CURRENT AFFAIRS – 03/02/2024

CURRENT AFFAIRS – 03/02/2024

Exposing India’s financial markets to the vultures

(General Studies- Paper III)

Source : TH

In September 2023, J.P. Morgan announced plans to include Indian local currency government bonds (LCGBs) in its Government Bond Index-Emerging Markets (GBI-EM) Global index suite, effective from June 2024.

- Bloomberg followed suit in January 2024 by proposing the addition of India’s “fully accessible route (FAR)” bonds to the Bloomberg Emerging Market Local Currency Index, set to take effect in September 2024.

- FTSE Russell also retained India on its watchlist for a potential upgrade, emphasizing the need for reforms in the government bond market.

Key Highlights

- Initiation of the Process in 2019:

- The process of incorporating Indian government bonds into global indices began in 2019.

- By 2020, a segment of government bonds became officially accessible to foreign investors through the introduction of the FAR.

- Despite delays related to capital gains taxes and local settlement, the fundamental policy remained unchanged.

- Recent moves by J.P. Morgan and Bloomberg indicate a potential inclusion of Indian LC government and corporate bonds in more benchmark indices.

- Efforts to Internationalize the Rupee:

- In October 2022, a report by the Inter-Departmental Group (IDG) of the Reserve Bank of India (RBI) outlined efforts to internationalize the rupee by integrating Indian LCGBs into global indices.

- The report highlighted benefits such as reduced dependence on domestic institutions for public finance, access to large international resources, and greater stability of funds tracking indices compared to other portfolio inflows.

- While acknowledging potential risks, the report argued that the perceived benefits outweigh them.

- Observers noted that opening local bond markets could facilitate financing of current account and fiscal deficits, reduce the cost of public borrowing, and relieve the balance sheets of local financial institutions, potentially boosting lending and private investment.

- Opening Local Bond Markets

- The mainstream emphasizes a key benefit of opening local bond markets to foreign investors, addressing the “original sin” problem faced by emerging economies.

- This problem refers to their inability to borrow internationally in their own currencies, exposing them to exchange rate risk when external debt is denominated in reserve currencies.

- By opening bond markets and borrowing in local currency, emerging economies can transfer the exchange rate risk onto international lenders.

- However, this transfer is not without costs, as compensation is required for taking on the risk.

- Additionally, since these bonds fall under domestic jurisdiction, lenders face an added default risk, necessitating further compensation.

- Compensation and Higher Returns:

- To attract international investment, local currency bonds must offer higher returns than forex bonds issued under foreign jurisdiction.

- This compensation can be in the form of higher interest rates and/or capital gains.

- The higher returns serve to offset the risks associated with exchange rate fluctuations and potential defaults.

- Historically, even with large international investment in local bonds of emerging economies after the global crisis in 2008, the bond index in local currency terms outperformed the index in U.S. dollars.

- This outperformance was attributed to significant capital gains resulting from currency appreciations.

- Loss of Autonomy and Interest Rate Risks:

- The internationalization of bond markets in emerging economies brings about a substantial loss of autonomy in controlling long-term rates and exposes these economies to greater interest rate risks.

- During periods of global risk aversion and liquidity constraints, domestic bond markets can suffer adverse spillovers, as observed after events like the Lehman collapse in 2008 and the US Federal Reserve’s announcement of reducing bond purchases in 2013.

- Contrary to a common misconception, foreign portfolio inflows into local currency bond markets (LCBM) do not necessarily provide stable and long-term funding.

- Unlike sovereign bonds of main reserve-currency countries, local currency sovereign debt in emerging economies is held by fickle investors, primarily money managers from advanced economies.

- When concerns arise about potential short-term capital losses due to rising interest rates or local currency depreciation, stability tends to dissipate swiftly.

- Exchange Rate Risk and Volatility in Inflows:

- The move to floating exchange rates and increased volatility exposes local currency bond inflows to emerging economies to fluctuations.

- Investors bear exchange rate risk, leading to significant variations in the share of foreigners in local bond markets, sudden stops, and exits.

- Instances in Malaysia (2014-15) and Türkiye (after Spring 2018) exemplify how rapid exits resulted in large reserve losses, sharp currency declines, and adverse economic impacts.

- During market distress, external debt denominated in local currency plays a more substantial role in the drain of reserves and currency declines compared to forex debt.

- Evidence indicates that the volatility spillover for local currency bond funds is significantly larger than that for reserve-currency bond funds.

- Internationalization Beyond Bond Markets:

- The October 2022 report from the Inter-Departmental Group (IDG) of the Reserve Bank of India (RBI) reveals that the opening of the Local Currency Bond Market (LCBM) to foreign investors and the inclusion of Indian Local Currency Government Bonds (LCGBs) in global bond indices are part of a broader effort to internationalize the Indian rupee.

- Another crucial element in this strategy involves permitting banking services in the rupee (INR) outside the country.

- The report cites an example of settling trade with Russia in Indian rupees for crude oil, leading to an accumulation of the rupee in Russian banks.

- This showcases practical steps in facilitating the use of the Indian rupee in international trade transactions.

- According to Bloomberg reports, the RBI has granted authorization to 17 banks to settle trade in the Indian rupee across 18 countries, establishing 65 offshore deposit accounts.

- This move effectively creates an offshore INR market, introducing new avenues for speculation and potential instability.

- The expansion beyond bond markets underscores a comprehensive approach to internationalizing the Indian rupee.

- Lessons from Malaysia and Türkiye on Currency Internationalization

- Malaysian Experience during the 1997 Asian Crisis:

- The Malaysian experience during the 1997 Asian crisis serves as a cautionary tale.

- The offshore ringgit market in Singapore played a significant role in exacerbating the country’s economic challenges.

- Speculative activities in the offshore market led to a surge in offshore ringgit interest rates, influencing domestic rates and worsening the economic downturn.

- The Malaysian authorities had to implement capital controls in September 1998 to regain control and mitigate the impact of the crisis.

- Recent Türkiye Experience in 2022:

- Similarly, in 2022, Türkiye faced challenges related to the offshore lira market in London, becoming a source of speculation against the Turkish currency.

- The government implemented measures, including restrictions on bank lending to firms trading liras offshore, to curb the negative impact on the currency.

- Former RBI Governor Y.V. Reddy emphasizes that currency internationalization is a gradual process requiring all necessary building blocks to be in place.

- He notes that the Indian rupee is yet to be considered an international currency, and its internalization depends on sustained development in the financial system and improved economic performance.

- Malaysian Experience during the 1997 Asian Crisis:

- Internationalization Risks and Underestimation:

- The internationalization of bond markets and currencies in emerging economies is often portrayed as a solution to the consequences of the “original sin,” offering resilience to external shocks and improving investment volume and allocation.

- However, the risks involved are underestimated.

- The inherently unstable nature of international financial markets can lead to increased exchange rate instability and boom-bust cycles in capital flows.

- Past crises in emerging economies underscore the potential damage that international finance can inflict when policies fail to manage financial integration effectively.

What is Government Bond?

- Government bonds, also known as sovereign bonds or treasuries, are debt securities issued by a government to raise funds for public spending or to manage budgetary gaps.

- When an investor purchases a government bond, they are essentially lending money to the government in exchange for periodic interest payments and the return of the principal amount at the bond’s maturity.

- Government bonds are considered relatively low-risk investments because they are backed by the issuing government, which has the ability to tax its citizens to meet its debt obligations.

- The interest rate on government bonds, known as the yield, is determined by various factors, including prevailing market interest rates, inflation expectations, and the creditworthiness of the issuing government.

What is Bond Index?

- A bond index is a benchmark that measures the performance of a specific group or category of bonds.

- It is essentially a composite or average of the returns of a predefined set of bonds that share certain characteristics, such as maturity, issuer type, or credit quality.

- Bond indices provide a way to track and evaluate the overall performance of the bond market or a specific segment of it.

- For example, a government bond index might include bonds issued by various governments, allowing investors to gauge the performance of sovereign debt.

- Similarly, an index focusing on corporate bonds may include bonds issued by different companies.

- Bond indices play a crucial role for investors and financial professionals as they provide a standard against which they can measure the performance of their bond portfolios.

- Investors often use these indices as benchmarks to assess the relative success of their bond investments compared to the broader market or a specific sector.

- Popular bond indices include the Bloomberg Barclays Global Aggregate Bond Index and the ICE BofA Merrill Lynch U.S. Corporate Bond Index.

KYC, fund laundering concerns said to spurRBI’s Paytm unit ban

(General Studies- Paper III)

Source : TH

The Reserve Bank of India (RBI) has directed Paytm Payments Bank Ltd. (PPBL) to halt all new business transactions by February 29 and settle existing transactions by March 15.

- This action was taken in response to significant irregularities in the bank’s compliance with Know Your Customer (KYC) norms.

- The non-compliance exposed customers, depositors, and wallet holders to serious risks.

Key Highlights

- KYC Irregularities Uncovered:

- RBI supervisors and external auditors discovered major KYC shortcomings at PPBL, including missing KYC details for a large number of customers, PAN validation failures in lakhs of accounts, and instances where a single PAN was linked to multiple customers.

- In some cases, the same PAN was associated with over 100 customers, and in others, more than 1,000 customers.

- These irregularities raised concerns about the bank’s compliance with regulatory requirements.

- Money Laundering Concerns and Transaction Limit Violations:

- PPBL was found to be involved in transactions amounting to crores of rupees, surpassing regulatory limits in prepaid instruments with minimal KYC requirements.

- This raised concerns about potential money laundering activities.

- Additionally, an unusually high number of dormant accounts were allegedly used as ‘mule accounts’ to facilitate transactions, further complicating regulatory compliance.

- Allegations of money laundering at Paytm Payments Bank are attributed to deficiencies in its KYC processes and the absence of a transaction monitoring system.

- Law Enforcement Authorities across the country froze numerous accounts and wallets, asserting their use in digital frauds.

- The Comprehensive System Audit and compliance validation reports by external auditors revealed persistent non-compliances and supervisory concerns, leading to regulatory action by the RBI.

- Non-Compliance with ‘Arm’s Length Policy’:

- The payments bank is accused of not adhering to the ‘arm’s length policy’ while dealing with entities in its Promoter Group.

- Co-mingling of financial and non-financial business with promoter group companies, in violation of licensing conditions and RBI directives, is alleged.

- Dependence on the IT infrastructure of One97 Communications Ltd. (Paytm’s parent entity) was deemed absolute, raising data privacy and sharing concerns.

- Transactions were reportedly routed through parent-entity-owned apps.

- Auditors found instances where compliance details submitted by the bank were false upon verification, both by RBI supervisors and external auditors.

- Paytm Payments Bank allegedly did not disclose significant intra-group transactions and related party transactions.

- Substantial payables to One97 Communications Ltd. were not disclosed in the bank’s financial statements.

- Agreements were reportedly revised to benefit the parent entity or its group companies at the expense of the bank and its customers.

What is Money Laundering?

- Money laundering is the process of concealing the origins of illegally obtained money, typically by means of transfers involving foreign banks or legitimate businesses.

- The objective of money laundering is to make unlawfully gained proceeds (often from criminal activities) appear legitimate and to integrate them into the financial system without raising suspicion.

- Stages of Money Laundering:

- Placement:

- The initial stage involves introducing “dirty money” into the financial system.

- This may include breaking down large amounts of cash into smaller, less suspicious amounts, or depositing the funds into banks or other financial institutions.

- Layering:

- In this stage, the launderer attempts to distance the illicit proceeds from their source by creating complex layers of financial transactions.

- This may involve multiple transfers between accounts, purchases and sales of assets, or engaging in complex financial transactions to make the audit trail more difficult to trace.

- Integration:

- The final stage involves bringing the laundered money back into the legitimate economy, making it difficult to distinguish from legal income.

- The funds may be used to acquire assets, invest in businesses, or engage in other financial activities to legitimize their origin.

- Methods of Money Laundering:

- Shell Companies: Setting up fake businesses to create a semblance of legitimate economic activity and funneling illicit funds through these entities.

- Real Estate Transactions: Purchasing or selling real estate to convert illicit funds into valuable assets.

- Smurfing: Breaking down large amounts of money into smaller, less suspicious amounts to avoid detection.

- Cryptocurrencies: Using digital currencies to facilitate anonymous transactions and obscure the origin of funds.

- Trade-Based Laundering: Manipulating trade transactions to move money across borders, often involving overpricing or underpricing goods.

- Prevention and Regulation:

- Governments and financial institutions globally implement measures to combat money laundering.

- These include customer due diligence, reporting large transactions, monitoring international fund transfers, and implementing Anti-Money Laundering (AML) regulations.

- Financial institutions are required to have robust compliance programs to identify and report suspicious transactions to relevant authorities.

- Placement:

Multidimensional poverty: meaning, numbers

(General Studies- Paper II)

Source : The Indian Express

Finance Minister Nirmala Sitharaman stated in the Interim Budget speech that 25 crore Indians were lifted out of poverty in the last decade through the government’s ‘SabkakaSaath’ approach.

- The claim is supported by a discussion paper titled “Multidimensional Poverty in India Since 2005-06,” published by NITI Aayog on Jan 15.

Key Highlights

- The paper, co-authored by Ramesh Chand and Yogesh Suri from NITI Aayog, with technical inputs from UNDP and OPHI, reveals that multidimensional poverty in India declined from 29.17% in 2013-14 to 11.28% in 2022-23, with approximately 24.82 crore people escaping poverty during this period.

- At the state level, Uttar Pradesh, Bihar, and Madhya Pradesh led in the number of people escaping poverty.

- What is the Multidimensional Poverty Index (MPI)?

- The Multidimensional Poverty Index (MPI) employed in the study uses 10 indicators covering health, education, and standard of living, with each dimension given equal weight.

- The health dimension includes nutrition and child & adolescent mortality indicators, the education dimension covers years of schooling and school attendance, and the standard of living dimension encompasses household-specific indicators such as housing, household assets, cooking fuel, sanitation, drinking water, and electricity.

- The Indian MPI incorporates two additional indicators:

- maternal health and bank accounts, aligning with India’s national priorities.

- MPI Calculation Method:

- Identification of MPI Poor:

- If an individual is deprived in one-third or more of the 10 weighted indicators, they are classified as “MPI poor.”

- Three Separate Calculations:

- Incidence of Multidimensional Poverty (H):

- Involves determining the proportion of multidimensionally poor in the population.

- Calculated by dividing the number of multidimensionally poor individuals by the total population.

- Answers the question: “How many are poor?”

- Intensity of Poverty (A):

- Addresses the question: “How poor are they?”

- Technically, it represents the average proportion of deprivation experienced by multidimensionally poor individuals.

- Calculated by summing the weighted deprivation scores of all poor individuals and dividing by the total number of poor individuals.

- Calculation of MPI:

- The MPI is obtained by multiplying the Incidence of Multidimensional Poverty (H) and the Intensity of Poverty (A).

- Mathematically, MPI = H * A.

- MPI Value Interpretation:

- The MPI value for a specific population represents the share of weighted deprivations faced by multidimensionally poor individuals divided by the total population.

- Methodology for Calculating MPI Data for 2013-14 and 2022-23

- Health metrics in Multidimensional Poverty Index (MPI) calculations typically rely on data from different rounds of the National Family Health Survey (NFHS).

- NFHS is conducted every five years, with the last round referring to the 2019-21 period.

- Calculation for 2013-14 and 2022-23:

- The paper states that arriving at MPI data for 2013-14 and 2022-23 required specific methodologies.

- For 2013-14, the process involved interpolation of estimates, indicating the estimation of data points within the range of available observations.

- For 2022-23, the method used was extrapolation, suggesting the estimation of data points beyond the range of available observations.

- Rationale for Comparison:

- The paper justifies the comparison of estimates for 2013-14 with those for 2022-23 to gain a better understanding of the impact of various initiatives launched during the previous decade on poverty and deprivation.

- Although the actual estimates for 2015-16 and 2019-21 show an acceleration in the rate of reduction in MPI after 2015-16 compared to the period from 2005-06 to 2015-16, a comparison between 2013-14 and 2022-23 is deemed valuable.

- Incidence of Multidimensional Poverty (H):

- Identification of MPI Poor:

Note: Interpolation is a mathematical technique used to estimate values within the range of known data points. It involves predicting values that fall between observed data points based on the existing data.

- Extrapolation is a mathematical technique used to estimate values beyond the range of known data points. It involves extending the established trend or pattern observed in existing data to predict values outside the range of the available data.

Pirates of Arabian Sea, their Crimes and how maritime forces respond

(General Studies- Paper III)

Source : The Indian Express

Maritime piracy, an age-old issue, persists in various forms across different regions.

- Recent piracy incidents have been reported in waters off the west coast of Africa, Gulf of Aden, Horn of Africa, Bangladesh, and the Strait of Malacca.

Key Highlights

- Factors Leading to Maritime Piracy:

- Poor Policing: Sea areas lacking effective law enforcement and surveillance.

- Concentrations of Shipping Traffic: Areas where shipping routes converge, slow down, or anchorages where ships remain stationary.

- Governance Issues: Poor governance or turmoil in nearby land areas leading to unemployment, poverty, and increased crime.

- International Waters: Complexity in legal jurisdiction and coordination in international waters, straits, or archipelagic waters under the jurisdiction of multiple countries.

- Defining Maritime Piracy:

- The term ‘piracy’ encompasses a range of crimes, including petty theft from ships, armed robbery, and hijacking for ransom.

- Hijacking for ransom is particularly concerning as it induces panic in maritime business, prompts the designation of high-risk areas, raises maritime insurance premiums, jeopardizes the safety of ships and seafarers, and disrupts global supply chains.

- Addressing Piracy:

- Tackling the crime of piracy requires addressing the root causes, often linked to instability and misgovernance on land.

- Long-term solutions involve negotiations on land by concerned states and international diplomacy.

- Role of Maritime Forces and the Indian Navy:

- Maritime forces worldwide play a crucial role in containing and stabilizing situations at sea, preventing disruptions to mercantile peace and global economies.

- The Indian Navy has been one of the most proactive forces in addressing piracy, particularly in the troubled areas off the Horn of Africa and the Gulf of Aden.

- The Indian Navy initiated an anti-piracy patrol in 2008, which continues to this day.

- The navy has actively intervened in developing situations, successfully foiling numerous attempts by pirates to hijack merchant ships.

- During the peak of Somali piracy (2009-12), the Indian Navy’s efforts contributed to pushing back the boundaries of the high-risk area in the Arabian Sea westward.

- Recent intervention and rescue operations, such as the coordinated rescue of a Sri Lankan fishing trawler and the rescue of two Iranian flagged boats within 36 hours, showcase the continued professionalism and effectiveness of the Indian Navy in these waters.

- Identity of Pirates and Their Motivation:

- The pirates operating off Somalia and in the Gulf of Aden are not glamorous figures like those depicted in “Pirates of the Caribbean,” but rather individuals driven by extreme poverty to commit desperate acts at sea.

- These pirates are often highly distressed individuals, while their handlers remain ashore, benefiting from the proceeds of the criminal activities.

- The pirate operation typically involves a pirate mother ship, a larger vessel carrying supplies, ammunition, and stores.

- Accompanying the mother ship are several skiffs, small and low-freeboard fishing craft fitted with powerful outboard motors, allowing them speeds exceeding 40 knots.

- Modus Operandi:

- Target Selection: Pirates identify a lone ship, preferably slow-moving with a low freeboard.

- Skiff Approach: Skiffs, being small and low, do not appear on the radar of the target ship and become visible only when very close.

- Speed Advantage: Skiffs approach at high speed, exploiting the speed advantage over typical merchant vessels (12-15 knots).

- Surprise Boarding: Pirates board the target ship using grapnels and ladders, armed with small arms or, in some cases, a rocket launcher.

- Intimidation: The small, unarmed crew of merchant ships is often intimidated and overpowered by the pirates, who take control.

- Crew Response: Merchant ship crews, having orders not to resist to avoid damage, often lock themselves in a safe zone and send distress signals.

- Ransom Negotiation: Ship-owners prefer paying ransom to secure the release of the ship, cargo, and crew, and to avoid legal complications.

- Distress Signal: Crews send distress signals monitored by piracy reporting centers and maritime safety agencies.

- Key Components of Anti-Piracy Response: Maritime forces employ a multifaceted approach in their anti-piracy response, consisting of four main elements:

- Visible Presence: Maintaining a visible presence in high-risk areas to act as a deterrent against pirate attacks.

- Surveillance and Identification: Utilizing ships and aircraft for surveillance of high-risk areas, identifying suspect vessels, and reporting them for further investigation, often supported by information fusion centers ashore.

- Warning and Escort Services: Issuing warnings to passing ships about suspect vessels, announcing escort schedules, and facilitating convoys for merchant ships transiting high-risk areas.

- Proactive or Reactive Intervention: Proactively or reactively intervening in developing situations, thwarting piracy attempts, and rescuing hijacked vessels with a focus on minimizing casualties and damage.

- Coordination and Communication:

- Naval ships may operate independently or as part of a coalition force coordinated by a rotating commander from participating nations.

- Coalition forces maintain a common communication protocol, share information, and conduct static patrols or escort columns of merchant ships.

- Effective communication and coordination exist among all maritime forces, with communications to merchant vessels maintained on commercial open frequencies.

- Armed helicopters on ships are highly effective in responding rapidly to piracy situations, directing fire, and coordinating assistance from nearby vessels.

- Marine commandos, particularly the Indian Navy’s Maritime Intervention Operations (MIO) units, play a crucial role in overcoming pirates and securing the release of crews from safe zones on hijacked vessels.

- Handling Captured Pirates and Long-Term Solutions

- Legal Challenges and Disposal of Pirates:

- Apprehending pirates raises legal challenges due to inadequate national laws and the lack of an effective international legal mechanism for their trial and disposal.

- Complex jurisdictional issues arise from the involvement of multiple nationalities, countries, maritime zones, and flag states.

- Post-Capture Measures:

- Captured pirates are typically disarmed, and their boats are drained of fuel and set adrift to prevent further attacks.

- However, the lack of a robust legal framework often leads to pirates finding their way back ashore, potentially returning to piracy activities.

- In some cases, captured pirates may be handed over to a coastal state for legal proceedings.

- Long-Term Solution:

- A lasting solution to piracy involves addressing root causes such as misgovernance and unemployment in nations ashore, which contribute to maritime criminal activities.

- Until these underlying issues are addressed, piracy is likely to recur periodically, necessitating ongoing efforts by maritime forces to maintain mercantile peace.

- Legal Challenges and Disposal of Pirates:

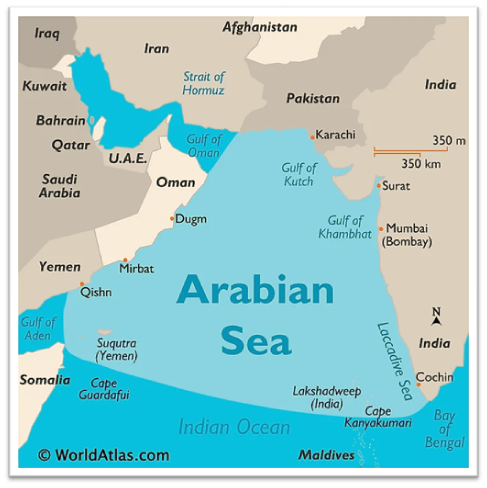

About Arabian Sea

- The Arabian Sea is a northwestern part of the Indian Ocean, situated between the Arabian Peninsula to the west and the Indian subcontinent to the east.

- Geography:

- Location: It is located in the northeastern part of the Indian Ocean.

- Borders: Bounded by the Arabian Peninsula to the northwest, the Indian subcontinent to the east, and the Horn of Africa to the southwest.

- Extent: Extends approximately 1,491 miles (2,400 km) in the north-south direction and 1,385 miles (2,233 km) in the east-west direction.

- Countries and Coastal Regions:

- Coastal Countries: The Arabian Sea borders several countries, including India, Pakistan, Iran, Oman, Yemen, and Somalia.

- Major Coastal Cities: Mumbai (India), Karachi (Pakistan), Muscat (Oman), and Aden (Yemen) are some of the major coastal cities along the Arabian Sea.

- Importance and Economic Activities:

- Trade Routes: The Arabian Sea is a crucial maritime trade route connecting the oil-rich regions of the Middle East with South Asia and beyond.

- Economic Activities: Fishing, shipping, and trade are significant economic activities in the coastal regions surrounding the Arabian Sea.

- Climate and Monsoons:

- Monsoon Influence: The Arabian Sea is influenced by the Indian monsoon, with the southwest monsoon bringing heavy rainfall to the coastal regions of India and neighboring countries during the summer.

- Biodiversity:

- Marine Life: The Arabian Sea is home to diverse marine life, including various species of fish, dolphins, whales, and other marine organisms.

- Historical Significance:

- Trade and Exploration: Throughout history, the Arabian Sea has been a vital route for maritime trade and exploration, connecting the civilizations of the Indian subcontinent, the Arabian Peninsula, and East Africa.

- Strategic Importance:

- Naval Operations: The Arabian Sea holds strategic importance for naval operations, with several countries maintaining a naval presence to safeguard their interests and ensure maritime security.

Children on Social Media

(General Studies- Paper II)

Source : The Indian Express

Mark Zuckerberg, CEO of Meta (parent company of Facebook, Instagram, and WhatsApp), issued an apology during his eighth appearance before the US Congress.

- Facing parents of children who experienced abuse on social media platforms, Zuckerberg expressed regret.

- The apology came amid increasing scrutiny on how social media platforms, including Meta, are used by predators targeting children.

Key Highlights

- Background:

- Meta’s CEO and CEOs of other platforms recently appeared before a US Senate committee to address concerns about child safety online.

- Whistleblowers, including Frances Haugen and Arturo Bejar, disclosed that Meta was aware of the harm its products caused to children.

- An investigation revealed that 1 lakh minors, mostly females, faced harassment on Meta platforms daily.

- Amnesty International reports in 2023 focused on abuses experienced by children on TikTok, attributing them to the platform’s recommender system and business model.

- Studies and leaked documents emphasize that social media platforms, driven by engagement and attention metrics, have not adequately addressed the harms caused by their algorithms.

- Urgent Need for Accountability on Social Media Platforms

- Predators use platforms for “grooming” minors and human trafficking, posing serious risks to children.

- Concerns extend beyond the US, impacting parents, policymakers, and society globally, including in India.

- India has over 600 million smartphone users, with teenagers representing a rapidly growing segment.

- NCRB data reveals that 28% of minors have faced sexual abuse, with underreporting prevalent.

- In 2022, India reported 38,911 child rape cases and around 3,500 cases of online sexual exploitation of children.

- India, despite being Meta’s largest market, has fewer content moderators compared to the US and Europe.

- Urgent measures are needed, including increased content moderation, mass awareness campaigns, and education on safe smartphone use.

- Law enforcement requires enhanced resources and training to combat online crimes.

- The argument of social media platforms being “platforms, not publishers” is viewed as inadequate for escaping accountability.

About NCRB

- The National Crime Records Bureau (NCRB) is an agency under the Ministry of Home Affairs, Government of India.

- It serves as the nodal agency for authentic and comprehensive crime statistics and related information in the country.

- Headquartered in New Delhi, it operates as the primary repository for collecting, analyzing, and managing crime data as defined by the Indian Penal Code (IPC) and Special and Local Laws (SLL).

- The current Director of NCRB is VivekGogia (IPS).

- NCRB was formed based on the recommendations of the Task Force in 1985 and the National Police Commission in 1977.

- It resulted from the merger of key entities, including the Directorate of Coordination and Police Computer (DCPC), Inter State Criminals Data Branch of CBI, and Central Finger Print Bureau of CBI.

- While initially merged with NCRB, the Statistical Branch of the Bureau of Police Research and Development (BPR&D) was later de-merged.

- Mission and Objectives: The primary mission of NCRB is outlined as follows:

- Information Technology for Law Enforcement: Provide Indian police with Information Technology and Criminal Intelligence to enhance their ability to uphold the law and protect citizens.

- Leadership in Crime Analysis: Offer leadership and excellence in crime analysis, particularly focusing on serious and organized crime.

- Functions and Responsibilities: NCRB serves as a central agency responsible for:

- Compiling and publishing annual crime reports, including the renowned “Crime in India” series.

- Conducting research and analysis on various aspects of crime and criminal justice.

- Managing databases related to crime, criminals, and law enforcement.

- Collaborating with police departments and criminal justice components across the country.

- Contributing to evidence-based policymaking through data-driven insights.

- Technological Initiatives:

- NCRB plays a significant role in the Crime and Criminal Tracking Network & Systems (CCTNS), a nationwide project aimed at creating a network for real-time information sharing among law enforcement agencies.