CURRENT AFFAIRS – 09/01/2024

- CURRENT AFFAIRS – 09/01/2024

- How AI can help detect cancer?

- Supreme Court Legal Services Committee

- First Advance Estimates of India’s GDP out

- Karnataka HC bans mining activity near KRS reservoir

- Understanding the EU’s carbon border tax

- How surgical care in India is a neglected part of public health?

- Debating India’s new hit-and-run law

- Structured negotiation as a boost for disability rights

CURRENT AFFAIRS – 09/01/2024

How AI can help detect cancer?

(General Studies- Paper III)

Source : The Indian Express

The Tata Memorial Hospital (TMH) in Mumbai, India, is leveraging artificial intelligence (AI) to combat the shortage of cancer specialists and enhance early-stage cancer detection.

- With cancer cases on the rise, TMH has initiated a ground-breaking project involving the establishment of a ‘Bio-Imaging Bank’ focused on utilizing AI, particularly deep learning.

Key Highlights

- Bio-Imaging Bank and AI Integration:

- The ‘Bio-Imaging Bank’ is a strategic initiative aiming to create an extensive repository that integrates radiology and pathology images with crucial clinical information, treatment specifics, outcome data, and additional metadata.

- The objective is to facilitate the development, validation, and rigorous testing of AI algorithms tailored for cancer detection.

- Initially concentrating on head-neck and lung cancers, the project plans to include a minimum of 1000 patients for each cancer type, surpassing this commitment by the completion date.

- The comprehensive database will serve as a foundation for training and testing various AI algorithms.

- These algorithms will address critical medical tasks such as screening for lymph node metastases, nucleus segmentation and classification, biomarker prediction (e.g., HPV in oropharyngeal and EGFR in lung cancer), and therapy response prediction.

- Collaborative Effort and Funding:

- This ambitious initiative is a multi-institutional project funded by the Department of Biotechnology. Collaborating institutions include IIT-Bombay, RGCIRC-New Delhi, AIIMS-New Delhi, and PGIMER-Chandigarh, emphasizing a collective effort to harness the potential of AI in revolutionizing cancer care.

- Emulating Human Brain for Cancer Detection:

- Artificial Intelligence (AI) plays a crucial role in early cancer detection by mimicking the information processing of the human brain.

- In the realm of cancer diagnosis, AI analyzes radiological and pathological images, learning from extensive datasets to recognize unique features associated with different types of cancers.

- This technological advancement enables the identification of tissue changes and potential malignancies, facilitating early detection.

- Through comprehensive imaging, AI leverages longitudinal patient data to understand the behavior of diseases, treatment responses, disease recurrence, and overall survival.

- AI and machine learning protocols utilize this data to develop predictive models for tumor survival and guide treatment aggressiveness.

- Tumor Image Bank Creation:

- To enhance AI’s effectiveness, TMC creates a tumor image bank involving the segmentation and annotation of images.

- This process includes outlining tumors, identifying different features, and annotating them as malignant, inflammatory, or edematous.

- Biopsy results, histopathology, immunohistochemistry reports, and genomic sequences are correlated with images and clinical data, forming the basis for developing diverse algorithms.

- Tata Memorial Hospital’s approach enables the development of algorithms specific to different tumors.

- The correlation of biopsy results and clinical data with images allows the creation of predictive and diagnostic models.

- These models, developed using thousands of breast cancer images, undergo AI and machine learning analysis, supported by technical expertise from partners like IIT-Bombay.

- Clinical Utility and Precision Medicine:

- The utilization of the biobank allows TMH to develop algorithms that assess treatment responses directly from images.

- This precision enables the avoidance of unnecessary chemotherapy for predicted non-responders, showcasing the clinical utility of AI in personalized cancer care.

- The integration of AI into cancer diagnostics not only enhances accuracy but also contributes to more targeted and effective treatment strategies.

- TMH has actively embraced AI technology, with the inclusion of data from 60,000 patients into the biobank over the past year.

- The hospital is utilizing AI to reduce radiation exposure for pediatric patients undergoing CT scans, achieving a notable 40% reduction in radiation through innovative projects.

- AI algorithms enhance images, ensuring a significant decrease in radiation exposure for children without compromising diagnostic quality.

- Pilot Implementation in ICU:

- The hospital is piloting a specific algorithm in the Intensive Care Unit (ICU) for thoracic radiology.

- This algorithm, focused on imaging and diagnosing conditions in the chest area, provides immediate and accurate diagnoses, proven to be 98% correct after cross-checks by doctors.

- TMH is actively validating various AI algorithms, such as the thoracic suit, which interprets digital chest X-rays and identifies pathologies like nodules and pneumothorax.

- The integration of AI in the ICU setting demonstrates its potential in aiding early diagnosis and saving valuable time in critical medical situations.

- Future Outlook: Can AI Reduce Cancer Fatalities?

- In the future, AI is anticipated to play a transformative role in cancer treatment, specifically in reducing fatalities in rural India.

- In future, AI can swiftly detect cancer with a simple click, eliminating the need for extensive tests and enabling general practitioners to diagnose complex cancers.

- The potential lies in tailoring treatment approaches based on diverse patient profiles, optimizing therapy outcomes, and significantly enhancing precision in cancer solutions.

- Challenges and Debates:

- While AI holds promise, its use raises debates about potential replacement of human radiologists.

- The technology is under regulatory scrutiny, and some doctors and health institutions express resistance to the complete replacement of human expertise by AI tools.

- The ongoing dialogue emphasizes the need for ethical and regulated integration of AI in healthcare.

Understanding the terminologies:

- Tumor:

- A tumor refers to an abnormal mass or lump of tissue that may develop when cells divide and grow uncontrollably.

- Tumors can be either benign (non-cancerous) or malignant (cancerous).

- Malignant tumors have the potential to invade nearby tissues and spread to other parts of the body.

- Biopsy:

- A biopsy is a medical procedure involving the removal of a small sample of tissue from a living body for examination and diagnosis.

- This sample is then analyzed by a pathologist to determine the presence of abnormalities, such as cancer or other diseases.

- Histopathology:

- Histopathology is the study of diseased tissues at a microscopic level.

- It involves examining the structure and function of tissues to identify abnormalities, understand the nature of diseases, and aid in the diagnosis and treatment of medical conditions.

- Immunohistochemistry (IHC):

- Immunohistochemistry is a technique used in histopathology to visualize the presence, distribution, and localization of specific proteins in tissue samples.

- It employs antibodies that bind to specific proteins, and the binding is visualized using various detection methods.

- IHC is valuable in cancer diagnosis to identify specific markers associated with different types of tumors.

- Chemotherapy:

- Chemotherapy is a medical treatment that uses drugs to kill or inhibit the growth of rapidly dividing cells, including cancer cells.

- It is a systemic treatment that can affect both cancerous and healthy cells.

- Chemotherapy is commonly used to treat various types of cancer, either alone or in combination with other treatment modalities.

- Pneumothorax:

- Pneumothorax is a medical condition characterized by the presence of air in the pleural cavity, the space between the lung and the chest wall.

- This condition can result in the collapse of the lung, causing difficulty in breathing.

- Pneumothorax can be spontaneous or occur due to trauma, lung disease, or medical procedures.

Supreme Court Legal Services Committee

(General Studies- Paper II)

Source : The Indian Express

Supreme Court Judge Justice BR Gavai has been appointed as the Chairman of the Supreme Court Legal Services Committee (SCLSC), succeeding Justice Sanjiv Khanna.

- The Department of Justice issued a notification on December 29, 2023, formalizing Justice Gavai’s nomination to lead the committee.

Key Highlights

- Role and Purpose of SCLSC:

- The Supreme Court Legal Services Committee operates under Section 3A of the Legal Services Authorities Act, 1987.

- Its primary objective is to provide “free and competent legal services to the weaker sections of society” in cases within the jurisdiction of the Supreme Court.

- The committee plays a crucial role in ensuring access to justice for marginalized sections of the population.

- Constitution and Membership:

- As per Section 3A of the Act, the committee is constituted by the Central Authority, namely the National Legal Services Authority (NALSA).

- The committee includes a sitting Supreme Court judge as the chairman, along with other members possessing specified experience and qualifications.

- Both the chairman and other members are nominated by the Chief Justice of India (CJI).

- Additionally, the CJI has the authority to appoint the Secretary to the Committee.

- Composition of SCLSC:

- As of the present date, Justice BR Gavai serves as the Chairperson of SCLSC, leading a committee consisting of nine members nominated by the CJI.

- The committee has the authority to appoint officers and other employees as deemed necessary, following the guidelines prescribed by the Centre and in consultation with the CJI.

- Legal Framework:

- Rule 10 of the NALSA Rules, 1995, outlines the criteria for the numbers, experience, and qualifications of SCLSC members.

- Section 27 of the Legal Services Authorities Act, 1987, empowers the Central Government to make rules, in consultation with the CJI, through notification, to facilitate the effective implementation of the provisions of the Act.

- Constitutional Imperative for Legal Services:

- The need for legal services in India is explicitly addressed in the Constitution, emphasizing the principle of justice on an equal opportunity basis.

- Article 39A states the State’s responsibility to ensure that the legal system promotes justice and provides free legal aid to citizens, particularly those facing economic or other disabilities.

- Articles 14 (right to equality) and 22(1) (rights to be informed of grounds for arrest) reinforce the obligation for the State to ensure equality before the law and a legal system promoting justice based on equal opportunity.

- Genesis of Legal Aid Programs:

- While the concept of legal aid emerged in the 1950s, significant strides were made in 1980 when a national committee chaired by then Supreme Court Judge Justice PN Bhagwati was established to monitor legal aid activities across India.

- Legal Services Authorities Act (1987):

- The Legal Services Authorities Act, enacted in 1987, provided a statutory foundation for legal aid programs.

- It aims to offer free and competent legal services to various eligible groups, including women, children, SC/ST and EWS categories, industrial workers, disabled persons, and others.

- The Act led to the establishment of the National Legal Services Authority (NALSA) in 1995.

- Role of NALSA and State Legal Services Authorities (SLSAs):

- Under the Act, NALSA monitors and evaluates legal aid programs nationally, formulates policies, and oversees the implementation of legal services.

- State Legal Services Authorities (SLSAs) were established in each state to execute NALSA’s policies, provide free legal services, and conduct LokAdalats.

- SLSAs are headed by the Chief Justice of the respective High Court, with the senior HC judge as its Executive Chairman.

- District Legal Services Authorities (DLSAs) and Taluk Legal Services Committees:

- At the district level, DLSAs and Taluk Legal Services Committees operate to deliver legal services.

- DLSAs, chaired by the District Judge, function within the District Courts Complex.

- Taluk Legal Services Committees, led by senior civil judges, operate at the taluk or sub-divisional level.

- These bodies organize legal awareness camps, provide free legal services, and facilitate legal document processes.

- Functional Framework:

- Collectively, these legal service bodies aim to ensure justice accessibility, especially for marginalized sections.

- They organize awareness programs, deliver free legal aid, and facilitate legal document processes to empower citizens with the knowledge and assistance needed to navigate the legal system.

About NALSA (National Legal Services Authority)

- NALSA, established on November 9, 1995, operates under the authority of the Legal Services Authorities Act of 1987.

- This legal framework outlines its mandate and responsibilities.

- The primary purpose of NALSA is to provide free legal services to eligible candidates, as defined in Section 12 of the Act.

- Additionally, NALSA plays a crucial role in organizing LokAdalats to facilitate the swift resolution of cases.

- Leadership Structure:

- The Chief Justice of India serves as the patron-in-chief of NALSA.

- The Executive-Chairman, the second senior-most Judge of the Supreme Court of India, oversees its day-to-day operations.

- Similar mechanisms are established at the state and district levels, with the Chief Justice of High Courts and Chief Judges of District courts heading them, respectively.

First Advance Estimates of India’s GDP out

(General Studies- Paper III)

Source : The Indian Express

The First Advance Estimates (FAEs) for the current financial year (2023-24) indicate a projected GDP growth of 7.3%, a slight acceleration compared to the 7.2% growth recorded in the previous financial year (2022-23).

- These estimates, released by the government, serve as the initial growth projections for the ongoing fiscal year.

Key Highlights

- Release Timing and Revisions:

- The FAEs are traditionally presented at the conclusion of the first week of January each year.

- They represent the first estimates for the fiscal year’s growth.

- Subsequent to the FAEs, the Ministry of Statistics and Programme Implementation (MoSPI) will release the Second Advance Estimates by the end of February, followed by Provisional Estimates by the end of May.

- The GDP estimates undergo revisions as more accurate and comprehensive data become available.

- Over the next three years, MoSPI will release the First, Second, and Third Revised Estimates before settling on the final figure, referred to as the “Actuals.”

- Purpose and Significance of FAEs:

- While the FAEs are not final data, their crucial significance lies in being the last GDP figures released before the finalization of the Union Budget for the upcoming financial year.

- As such, these estimates form the basis for the Budget numbers.

- Despite their preliminary nature, they provide essential insights into economic performance, guiding the government in its budgetary planning and policy decisions.

- Context of Lok Sabha Elections:

- This year’s FAEs assume additional significance due to the impending Lok Sabha elections in April-May.

- Although a full-fledged Union Budget won’t be presented, the FAEs offer the first comprehensive overview of economic growth during the ten years of Prime Minister Narendra Modi’s government.

- GDP Growth Overview:

- The FAEs for the financial year 2023-24 reveal an optimistic projection for India’s real GDP.

- The chart illustrates both the absolute value of India’s real GDP, approaching nearly Rs 172 lakh crore by March 2024, and the growth rate, estimated at 7.3%.

Note: CAGR 2014-15* to 2018-19

- The chart highlights the significant growth in India’s GDP over the years.

- When Prime Minister Modi assumed office for the first time, the GDP stood at Rs 98 lakh crore.

- By the start of his second term, it had risen to almost Rs 140 lakh crore.

- The anticipated growth to Rs 172 lakh crore reflects a substantial expansion.

- The 7.3% growth rate estimated for 2023-24 exceeds expectations, presenting a positive surprise.

- Most observers, including the Reserve Bank of India, had foreseen a growth rate ranging between 5.5% and 6.5%.

- The higher-than-expected growth underscores the resilience and strength of India’s economic recovery, defying earlier projections.

- Comparative Growth Performance:

- However, the analysis reveals a deceleration in growth during the second term of the Modi government compared to the first.

- From 2014-15 to 2018-19, the compounded annual growth rate (CAGR) was 7.4%. In contrast, during the second term (2019-20 to 2023-24), the CAGR dropped to 4.1%.

- This deceleration is attributed to the low growth rates experienced in the first two years of the current government’s term, marked by less than 4% growth in 2019-20 and a contraction of 5.6% in 2020-21 amid the Covid-19 pandemic.

- Optimism Beyond Base Effect:

- Despite acknowledging the impact of the low base effect in the previous fiscal years (FY22 and FY23), the 7.3% growth rate for the current year suggests an optimistic picture.

- The momentum driving this growth is seen as largely independent of the base effect that inflated GDP growth rates in the immediate aftermath of the pandemic.

- Key Drivers of India’s GDP Growth: Understanding the Engines

- India’s Gross Domestic Product (GDP) is a comprehensive measure encompassing various spending categories, reflecting the demand side of the economy.

- Four primary “engines” drive GDP growth, each contributing differently to the overall economic activity.

- Private Final Consumption Expenditure (PFCE):

- Definition: Spending by individuals in their individual capacity.

- Contribution: PFCE constitutes almost 60% of India’s GDP.

- Significance: This engine reflects the spending patterns and consumption behavior of the population, indicating the strength of domestic demand.

- Gross Fixed Capital Formation (GFCF):

- Definition: Investments aimed at enhancing the productive capacity of the economy, such as building factories or purchasing equipment.

- Contribution: GFCF is the second-largest engine, typically accounting for 30% of the GDP.

- Significance: This engine gauges the level of investments made in infrastructure, technology, and other productive assets, influencing long-term economic growth.

- Government Final Consumption Expenditure (GFCE):

- Definition: Spending by governments to meet daily expenditures, including salaries.

- Contribution: GFCE is the smallest engine, accounting for around 10% of GDP.

- Significance: This engine reflects government spending on various services and operations, contributing to overall economic activity.

- Net Exports:

- Definition: The net spending resulting from Indian spending on imports and foreigners spending on Indian exports.

- Contribution: Net exports tend to have a negative impact on GDP calculations due to India’s tendency to import more than it exports.

- Significance: This engine reflects the international trade dynamics, highlighting the balance between imports and exports and their influence on the overall economic performance.

- Analysis of Key Economic Drivers:

- Private Consumption Demand:

- The overall demand by people is anticipated to grow by 4.4% in the current year.

- This growth rate is similar to the Compound Annual Growth Rate (CAGR) of 4.5% in the second term of the Modi government but significantly lower than the 7.1% growth rate observed in the first term.

- Muted private consumption is exacerbated by increasing inequality, with certain segments, particularly the urban rich, experiencing faster consumption growth compared to large sections, especially rural India, that have yet to recover adequately.

- Investment Spending:

- Investment spending has shown a growth of 9.3% in the current financial year.

- This growth contributes to bringing the CAGR in the second term (5.6%) closer to the CAGR in the first term (7.3%).

- Two lingering concerns include a significant portion of investment spending still reliant on government contributions, and the persistence of muted private consumption despite apparent growth in investment.

- Government Spending:

- Government spending in the current year has grown at a rate of 3.9%.

- Despite Covid disruptions, government spending growth has been sluggish in the second term, with a CAGR of 2.8%, considerably lower than the CAGR of 7.9% observed in the first term.

- Net Exports:

- The drag effect of net exports, represented with a negative sign, has grown by 144% in the current year.

- Over the two terms, there is a mild improvement, with the growth rate decelerating from 19.6% to 13.3%, indicating a reduction in the negative impact.

- Private Consumption Demand:

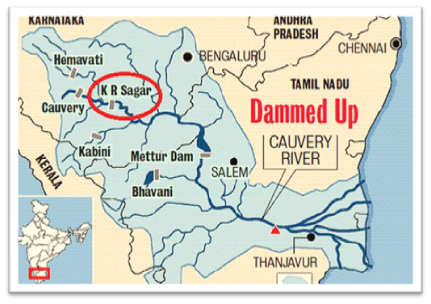

Karnataka HC bans mining activity near KRS reservoir

(General Studies- Paper I)

Source : TH

The High Court of Karnataka has issued a comprehensive ban on all mining and quarrying activities within a 20-km radius of the historic Krishnarajasagar (KRS) dam in Mandya district.

- The ban extends to mining operations with prior permissions or licenses, those already in operation, and even those permitted through court orders in previous legal proceedings.

Key Highlights

- This interim order, delivered by a division bench led by Chief Justice Prasanna B. Varale and Justice Krishna S. Dixit, is a suomotu response, initiated by the court itself.

- The decision comes in the wake of a necessity for a thorough study, as per the Dam Safety Act of 2021, to assess potential risks posed to the dam by ongoing mining activities.

- The court specified that the ban will persist until the completion of a comprehensive study conducted by experts, and a subsequent decision made by the State committee on dam safety.

- This committee was established in accordance with the provisions of the Dam Safety Act.

- Petition Background:

- The legal proceedings leading to this order were prompted by a petition filed by C.G. Kumar, a landowner from Chinakurali village in Pandavapura taluk, Mandya district.

- The petitioner contested a restriction imposed by the Deputy Commissioner of Mandya district in May 2023, which prohibited the use of land for quarrying and mining activities.

- Kumar argued that this restriction hindered the utilization of his agricultural land for such activities, even after its official conversion for non-agricultural purposes.

- The High Court bench, recognizing its previous permissions for mining within a 20-km radius of the Krishnarajasagar (KRS) dam, has attributed these decisions to a lack of awareness regarding the Dam Safety Act, 2021.

- The court observed that the Deputy Commissioner of Mandya had appropriately prohibited mining activities using explosives within the specified radius.

- Current Ruling and Restrictions:

- The court emphasized that the petitioner is not eligible for permission to conduct mining activities, with or without blasting, until a decision is reached by the committee according to the Dam Safety Act.

- The ban applies to both newly proposed activities and those previously sanctioned.

- Highlighting the historical importance of the Krishnarajasagar dam, the court noted its construction under the guidance of visionaries such as Bharat Ratna Sir M. Visvesvaraya and Maharaja NalvadiKrishnaraja Wadiyar.

- The dam serves as a crucial water source for drinking and irrigation for a large population.

- Judicial Approach:

- The bench refrained from imposing a strict deadline for the study’s completion, recognizing the need for experts to determine a conducive period and conduct experimental blasts.

- The court emphasized the importance of gathering accurate data related to safety threats posed to the dam from blasting activities.

About Krishna Raja Sagara (KRS) Dam: A Historical Overview

- Krishna Raja Sagara, commonly known as KRS, encompasses both a lake and the dam that forms it.

- Situated near Krishna Raja Sagara settlement in the Indian state of Karnataka, this gravity dam is constructed using surki mortar.

- It is strategically positioned at the confluence of the Kaveri River and its tributaries Hemavati and Lakshmana Tirtha in the Mandya district.

- Construction and Naming:

- Maharaja Krishna Raja Wadiyar IV of Mysore undertook the construction of the dam during a severe famine, despite the challenging financial conditions in the state.

- The dam was aptly named after him.

- Notably, the dam’s construction played a crucial role in alleviating the historical water scarcity issues in the Mysore region.

- Water Scarcity and Migration:

- Historically, the Mysore region, particularly Mandya, faced water scarcity, leading to mass migrations during hot summers.

- The severe drought of 1875–76 exacerbated the situation, causing significant population loss in the Kingdom of Mysore.

- The Kaveri River was identified as a potential solution to address the water needs for irrigation in the region.

- Survey and Plan:

- Despite initial opposition from the finance ministry, the Chief Engineer of Mysore persisted in championing the dam project.

- With the support of Diwan T. Ananda Rao and Maharaja Krishna Raja Wadiyar IV, the project received the green light on October 11, 1911.

- A budget of ₹81 lakh was allocated.

- The Madras Presidency initially resisted, but with the persuasion of Visvesvaraya, the imperial government granted consent.

- However, the original plan for a 194-feet high dam had to be revised.

- The foundation stone for the Krishna Raja Sagara (KRS) Dam was laid on November 11, 1911. The dam, constructed across the Kaveri River, was completed in 1924.

- KRS Dam stands as the primary water source for the districts of Mysore.

- The dam plays a crucial role in irrigation, benefiting the agricultural lands in Mysore and Mandya.

- Additionally, it serves as the primary drinking water source for the residents of Mysore, Mandya, and a significant portion of Bengaluru, the capital of Karnataka.

- The water released from KRS Dam flows into the state of Tamil Nadu and is stored in the Mettur Dam located in the Salem district.

About Dam Safety Act, 2021

- The Dam Safety Act, enacted in 2021, is a crucial legislation in India aimed at ensuring the safety and maintenance of dams across the country.

- The Act establishes the National Dam Safety Authority (NDSA) as the central regulatory body responsible for formulating policies, guidelines, and standards related to dam safety at the national level.

- Each state is mandated to set up a State Dam Safety Organization (SDSO) to implement the policies and guidelines provided by the NDSA.

- Responsibilities of NDSA:

- NDSA is tasked with maintaining a national database of dams, analyzing potential risks, and ensuring the implementation of safety measures.

- It provides technical assistance to SDSOs and promotes research and development in dam safety.

- Dam owners are required to prepare and implement Emergency Action Plans (EAP) to address emergency situations, such as dam failures or imminent threats.

- The Act mandates periodic inspection and surveillance of dams to assess their structural integrity, and dam owners are obligated to submit safety inspection reports.

- Classification of Dams:

- Dams are classified based on their potential hazard and potential consequences of failure, leading to a tiered approach in implementing safety measures.

- The legislation emphasizes the need for regular safety reviews and, if necessary, rehabilitation of dams to ensure compliance with safety standards.

Understanding the EU’s carbon border tax

(General Studies- Paper III)

Source : TH

A significant development causing concern for India is the European Union’s (EU) implementation of the Carbon Border Adjustment Mechanism (CBAM).

- The CBAM is part of the EU’s strategy to achieve a 55% reduction in greenhouse gas (GHG) emissions by 2030, compared to 1990 levels, under the European Green Deal.

Key Highlights

- The CBAM aims to tax carbon-intensive products entering the EU from 2026.

- It is seen as a measure to prevent carbon leakage, where carbon-intensive production might shift to non-EU countries with less stringent environmental regulations.

- Two-Phase Approach:

- The CBAM is structured in two phases.

- The first, or transitional phase, begins from October 1, 2023.

- During this phase, EU manufacturers and importers of energy-intensive industries must report GHG emissions embedded in their imports without financial obligations.

- The definitive phase commences on January 1, 2026.

- EU’s Greenhouse Gas Reduction Target:

- The EU justifies the CBAM as a means to achieve its ambitious target of a 55% reduction in GHG emissions by 2030.

- The European Green Deal outlines the context for this policy.

- The EU expresses concerns that its industries might face competition from carbon-intensive imports from countries like India and China.

- To address this, the CBAM imposes an import duty on carbon-intensive industries from non-EU countries.

- The CBAM is designed to function similarly to the EU’s Emission Trading System (ETS).

- Under the ETS, companies must purchase allowances corresponding to their GHG emissions.

- The CBAM aims to replace the allocation of ETS allowances during its implementation.

- During the transitional phase until December 2025, reporting GHG emissions in imports is mandatory, but no financial obligations are imposed on EU manufacturers and importers of energy-intensive industries.

- From January 1, 2026, the CBAM enters its definitive phase.

- Importers will be required to annually surrender CBAM certificates corresponding to the declared emissions embedded in their imports.

- The CBAM, to be implemented by the European Union (EU), will focus on the declared carbon content embedded in imported goods.

- The calculation methodology is based on the EU’s Emission Trading System (ETS) mechanism.

- However, for the initial reporting year, flexibility is allowed, permitting the use of default values or the monitoring, reporting, or verification rules of the country of production.

- India’s Carbon Trading Initiatives:

- India has initiated its own carbon trading mechanism known as the Carbon Credit Trading System (CCTS), introduced through the amendment of the Energy Conservation Act, 2001, in December 2022.

- Key Features of India’s CCTS:

- Introduced in December 2022, CCTS aims to combat climate change by incentivizing emission reduction actions, thereby attracting increased investments in clean energy from the private sector.

- The Ministry of Power in India is currently working on the specifics to operationalize the CCTS, including the valuation of carbon credits.

- India complements the mandatory CCTS with a voluntary market-based mechanism known as the Green Credit Programme Rules, notified by the Ministry of Environment in 2023.

- The scheme is designed to encourage environmentally proactive actions that go beyond the mandatory carbon reduction mandate.

- While the CBAM in the EU focuses on mandatory carbon content declarations for imports, India’s approach involves a dual mechanism – the mandatory CCTS and the voluntary Green Credit Programme Rules.

- India is still finalizing the operational details, including the carbon valuation, for its carbon trading initiatives.

- Impact on India:

- India is anticipated to be among the top eight countries adversely affected by the European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM).

- A Global Trade Research Initiative report highlights that a significant portion of India’s exports, particularly in iron, steel, and aluminum products, worth $8.2 billion, went to the EU in 2022.

- Core sectors, notably steel, are expected to face substantial impacts from CBAM.

- India faces limited options in navigating the CBAM framework, given its potential impact on key export sectors.

- The primary strategies India can consider include:

- India may challenge CBAM as violative of the common but differentiated responsibilities principle agreed upon under the Paris Agreement.

- This approach could be explored to safeguard India’s interests and advocate for fair treatment.

- Another option is to advocate for the EU to collect the carbon tax and redistribute the funds to affected countries like India, allowing them to invest in green technologies.

- This approach aligns with a pragmatic solution, especially as CBAM enters its definitive phase in 2026.

- World Trade Organization (WTO) Challenge:

- India has already initiated a challenge against CBAM before the World Trade Organization under the special and differential treatment provisions, emphasizing the need for a fair and equitable resolution.

- The EU’s approach to CBAM appears to overlook other factors influencing the shift of production outside the EU, such as the availability of cheap labor and alternative modes of production, as well as opportunities to expand into other geographic regions.

- Adding to the challenges, the U.K. has announced its own CBAM enforcement by 2027, posing additional upheaval for India’s exports in the coming years.

- Urgency for India

- Recognizing the limited time available, there is an urgent need for India to formulate its own carbon taxation measures aligned with the principles of the Paris Agreement.

- Swift action is imperative to safeguard Indian industries’ interests and respond effectively to the changing global trade landscape influenced by carbon border adjustments.

Overview of the European Union Emissions Trading System (EU ETS)

- The European Union Emissions Trading System (EU ETS) is a cap-and-trade scheme initiated in 2005 by the European Union to mitigate greenhouse gas emissions within its member countries.

- This mechanism imposes limits on specified pollutants, and companies operating within the system are granted the flexibility to trade emissions rights.

- Covering approximately 45% of the EU’s total greenhouse gas emissions, the EU ETS plays a crucial role in the region’s efforts to reduce environmental impact and combat climate change.

How surgical care in India is a neglected part of public health?

(General Studies- Paper II)

Source : TH

The Lancet Commission on Global Surgery (LCoGS) argues that the number of recorded surgeries in India, particularly minor ones, is significantly lower than the actual need.

- In 2019-2020, over 14 million minor surgeries were recorded, accounting for a quarter of all surgeries.

- However, LCoGS contends that this is insufficient compared to the surgical requirements.

Key Highlights

- LCoGS researchers found notable global disparities in surgical rates.

- For instance, New Zealand, with universal health coverage, had 5,000 surgeries per 100,000 people in 2015.

- In contrast, India, with a population of approximately 1.4 billion, had a surgical rate ranging from 166 to 3,646 surgeries per 100,000, influenced by various factors.

- Proposed LCoGS Indicators:

- The Lancet Commission on Global Surgery proposes six indicators to assess and monitor surgical care comprehensively:

- Timely geographical access to surgical care facilities.

- Workforce density, measured by the number of surgeons, obstetricians, and anaesthetists per 100,000 people.

- Surgical volumes/rates, including essential and emergency surgeries per 100,000 people.

- Perioperative mortality rate, measuring mortality within 30 days of surgery per 1,000 procedures.

- Population at risk of impoverishment due to seeking surgery.

- Population at risk of catastrophic expenditure (over 10% of annual household expenses) due to seeking surgery.

- These indicators aim to provide a holistic understanding of surgical care at both the population and ground levels.

- The Lancet Commission on Global Surgery proposes six indicators to assess and monitor surgical care comprehensively:

- Global Call for Improved Data Collection:

- There is a need for countries, especially low- and middle-income nations, to collect and monitor high-quality data for these indicators.

- This data can offer insights into healthcare systems, population-level surgical needs, and disparities, contributing to more informed and effective healthcare policies.

- Challenges to Access in India and Globally

- Millions of individuals in India, irrespective of the severity of their medical condition, face the stark reality of considering surgery as a luxury rather than a basic right.

- This issue is not unique to India, as globally, five billion people are denied the fundamental right to access surgery when needed.

- More than 90% of rural Indians lack access to required surgery.

- Limited data based on Lancet Commission on Global Surgery (LCoGS) indicators exposes key reasons behind this disparity.

- Barriers to Timely Access:

- In rural, remote, and hilly areas, where over two-thirds of the population resides, challenges such as poor road networks, insufficient facilities, and a lack of vehicles, including ambulances, hinder timely access to hospitals.

- Even if individuals reach a facility, the scarcity of essential resources like surgeons, anaesthetists, and clinical staff becomes a major impediment.

- The shortage of the Surgical, Obstetric, and Anaesthesia (SOA) workforce is particularly acute beyond metropolitan and tier-II cities.

- The capacity for surgeries is hindered by geographical and economic disparities, impacting the availability of major surgeries in rural India, where the met need is less than 7%.

- Financial Impact and Catastrophic Expenses:

- With limited surgical-care capability in public health facilities offering free or subsidized care, individuals often resort to private hospitals.

- This absence of universal healthcare coverage exacerbates the financial burden, with more than 60% of surgery patients in rural India facing catastrophic expenses, leading to a risk of impoverishment for several thousand.

- Addressing Gaps in Surgical Care: The Need for Systemic Reforms

- India’s current surgical system relies on civilian initiatives and subnational programs, including small private establishments led by surgeons, government teaching hospitals, and public district hospitals, all of which aim to address systemic gaps in surgical care.

- Various organizations, such as the Association for Rural Surgeons of India and emergency services like EMRI Green Health Services, contribute to filling these gaps.

- Additionally, initiatives like SEARCH and Jan SwasthyaSahyog cater to tribal populations in challenging-to-reach areas.

- Despite these initiatives, systemic gaps persist, emphasizing the need for comprehensive reforms to improve surgical care.

- The challenges are recognized, and numerous efforts by individual surgeons and organizations contribute to enhancing surgical care.

- Lack of Recognition and Policy Focus:

- The primary issue lies in a lack of recognition of the problems associated with surgical care access, preventable disease burden due to surgery, and the economic impact of surgery on society.

- These aspects are not yet integrated into mainstream public health considerations.

- Despite advancements, the neglect of surgical care in health policymaking and planning remains a significant hurdle.

- Over the past seven decades, India’s focus on surgical care has been limited, with minimal attention in the recent National Health Policy (2017).

- Many countries in Africa and South Asia have initiated National Surgical Obstetric Anaesthesia Plans (NSOAPs) or similar policies, but India currently lacks an NSOAP.

- Key Recommendations for Improvement:

- The way forward involves leveraging existing data, integrating surgical care data into existing surveys and systems, and establishing dedicated mechanisms for data collection.

- Raising awareness about the importance of surgical care in public health and advocating for its inclusion in mainstream health policies is crucial.

- Addressing the lack of investments in monitoring and evaluating surgical care indicators is essential for informed decision-making and policy planning.

Debating India’s new hit-and-run law

(General Studies- Paper II)

Source : TH

Protests have erupted among transporters and commercial drivers in several Indian states, including Maharashtra, Chhattisgarh, West Bengal, and Punjab.

- This is in response to the recent legislation addressing hit-and-run incidents. Section 106(2) of the Bharatiya Nyaya Sanhita, 2023 (BNS), imposes severe penalties, including up to 10 years in jail and fines, for fleeing an accident scene without reporting to the police or magistrate.

- This legislation complements the existing colonial-era provision in Section 304A of the Indian Penal Code, 1860, related to causing death due to rash or negligent acts.

Key Highlights

- Protesters’ Demands:

- Transporters and commercial drivers are demanding the withdrawal or amendment of Section 106(2), emphasizing the need for reconsideration due to perceived flaws in the legislation.

- The protesters argue that while stringent measures for hit-and-run cases are essential, the new law raises concerns that warrant revisiting.

- They argue that the legislation, particularly Section 106(2) of the Bharatiya Nyaya Sanhita, 2023 (BNS), imposes stringent penalties, including a 10-year imprisonment and a ₹7 lakh fine, even for unintentional accidents.

- The primary demands of the protesters are as follows:

- Protesters assert that the prescribed penalty is excessive, especially considering the challenging work conditions faced by drivers, such as long driving hours and difficult roads.

- They contend that accidents may occur beyond the driver’s control, citing factors like poor visibility due to fog, and argue that the law does not adequately consider these circumstances.

- Drivers express concerns about the potential for mob violence against them if they stop to assist the injured at accident sites, contributing to their reluctance to stay at the scene.

- There are concerns that the law may be abused by law enforcement agencies, negatively impacting drivers.

- Need for the Legislation:

- The introduction of the new law is prompted by alarming figures related to road accidents in India.

- The country witnessed over 1.68 lakh road crash fatalities in 2022, registering an average of 462 deaths daily.

- Despite a global decrease in road crash deaths, India experienced a year-on-year increase of 12% in road accidents and 9.4% in fatalities in the same year.

- India, with only 1% of the world’s vehicles, accounts for about 10% of crash-related deaths and incurs an economic loss of 5-7% of its GDP annually due to road crashes.

- The hit-and-run law, as reflected in Section 106(2) of the Bharatiya Nyaya Sanhita, 2023, addresses the alarming statistics of hit and run incidents in India.

- The law aims to deter drivers from engaging in rash and negligent driving that leads to fatal consequences.

- Stringent punishment serves an expressive function, emphasizing the severity of consequences for such actions.

- In cases of causing death due to rash and negligent driving, the law imposes a positive obligation on offenders to report the incident to the police or magistrate.

- Failure to fulfill this duty is subject to criminalization.

- The law converts moral responsibility into a legal duty, emphasizing the obligation of the offender towards the victim of a road accident.

- By creating legal duties, the legislation enforces moral responsibility on offenders, compelling them to take responsibility for their actions.

- Comparison with Existing Motor Vehicle Laws:

- The imposition of legal duties in hit-and-run cases aligns with existing provisions in motor vehicle laws.

- For example, Section 134 of the Motor Vehicles Act, 1988, mandates the driver to take reasonable steps to secure medical attention for the injured unless impracticable due to factors beyond their control.

- The question of whether the offender fled from the spot is recognized as a significant factor in the motor accidents claims framework, as seen in the case of Rajesh Tyagi versus Jaibir Singh (2021) by the Delhi High Court.

- Clarification of Penalties:

- The widely circulated belief that Section 106(2) of the Bharatiya Nyaya Sanhita (BNS) prescribes a ₹7 lakh fine for fleeing an accident spot is debunked as incorrect.

- The BNS does not specify this amount.

- Compensation provisions under Section 161 of the Motor Vehicles (Amendment) Act, 2019, are highlighted, setting compensation amounts at ₹2 lakh for death and ₹50,000 for grievous hurt.

- Unlike BNS Section 106(2), this compensation is not recoverable from drivers.

- Examination of Legal Provisions:

- Section 106(1) of BNS addresses rash or negligent driving, with a punishment of up to five years and a fine if the driver reports the matter.

- Section 106(2) deals with failure to report an accident, leading to imprisonment of up to 10 years.

- Importantly, the offence in Section 106(2) is not non-bailable.

- An exception under 106(1) exempts doctors from harsh penalties for rash or negligent acts, limiting the punishment to up to two years with a fine.

- Concerns and Proposed Reforms:

- Concerns raised by truck drivers prompt a call for revisiting and reconciling Section 106(1) and 106(2) to ensure fair treatment for over 35 lakh truck drivers.

- Advocates propose separating rash and negligent driving under different liability degrees to avoid prejudice against drivers in various circumstances.

- Recommends avoiding a uniform 10-year imprisonment for all cases and instead categorizing penalties based on the nature of injuries, reserving Section 106(2) for accidents resulting in death.

- This involves categorizing penalties based on liabilities, especially for accidents resulting in minor injuries.

- The need to clarify Section 106(2) and introduce measures like community service, revoking driving licenses, or mandatory retests for accidents causing minor injuries is emphasized.

- A focus on determining liability based on contributory factors is suggested.

Structured negotiation as a boost for disability rights

(General Studies- Paper II)

Source : TH

Structured negotiation is gaining prominence as an effective dispute resolution technique, particularly in disability rights cases.

- This collaborative approach involves bringing defaulting service providers to the negotiation table, emphasizing compliance with social welfare legislations.

- It has demonstrated notable success, especially in the United States, where it has effectively addressed issues such as inaccessible ATMs, point of sale devices, pedestrian signals, and websites.

Key Highlights

- Success Stories and Impact:

- Structured negotiation has achieved positive outcomes in various sectors.

- Major corporations like Walmart, CVS, and Caremark have embraced accessible prescription bottles for blind or low vision customers.

- The approach has also contributed to institutional reforms, leading to the creation of more accessible voting machines and websites.

- The success of structured negotiation lies in its ability to create a win-win situation.

- Defaulting service providers seek to avoid the high costs and negative publicity associated with litigation, while complainants aim for barrier-free participation in the marketplace.

- This approach allows businesses to ensure accessibility without litigation hurdles, and users with disabilities can obtain disabled-friendly offerings without the adversarial nature of legal proceedings.

- Legal Precedents and Foundations:

- A crucial factor in the success of structured negotiation is the establishment of a robust body of disabled-friendly legal precedents.

- Courts play a pivotal role in creating a blueprint for accessibility and legal compliance in specific sectors.

- Once these precedents are set, structured negotiation becomes a viable pathway for businesses to achieve accessibility goals without resorting to litigation, benefiting both service providers and individuals with disabilities.

- The Rights of Persons with Disabilities Act, 2016 in India allows reporting non-compliance to the Chief Commissioner for Persons with Disabilities (CCPD), who can issue notices and impose penalties on defaulting service providers.

- However, the effectiveness of this approach in addressing accessibility barriers remains uncertain.

- Challenges in Traditional Approaches:

- Recent incidents, such as the CCPD directing PayTM to enhance accessibility, highlight challenges in real-time implementation.

- Despite directives, the PayTM application became more inaccessible, showcasing the need for constant vigilance and user inputs to validate effective solutions.

- The Role of Structured Negotiation:

- It provides an avenue for service providers to avoid non-compliance labels, hefty legal fees, and prolonged court proceedings.

- Simultaneously, it empowers Persons with Disabilities to directly engage with service providers, ensuring their concerns are heard, and allowing them to monitor the implementation of accessibility fixes.

- Amidst red tape and bureaucratic challenges, the Structured Negotiation technique presents an opportunity to streamline the resolution process, fostering direct communication between stakeholders and promoting real-time solutions to enhance accessibility.

- The efficacy of any alternative dispute resolution model depends on the priority accorded by service providers to the challenges faced by persons with disabilities.

- Businesses that neglect this approach risk their own detriment, missing out on the substantial purchasing power wielded by persons with disabilities.

- Beyond legal compliance, prioritizing the needs of disabled users and demonstrating openness to engage in structured negotiations is a powerful step toward inclusivity and business success.

Summary of the Rights of Persons with Disabilities Act, 2016:

- The Rights of Persons with Disabilities Act, 2016 is a landmark legislation in India aimed at safeguarding and promoting the rights of individuals with disabilities.

- Enacted to replace the Persons with Disabilities (Equal Opportunities, Protection of Rights and Full Participation) Act, 1995, the 2016 Act is aligned with the United Nations Convention on the Rights of Persons with Disabilities (UNCRPD).

- Key Provisions:The Act broadens the definition of disabilities, encompassing physical,

- intellectual, mental, and sensory impairments, ensuring a more inclusive approach.

- The types of disabilities have been increased from existing 7 to 21 and the Central Government will have the power to add more types of disabilities.

- Persons with disabilities are entitled to various rights, including the right to equality, non-discrimination, and full and effective participation in society.

- The Act emphasizes equal opportunities in education, employment, and accessibility.

- The legislation mandates that not less than 4% of the total number of vacancies in government establishments should be reserved for persons with benchmark disabilities.

- Every child with benchmark disability between the age group of 6 and 18 years shall have the right to free education.

- Persons with “benchmark disabilities” are defined as those certified to have at least 40 per cent of the disabilities specified above.

- It underscores the importance of accessibility in public buildings, transport, and information and communication technologies to facilitate the full inclusion of persons with disabilities.

- The Act provides for grant of guardianship by District Court under which there will be joint decision – making between the guardian and the persons with disabilities.

- National and State Advisory Boards:

- Advisory boards at the national and state levels are established to oversee the implementation of the Act and advise the government on disability-related matters.

- Office of Chief Commissioner of Persons with Disabilities has been strengthened who will now be assisted by 2 Commissioners and an Advisory Committee comprising of not more than 11 members drawn from experts in various disabilities.

- Similarly, the office of State Commissioners of Disabilities has been strengthened who will be assisted by an Advisory Committee comprising of not more than 5 members drawn from experts in various disabilities.

- The Chief Commissioner for Persons with Disabilities and the State Commissioners will act as regulatory bodies and Grievance Redressal agencies and also monitor implementation of the Act.

- Penalties for Offenses:

- Stringent penalties are prescribed for offenses committed against persons with disabilities, reinforcing the protection and security afforded to them.

- Any person who violates provisions of the Act, or any rule or regulation made under it, shall be punishable with imprisonment up to six months and/ or a fine of Rs 10,000, or both.

- For any subsequent violation, imprisonment of up to two years and/or a fine of Rs 50,000 to Rs five lakh can be awarded.

- Whoever intentionally insults or intimidates a person with disability, or sexually exploits a woman or child with disability, shall be punishable with imprisonment between six months to five years and fine.

- Special courts are designated to handle cases related to offenses committed against persons with disabilities, ensuring swift justice.