance regional connectivity, economic growth, and people-to-people exchanges among the three countries.

The Project History in Srilanka and China’s Influence

- Chinese Firm Awarded Contract: A state-run Chinese firm, China Harbour Engineering Company, had been awarded the contract to develop the Colombo Port’s eastern container terminal in Sri Lanka.

- Tripartite Deal Scrapped: Sri Lanka scrapped a previous tripartite agreement involving India, Japan, and Sri Lanka to develop the deep-sea container port, opting for Chinese involvement instead.

- Chinese Investment in Sri Lanka: China has been a major investor in Sri Lanka’s infrastructure projects, including the Hambantota port, which was leased to a state-run Chinese company for 99 years in a debt swap.

- Debt Trap Concerns: There are growing concerns both locally and internationally that China’s investments could potentially lead Sri Lanka into a debt trap.

- Strategic Significance: The Colombo Port’s development holds strategic importance due to its location and role in maritime trade.

Source : The Hindu

RBI’s Monetary Policy

(General Studies- Paper III)

The Monetary Policy Committee (MPC) of the Reserve Bank of India decided unanimously to keep the policy repo rate unchanged.

Key Highlights

- Monetary Policy Committee (MPC) Decision: The Reserve Bank of India’s (RBI) MPC decided to keep the policy repo rate unchanged at 6.5%.

- Inflation Projection: The MPC raised the projection for retail inflation in the current fiscal year by 30 basis points to 5.4%.

- Inflation Observations: RBI Governor Shaktikanta Das noted that headline inflation, which had reached a low of 4.3% in May 2023, rose in June and is expected to surge in July-August, particularly due to vegetable prices.

- Economic Activity: Despite weak external demand, domestic economic activity is holding up well and is likely to retain momentum.

- Inflation Target: The MPC remains committed to aligning inflation with the 4% target and anchoring inflation expectations.

- GDP Growth Projection: Real GDP growth projection for 2023-24 retained at 6.5%, with Q1 at 8%, Q2 at 6.5%, Q3 at 6%, and Q4 at 5.7%.

- Excess Liquidity: To manage excess liquidity, scheduled banks will maintain an incremental cash reserve ratio (I-CRR) of 10% on the increase in their net demand and time liabilities (NDTL).

- Temporary Measure: The I-CRR is a temporary measure intended to absorb surplus liquidity, and existing cash reserve ratio (CRR) remains unchanged at 4.5%.

Let us learn few Terminologies

Cash Reserve Ratio (CRR):

- The cash reserve ratio (CRR) is the portion of total deposits that banks are required to keep as reserves with the central bank.

- It is a crucial tool for controlling the money supply in the economy and ensuring stability in the financial system.

- The CRR is expressed as a percentage of a bank’s NDTL (Net Demand and Time Liabilities), which includes demand deposits, time deposits, and other liabilities.

Incremental Cash Reserve Ratio (I-CRR):

- The incremental cash reserve ratio (I-CRR) is an extension of the regular CRR.

- It requires banks to maintain an additional portion of their incremental (newly generated) NDTL as reserves with the central bank.

- The I-CRR is imposed for a specific period and is designed to absorb excess liquidity from the banking system that might arise due to certain factors, such as the return of currency notes or other liquidity injections.

Net Demand and Time Liabilities (NDTL):

- Net Demand and Time Liabilities (NDTL) refer to the total deposits held by a bank’s customers that are subject to immediate withdrawal (demand deposits) as well as deposits that have a specific maturity date (time deposits).

- NDTL is an important factor in determining the reserve requirements that banks need to maintain with the central bank.

Liquidity Management:

- Liquidity management refers to the process by which central banks control the amount of money circulating in the economy.

- It involves adjusting the level of reserves that banks are required to hold, influencing the money supply, and maintaining stability in financial markets.

Monetary Policy Tools:

- Cash reserve ratio (CRR) and incremental cash reserve ratio (I-CRR) are tools used by central banks as part of their monetary policy measures to achieve various objectives, including controlling inflation, promoting economic growth, and maintaining financial stability.

Let us learn few Terminologies

Cash Reserve Ratio (CRR):

- The cash reserve ratio (CRR) is the portion of total deposits that banks are required to keep as reserves with the central bank.

- It is a crucial tool for controlling the money supply in the economy and ensuring stability in the financial system.

- The CRR is expressed as a percentage of a bank’s NDTL (Net Demand and Time Liabilities), which includes demand deposits, time deposits, and other liabilities.

Incremental Cash Reserve Ratio (I-CRR):

- The incremental cash reserve ratio (I-CRR) is an extension of the regular CRR.

- It requires banks to maintain an additional portion of their incremental (newly generated) NDTL as reserves with the central bank.

- The I-CRR is imposed for a specific period and is designed to absorb excess liquidity from the banking system that might arise due to certain factors, such as the return of currency notes or other liquidity injections.

Net Demand and Time Liabilities (NDTL):

- Net Demand and Time Liabilities (NDTL) refer to the total deposits held by a bank’s customers that are subject to immediate withdrawal (demand deposits) as well as deposits that have a specific maturity date (time deposits).

- NDTL is an important factor in determining the reserve requirements that banks need to maintain with the central bank.

Liquidity Management:

- Liquidity management refers to the process by which central banks control the amount of money circulating in the economy.

- It involves adjusting the level of reserves that banks are required to hold, influencing the money supply, and maintaining stability in financial markets.

Monetary Policy Tools:

- Cash reserve ratio (CRR) and incremental cash reserve ratio (I-CRR) are tools used by central banks as part of their monetary policy measures to achieve various objectives, including controlling inflation, promoting economic growth, and maintaining financial stability.

About Monetary Policy Committee (MPC)

The Monetary Policy Committee (MPC) was established in India on June 27, 2016, through an amendment to the Reserve Bank of India Act, 1934.

The MPC was created to make the process of monetary policy decisions more transparent, accountable, and objective.

Members:

- The MPC consists of six members, including three officials from the Reserve Bank of India (RBI) and three external members appointed by the Central Government.

- The RBI Governor serves as the ex-officio Chairperson of the MPC.

- The Deputy Governor of the RBI in charge of the Monetary Policy Department is also a member.

- The remaining four members are nominated by the Central Government based on their expertise in economics, monetary policy, and related fields.

Functions:

- The primary function of the MPC is to set the policy repo rate and other key policy rates to achieve the inflation target set by the government.

- The MPC is responsible for formulating and implementing India’s monetary policy.

- It decides the stance of monetary policy, which includes either accommodative, neutral, or tight.

- The MPC’s decisions are aimed at achieving price stability while supporting economic growth.

- The MPC’s decisions are binding, and the RBI is responsible for implementing and operationalizing the policy measures decided by the committee.

Inflation Target:

- The MPC is tasked with maintaining price stability by targeting a specific inflation rate.

- The inflation target is set at 4% with a tolerance range of +/- 2 percentage points.

Source : The Hindu

China’s “Sponge City” Initiative

(General Studies- Paper II and III)

China has experienced recent devastating floods causing casualties, infrastructure damage, and raising concerns about the effectiveness of the 2015 “sponge city” initiative.

- The initiative aimed to enhance flood resilience in major cities and optimize rainwater usage through architectural, engineering, and infrastructural modifications.

Key Highlights

- The “sponge city” initiative aimed to reduce urban flood risks and enhance water management in highly populated cities.

- Implemented through measures such as permeable asphalt, new canals, ponds, and wetland restoration to improve water distribution, drainage, and storage.

- These solutions not only tackled waterlogging and flooding but also aimed to improve the overall urban environment.

- Challenges from Urbanization and Vulnerability to Flooding:

- Rapid urbanization led to vast areas covered in impermeable concrete, diminishing water absorption capacity.

- Wetlands were paved over, and traditional flood plains along major rivers were encased in concrete, leading to waterlogging and flooding.

- Data from 2018 indicated that 641 out of 654 large- and medium-sized cities in China were vulnerable to flooding and waterlogging, with 180 facing annual flood risks.

Progress and Implementation:

- Pilot initiatives showed positive outcomes, with local projects like green roofs and rain gardens effectively reducing runoff.

- Implementation of the initiative remained inconsistent; only 64 out of 654 cities had established legislation based on sponge city guidelines by the previous year.

Limitations and Challenges:

- Sponge city measures, even if fully implemented, may not have prevented recent flood disasters.

- Notable example: Zhengzhou allocated substantial funds to the initiative but struggled to cope with historic rainfall in 2021.

- Experts suggest that sponge city infrastructure can handle up to 200 millimeters (7.9 inches) of rain per day.

- Unprecedented rainstorms in July 2021, with rainfall exceeding 200 mm in just one hour in Zhengzhou, highlighted limitations.

- Climate Change and Future Considerations:

- Authorities are adapting to climate change as heavy rains impact arid northern cities where sponge city development is less advanced.

Source : The Indian Express