CURRENT AFFAIRS – 02/01/2024

- CURRENT AFFAIRS – 02/01/2024

- Aadhaar-linked pay becomes mandatory for MGNREGS workers

- The government’s OTT oversight

- XPoSat in orbit; to study black holes, neutron stars

- Reigniting the flame of India-Korea defence cooperation

- India’s 1991 crisis and the RBI Governor’s role

- Why did FIU IND act against virtual asset providers?

- India and Pak. exchange list of nuclear installations

CURRENT AFFAIRS – 02/01/2024

Aadhaar-linked pay becomes mandatory for MGNREGS workers

(General Studies- Paper II)

Source : TH

As of the New Year, the implementation of the Aadhaar-based Payment System (ABPS) for wages under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) has become mandatory.

- The ABPS requires the seeding of workers’ Aadhaar details to their job cards for payment processing.

Key Highlights

- The deadline for this mandate, extended five times to facilitate database reconciliation by State governments, concluded on December 31, 2023.

- However, the imposition of the ABPS has led to a surge in MGNREGA job card deletions, a trend activists attribute directly to the mandatory payment method.

- The first directive to enforce ABPS was issued on January 30, 2023, with subsequent extensions until December 31.

- According to data from the Union Rural Development Ministry, as of December 27, 34.8% of job card holders remain ineligible for ABPS.

- Government sources contend that the decision not to extend the deadline further is driven by the status of active workers, defined as those who have worked at least one day over the past three financial years.

- As of December 27, 12.7% of these active workers are still not eligible for ABPS.

- Out of the 25.25 crore registered workers under MGNREGA, 14.35 crore fall under the category of active workers.

- Despite the mandate, the Ministry has urged State governments to adopt a generous approach, allowing for exceptions in cases where linking has not been done for genuine reasons.

- Deletion of 7.6 Crore Job Cards

- A significant controversy has arisen as reports indicate that, under pressure from the Union government to achieve 100% Aadhaar-Based Payment System (ABPS) eligibility for job cards, several states have deleted 7.6 crore cards in the past 21 months.

- LibTech India, a consortium of academics and activists, has shed light on the issue, revealing that discrepancies between Aadhaar and job card details, such as variations in workers’ names and purported unwillingness to work, have led to these mass deletions.

- The pressure for ABPS implementation intensified since April 2022, with 7.6 crore workers being removed from the system.

- Notably, the number of deleted workers far exceeds those genuinely ineligible for payments.

- The Right to Work

- This push towards ABPS, which uses the worker’s unique 12-digit Aadhaar number as their financial address, contradicts the spirit of the MNREGA Act passed by Parliament.

- More than one-third of the total MNREGA registered workers have been rendered ineligible, potentially denying them the right to work.

- The researcher argues for the government to not only withdraw the mandatory implementation of ABPS but also instruct states to reinstate wrongly deleted workers and compensate them for the loss of work opportunities.

- The ABPS involves a complex process where a worker’s Aadhaar details must be linked to their job card, bank account, and the National Payments Corporation of India (NCPI) database.

- The government contends that ABPS implementation aims to plug leaks, expedite payments, and reduce rejections.

- However, critics argue that the extensive Aadhaar linking and mapping requirements have led to the indiscriminate deletion of job cards, raising concerns about the denial of livelihoods for a substantial number of workers.

What is Aadhaar-based Payment System (ABPS)?

- Background:

- The Reserve Bank of India (RBI) initiated a concerted effort to accelerate financial inclusion in the country.

- Two working groups were formed, focusing on MicroATM standards and Central Infrastructure & Connectivity for Aadhaar-based financial inclusion transactions.

- One of the outcomes of these initiatives is the Aadhaar-enabled Payment System (AePS) or ABPS.

- APBS is a unique payment system implemented by National Payments Corporation of India (NPCI), which uses Aadhaar number as a central key for electronically channelizing the Government subsidies and benefits in the Aadhaar Enabled Bank Accounts (AEBA) of the intended beneficiaries.

- APB System is used by the Government Departments and Agencies for the transfer of benefits and subsidies under Direct Benefit Transfer (DBT) scheme launched by Government of India.

- AePS operates as a bank-led model, facilitating online interoperable financial inclusion transactions at Point of Sale (PoS) terminals, often referred to as MicroATMs.

- AePS significantly expands the range of financial services by allowing users to perform different types of transactions, particularly benefiting underserved and remote areas.

What is Aadhaar number?

- It is a 12 digit unique identification number that stores demographic and biometric information of the resident with photograph issued by Unique Identification Authority of India (UIDAI) on behalf of Government of India.

- Aadhaar serves as a proof of identity and address, anywhere in India.

Government appoints Arvind Panagariya as sixteenth Finance Commission chief

(General Studies- Paper III)

Source : TH

The government has appointed former NitiAayog vice chairman and Columbia University professor Arvind Panagariya as the chairman of the Sixteenth Finance Commission.

- This critical Constitutional body will play a crucial role in recommending the tax revenue sharing formula between the Centre and the States for the five-year period beginning April 2026.

Key Highlights

- The Commission’s terms of reference were approved by the Cabinet on November 29.

- The appointment was notified by the Finance Ministry based on President DraupadiMurmu’s order.

- Tenure and Deadline:

- Panagariya and other members of the Commission will hold office until the submission of the report or October 31, 2025, whichever is earlier.

- The deadline for the Commission to submit its recommendations is October 2025, aiming to incorporate them in the Budget exercise for 2026-27.

- Commission’s Background:

- Arvind Panagariya previously served as the first vice chairman of the NitiAayog from 2015 to 2017.

- The Sixteenth Finance Commission is crucial for determining the tax revenue sharing formula between the Central and State governments for the next five years.

- Members and Secretary:

- The names of other members of the Commission will be notified separately.

- RitvikRanjanam Pandey, former joint secretary in the Department of Revenue, has been appointed as the panel’s secretary.

- Previous Finance Commission:

- The Fifteenth Finance Commission, chaired by NK Singh, was constituted in November 2017.

- The terms of reference for the Sixteenth Finance Commission include reviewing the financing of Disaster Management initiatives and proposing measures to augment States’ consolidated funds to supplement resources available with Panchayats and Municipalities.

- The Fifteenth Finance Commission’s tenure was expanded to six years in late 2019, with the mandate to submit two reports covering the periods of 2020-21 and an extended period of 2021-22 to 2025-26.

About Finance Commission

- Article 280 of the Constitution of India establishes the Finance Commission, serving as a quasi-judicial body with the responsibility of recommending the distribution of tax revenues between the Central and State governments.

- The President of India constitutes the Finance Commission every fifth year or as deemed necessary.

- Composition:

- The Finance Commission comprises a Chairman and four other members appointed by the President of India.

- The members hold office for the duration specified by the President, with eligibility for reappointment.

- Qualifications:

- The Chairman is required to be a person with experience in public affairs.

- The four other members are chosen from individuals with specific qualifications:

- A judge of a high court or an individual qualified to be appointed as one.

- A person with specialized knowledge of government finance and accounts.

- An individual with extensive experience in financial matters and administration.

- A person possessing special knowledge of economics.

- The Finance Commission functions in a quasi-judicial capacity, implying a role that combines both judicial and executive elements.

- Functions:

- The primary function of the Finance Commission is to recommend the distribution of tax revenues between the Central and State governments.

- It also plays a crucial role in suggesting grants-in-aid to states to address fiscal disparities and promote balanced regional development.

- The Commission assesses the financial positions of both the Central and State governments and provides recommendations for improving fiscal discipline and efficiency in resource utilization.

Note: The recommendations put forth by the Finance Commission are of an advisory nature and do not carry a binding obligation on the government.

The government’s OTT oversight

(General Studies- Paper II)

Source : TH

The Centre has introduced a draft Broadcasting Services (Regulation) Bill, 2023, aimed at revamping the regulatory framework for the broadcasting sector in India.

- The Ministry of Information and Broadcasting released the draft for public consultation on November 10.

Key Highlights:

- The draft Bill extends regulation from conventional television services to encompass OTT platforms and digital content, including news programs regulated under the Information Technology Act, 2000.

- The government’s objective is to establish a unified legal framework for regulating diverse broadcasting services in the country.

- The proposed legislation is intended to replace the Cable Television Networks (Regulation) Act, which has been in effect for approximately three decades.

- New Regulations Proposed:

- The draft Bill introduces several new regulations, such as mandatory registration for broadcasting services.

- It suggests the formation of ‘content evaluation committees’ to encourage self-regulation on digital platforms.

- Establishment of program and advertisement codes is recommended.

- The draft proposes a three-tier regulatory mechanism, indicating a structured approach to oversight in the broadcasting sector.

- The Centre asserts that the Bill will enhance the ease of doing business and ensure compliance with broadcasting codes.

- The move is intended to update the regulatory framework to align with the evolving needs of the sector.

- Key Provisions of the Broadcasting Services (Regulation) Bill, 2023

- Registration Requirement:

- No person or broadcasting company can provide services or operate a network without formal registration or intimation to the government.

- Exceptions exist for authorized bodies like PrasarBharati or Parliament channels.

- Cable and satellite broadcasting network operators must register to operate under provisions similar to the Cable Television Networks (Regulation) Act of 1995.

- Broadcasters need approval from the registering authority for transmitting programs.

- Subscriber data maintenance is mandatory.

- Similar provisions apply to terrestrial and radio broadcasting networks.

- Expansion to Internet-Based Broadcasting:

- Broadcasting rules extend to internet-based networks, including Internet Protocol Television (IPTV) and OTT broadcasting services, provided they meet subscriber or viewer thresholds.

- The Union government will prescribe limits for subscriber or viewer numbers at a later stage.

- Exclusion of OTT Broadcasting Services from Social Media:

- OTT broadcasting services, under the Act, do not include social media intermediaries or their users, as defined in the Information Technology Act, 2000.

- Programme and Advertisement Codes:

- Programmes and advertisements on TV, radio, and other broadcasting services must adhere to the yet-to-be-defined Programme Code and Advertisement Code.

- Codes apply to individuals and organizations broadcasting news and current affairs online through e-newspapers, news portals, websites, and similar social media platforms, operating as a “systematic business” or “professional” entity.

- Exemptions are granted to digital copies of newspapers and publishers of commercial newspapers.

- Broadcasters must classify their programmes based on context, theme, tone, impact, and target audience.

- Classification information must be prominently displayed at the beginning of the show for viewer awareness.

- Access Control Measures:

- Network operators are required to implement access control measures for shows classified for restricted viewing, especially those with adult content.

- Accessibility Guidelines for Persons with Disabilities:

- Broadcasting network operators and broadcasters must make their platforms, equipment, and programmes more accessible to persons with disabilities.

- Suggested measures include audio descriptions, sign language translations, subtitles with different fonts, sizes, and colors, and the use of accessible applications.

- Grievance Redressal Officer:

- A disability grievance redressal officer appointed by the Centre will address complaints related to accessibility guidelines.

- Penalties may be imposed on broadcasters or broadcasting network operators in case of violations.

- Self-Regulation by Broadcasters and Network Operators:

- Every broadcaster or broadcasting network operator is mandated to establish a Content Evaluation Committee (CEC).

- The CEC must have members representing various social groups, including women, child welfare, scheduled castes, scheduled tribes, and minorities.

- Only programmes certified by the CEC can be aired, except for specific shows exempted by the government.

- The Centre retains the authority to define the size, quorum, and operational details of the CEC.

- Details of committee members, including their names and credentials, should be published on the broadcaster’s or network operator’s website.

- Self-Regulatory Organizations:

- Proposed bodies of broadcasters, broadcasting network operators, or their associations will form self-regulatory organizations.

- These organizations will guide their members to ensure compliance with broadcasting rules and address grievances related to content violations.

- They can handle appeals against decisions of broadcasters or network operators.

- If a broadcaster is found guilty of wrongdoing, the self-regulatory organization to which it belongs has the authority to expel, suspend, or impose penalties.

- Penalties may include advisories, censures, warnings, or monetary fines, not exceeding Rs. 5 lakh for each violation.

- Broadcast Advisory Council:

- The Centre will establish the Broadcast Advisory Council.

- Consists of independent experts and government representatives.

- The Council oversees the implementation of regulations.

- Hears content violation complaints and makes recommendations to the government.

- Can form review panels to assist with functions, assigning specific cases or appeals.

- Inspection and Seizure:

- The Centre and authorized officers have the right to inspect broadcasting networks and services.

- Operators must provide necessary equipment, services, and facilities at their own cost for interception or monitoring during an inspection.

- Typically, inspections will be conducted after providing reasonable notice in writing, specifying the reasons for confiscation.

- Inspections without prior notice are allowed if providing notice would defeat the purpose of the inspection, raising concerns about government overreach.

- The Bill states that no prior permission or intimation is required for the Central Government or its authorized officers to carry out inspections.

- The inspecting team can seize equipment if they believe that the operator has violated norms.

- Companies can be held liable for contraventions unless they prove lack of knowledge or due diligence.

- Seized equipment is liable for confiscation unless compliance with rules or guidelines is demonstrated within 30 days.

- A written notice must be provided to the operator, informing them of the grounds for confiscation, giving an opportunity for making a representation.

- If no notice is given within 10 days from the date of seizure, the equipment must be returned to the operator.

- Penalties for Non-Compliance:

- Penalties for non-compliance include the removal of objectionable shows, orders, apologies, off-air periods, or even cancellation of registration.

- The Centre may prohibit the transmission of a programme or operation of broadcaster or broadcasting network in the interest of public order, decency, morality, or national security.

- Prohibition is justified if the programme is likely to promote disharmony, hatred, or ill-will among different groups.

- Government’s Regulatory Powers:

- The Central Government can regulate or prohibit the transmission or re-transmission of any television channel or programme in the interest of India’s sovereignty, integrity, security, friendly relations with foreign states, public order, decency, or morality.

- Monetary Penalties and Imprisonment:

- Monetary penalties and imprisonment are prescribed for certain serious offences.

- Penalty amounts vary based on the financial capacity of the company or individual, with different rates for unregistered entities and categories such as major, medium, small, and micro.

- The maximum penalty for unregistered entities and major categories is 100%, while for medium, small, and micro categories, it is 50%, 5%, and 2%, respectively.

- Concerns Raised by Legal Experts

- The Bill’s broad scope covering traditional broadcasters and the evolving OTT space has raised concerns.

- The differing business models and content delivery mechanisms of cable TV and OTT platforms may not be adequately addressed.

- Digital rights organization Internet Freedom Foundation (IFF) calls for cautious examination, expressing concerns about the potential impact on online free speech, journalistic expression, artistic creativity, and citizens’ right to access diverse viewpoints.

- IFF points out the proposed codes’ similarity to the Code applicable to cable TV, raising apprehensions about increased censorship of TV programs.

- The fear is that online content producers may limit their output to avoid government discretion and potential punishments.

- IFF argues that exerting executive control over OTT content may lead to over-compliance and self-censorship, as platforms seek to avoid the government’s broad discretion in imposing penalties.

- IFF highlights concerns about several provisions left to be determined later by the Centre, emphasizing that excessive delegation of rule-making could create uncertainty for stakeholders.

- The subjective nature of terms like “good taste” and “decency” may lead to ambiguous interpretations.

- IFF emphasizes the need for relevant safeguards to protect against arbitrary rule-making, given the extensive use of phrases like “as may be prescribed” and “as notified by the [Union] Government” in the Bill.

- Registration Requirement:

XPoSat in orbit; to study black holes, neutron stars

(General Studies- Paper III)

Source : TH

On January 1, 2024, the Indian Space Research Organisation (ISRO) marked the beginning of the New Year with the successful launch of the PSLV-C58 X-ray Polarimeter Satellite (XPoSat) mission.

- This mission, the 60th for the Polar Satellite Launch Vehicle (PSLV), took place from the Satish Dhawan Space Centre in Sriharikota.

- The XPoSat was deployed into an eastward low inclination orbit approximately 22 minutes after liftoff.

Key Highlights

- XPoSat Mission Objectives:

- XPoSat represents ISRO’s inaugural dedicated scientific satellite for conducting research on space-based polarization measurements of X-ray emissions from celestial sources.

- The satellite is equipped with two essential payloads:

- POLIX (Polarimeter Instrument in X-rays) developed by the Raman Research Institute, and

- XSPECT (X-ray Spectroscopy and Timing) by the Space Astronomy Group of URSC, Bengaluru.

- This successful mission elevates India’s status as only the second nation in the world to deploy an observatory for studying astronomical sources such as black holes and neutron stars.

- XPoSat is specifically designed for X-ray polarimetry, making it the second mission of its kind globally, following NASA’s Imaging X-ray Polarimetry Explorer (IXPE) launched in 2021.

- PSLV-C58 Mission Highlights:

- As part of the PSLV-C58 mission, the PSLV Orbital Experimental Module-3 (POEM-3) experiment was executed, aiming to achieve the objective of deploying 10 additional payloads.

- These 10 payloads were developed by a diverse range of entities, including start-ups, educational institutions, and ISRO centers.

- Among the payloads, the ISRO Fuel cell Power System (FCPS) holds particular significance, as it is poised to have potential applications in India’s proposed space station scheduled for establishment by 2035.

More details about XPoSat

- The mission’s primary objectives include measuring X-Ray polarization in the 8-30 keV energy band and conducting long-term spectral and temporal studies of cosmic X-Ray sources in the 0.8-15 keV energy band.

- With an anticipated mission life of approximately 5 years, XPoSat will observe X-Ray sources during its transit through Earth’s shadow, particularly during the eclipse period.

- The mission aims to scrutinize X-rays from intense sources like neutron stars and supermassive black holes, unraveling the mysteries of their origins.

- XPoSat Mission Payloads: POLIX and XSPECT

- India’s XPoSat Mission is poised to make groundbreaking strides in X-Ray astronomy, driven by its two primary payloads—POLIX (Polarimeter Instrument in X-rays) and XSPECT (X-ray Spectroscopy and Timing).

- Developed by renowned Indian space research institutions, these payloads are designed to provide comprehensive insights into the polarization, spectroscopy, and timing of X-rays emanating from diverse astronomical sources.

- POLIX Payload: X-ray Polarimeter for Medium Energy Range (8-30 keV):

- POLIX is dedicated to measuring polarimetry parameters, specifically the degree and angle of polarization, in the medium X-ray energy range of 8-30 keV photons originating from astronomical sources.

- Developed by the Raman Research Institute (RRI), Bangalore, with support from ISRO centers.

- Objective: To observe a diverse range of bright astronomical sources across categories during the planned 5-year lifetime of the XPoSat mission.

- XSPECT Payload: X-ray Spectroscopy and Timing Instrument (0.8-15 keV):

- XSPECT provides spectroscopic information within the energy range of 0.8-15 keV and offers fast timing capabilities.

- Developed by the U R Rao Satellite Centre (URSC), ISRO.

- Target Sources: Anticipated to observe a variety of sources, including X-ray pulsars, black hole binaries, low-magnetic field neutron stars (NS), active galactic nuclei (AGNs), and magnetars.

- Objective: Contribute to the understanding of soft X-ray

Understanding X-rays in Space:

- X-rays in space, with significantly higher energy and shorter wavelengths (ranging from 0.03 to 3 nanometers), emanate from objects with extreme temperatures, such as pulsars, galactic supernova remnants, and black holes.

- The physical temperature of an object dictates the wavelength of the emitted X-rays, with hotter objects emitting shorter wavelengths.

- Polarized X-rays, observed through missions like XPoSat and IXPE, provide a unique perspective on the emission sources.

- By measuring the polarization of these X-rays, scientists can discern the origin and intricacies of the emitted light.

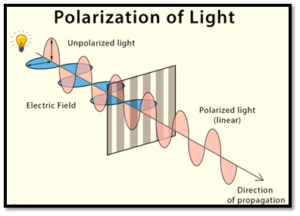

Understanding the Polarization of Light

- Polarization of light is a phenomenon that describes the orientation of the oscillations of electric and magnetic fields comprising an electromagnetic wave.

- This property of light plays a crucial role in various scientific and technological applications.

- Nature of Light:

- Light is an electromagnetic wave composed of oscillating electric and magnetic fields.

- These fields oscillate perpendicular to the direction of wave propagation, forming a transverse wave.

- Direction of Oscillation:

- In polarized light, the oscillations of the electric field vectors occur predominantly in a specific direction.

- The direction of polarization refers to the orientation of these electric field vectors.

- Unpolarized Light vs. Polarized Light:

- Unpolarized Light: In natural light sources, like the sun or incandescent bulbs, the electric field vectors of the light waves are randomly oriented in all directions.

- Polarized Light: When the electric field vectors align predominantly in a specific direction, the light is said to be polarized.

- Degrees of Polarization:

- The degree of polarization quantifies the extent to which light is polarized.

- It is expressed as a percentage, where 0% represents completely unpolarized light, and 100% represents fully polarized light.

- Applications:

- Sunglasses: Polarized sunglasses reduce glare from reflective surfaces by blocking horizontally polarized light.

- LCD Screens: Liquid crystal displays (LCDs) use polarization to control the passage of light, resulting in vibrant and clear images.

- Communication Devices: Polarization is utilized in various communication technologies, such as antennas and satellite communication, to control signal transmission.

- Photography: Polarizing filters in photography enhance contrast, reduce reflections, and improve colour saturation.

- Scientific Research: In fields like astronomy and materials science, studying polarized light provides valuable information about the composition and properties of substances.

Significance of Polarization of Light in Astronomy

- Polarized light is a valuable tool for studying magnetic fields in space.

- Certain astronomical objects, like stars, galaxies, and nebulae, exhibit polarized light patterns that provide information about the strength and orientation of magnetic fields within them.

- In astronomy, polarization helps researchers study the environments around stars.

- It allows scientists to explore the structures of dust clouds, disks, and other materials surrounding stars, giving clues about the formation of planetary systems.

Reigniting the flame of India-Korea defence cooperation

(General Studies- Paper II)

Source : TH

The recent visit of General Manoj Pande, Chief of the Army Staff of India, to the Republic of Korea in November 2023, marked a crucial development in India-Korea defense relations.

- While the visit strengthened diplomatic ties, it also brought to light challenges that require careful consideration.

Key Highlights

- Challenges in Establishing a Comprehensive Defense Framework:

- Despite recent high-level engagements, a notable challenge is the absence of a shared vision for a new comprehensive defense framework.

- The need for a robust structure guiding bilateral cooperation, aligning policies, and fostering a sustainable regional order is imperative.

- Both nations must transcend the limitations of bilateral cooperation and embrace a paradigm shift to navigate the swiftly evolving global scenario.

- Korean Perception of India’s Regional Role:

- A significant hurdle lies in the Korean government’s resistance to reassess India’s role in the region.

- It is crucial for Korea to recognize India not solely as a consumer of defense products but as a regional power capable of substantial contributions to peace and stability in the Indo-Pacific.

- Overcoming Cold War mentalities is essential for forging a deeper and more meaningful partnership.

- The strategic shift in Korea’s thinking is crucial for meaningful engagement.

- Challenges Posed by the Emerging Coalition:

- The emerging coalition of North Korea, China, and Russia presents a new challenge to collaborative efforts between India and Korea.

- Divergent stances may emerge, necessitating a nuanced appraisal of each party’s strategic imperatives.

- Focus on Weapons Acquisition vs. Broader Strategic Considerations:

- The Indian government’s emphasis on weapons acquisition and technology transfer from Korea, while pivotal, has sometimes overshadowed broader strategic considerations.

- Similarly, the Korean defense establishment’s profit-driven focus on weapons sales to India, devoid of strategic considerations, may prove shortsighted amid fast-changing geopolitical dynamics.

- Balancing long-term strategic goals over short-term gains is emphasized, considering powerful arms lobbies in both nations.

- The high-level interactions of Gen. Pande with top Korean military leadership and engagements with defense institutions are expected to further unite the defense communities of both countries.

- This unity could pave the way for overcoming challenges and fostering a more robust defense collaboration between India and Korea.

- Technological Collaboration as a Cornerstone:

- India and South Korea are strategically positioning themselves for collaborative ventures in the development of advanced defence systems and equipment, leveraging their technological capabilities.

- Recognizing the pivotal role of technology in future conflicts, both nations aim to establish a limitless scope for cooperation, fostering a mutually beneficial defence technology and industry partnership.

- The objective is to propel India and South Korea to the forefront of innovation and self-reliance in the defence sector.

- Focus on Emerging Threats:

- Acknowledging the significance of defence against space warfare, information warfare, and cybersecurity, the two nations plan to explore opportunities for cooperation in these critical domains.

- South Korea’s status as an advanced high-tech digital superpower positions it as a valuable collaborator in developing robust security measures to counter emerging threats in the digital realm.

- The goal is to ensure the security of critical infrastructure and information in an era where cybersecurity is paramount.

- The shared concerns of India and South Korea in countering terrorism create potential avenues for collaboration, particularly in maritime security.

- Joint patrolling and information sharing in the Indian Ocean, where both countries have significant maritime interests, represent opportunities for coordinated efforts in ensuring regional stability.

- Utilizing Peacekeeping Expertise:

- Leveraging their United Nations peacekeeping expertise, India and South Korea can engage in collaborative efforts, sharing insights and resources for peacekeeping operations.

- This cooperation not only enhances regional stability but also underscores their joint commitment to global peace and security.

- Additionally, joint exercises and the exchange of best practices in Humanitarian Assistance and Disaster Relief (HADR) demonstrate a shared responsibility in addressing vulnerabilities to natural disasters.

- Enhancing joint army exercises is identified as a pathway for mutual growth, fostering interoperability, and strengthening the capabilities of both armies for effective collaboration in diverse scenarios.

- Strategic Outlook for Future Collaboration:

- While Gen. Pande’s visit has reignited the collaboration between India and Korea in the defence sector, the path forward necessitates a strategic and balanced approach.

- Meticulous navigation through challenges, coupled with adaptability to the evolving geopolitical landscape, is deemed essential for unlocking a robust and enduring defence collaboration.

- The ultimate goal is to create a partnership that fosters peace, stability, and prosperity in the Indo-Pacific region.

- United, both nations stand ready to navigate the complexities and uncertainties of the future, forging a path toward a stronger and more resilient partnership.

About India- South Korea Relations

- The deep and historic ties between India and the Republic of Korea (ROK) trace back to 48 AD, as documented in the 13th-century Korean text “SamgukYusa.”

- It narrates the tale of Princess Suriratna of Ayodhya, later known as Queen Heo Hwang-ok, who wedded King Kim-Suro of the ancient Gaya Confederacy in Korea.

- Although these early connections were profound, formal diplomatic relations were officially established in 1973, marking a significant milestone in the bilateral relationship.

- The 50th anniversary of formal diplomatic relations in 2023 reflects the vibrancy and enduring nature of the India-ROK relationship.

- Over five decades, the ties have evolved to encompass politics, economics, and culture, fostering a robust partnership between the two nations.

- Evolution of Strategic Relationship (2004 Onwards):

- The strategic relationship between India and ROK took a significant turn in 2004 when a “Long-Term Cooperative Partnership for Peace and Prosperity” was signed.

- This laid the foundation for strong economic and strategic ties between the two nations.

- In 2010, during the visit of ROK President Lee Myung-bak to India, the relationship was upgraded to a “Strategic Partnership.”

- Subsequently, Prime Minister Narendra Modi’s official visit in 2015 elevated it further to a “Special Strategic Partnership,” reflecting the deepening collaboration across various domains.

- ROK’s Indo-Pacific Policy and Focus on India (December 2022):

- In December 2022, under the leadership of President Yoon Suk Yeol, the Republic of Korea unveiled its Indo-Pacific policy titled “Strategy for a Free, Peaceful, and Prosperous Indo-Pacific Region.”

- This policy emphasizes advancing unique strategic cooperation with India, recognizing India as a prominent regional partner.

- The shared values, the largest population globally, advanced space and information technology, and tremendous economic potential make India a key focus in the ROK’s Indo-Pacific strategy.

- Strengthening Defence Relations:

- India and the Republic of Korea (ROK) have witnessed a substantial strengthening of their defence relations in recent years.

- Notably, annual Defence Ministerial Dialogues have been held since 2015, further elevated to a 2+2 dialogue format in 2019.

- Regular meetings between the Defense Research and Development Organisation (DRDO) and ROK’s Defense Acquisition Program Administration (DAPA) underscore the collaborative efforts in defence research and development.

- In 2022, joint exercises conducted by the Korea Coast Guard and the Indian Coast Guard showcased a commitment to improving interoperability and coordination in maritime security.

- A significant development in the defence and strategic partnership is reflected in the bilateral civil nuclear cooperation talks held in July 2023.

- Economic Ties and Business Connections:

- The Comprehensive Economic Partnership Agreement (CEPA), implemented on August 7, 2009, stands as a pivotal catalyst in the flourishing trade and economic relations between India and the Republic of Korea (ROK).

- India serves as the second home for many prominent Korean corporations, highlighting the depth of economic engagement between the two nations.

- India’s ‘Make in India’ initiative has played a pivotal role in attracting major Korean enterprises, including industry leaders such as Hyundai and Samsung.

- In 2016, the Commerce & Industry Minister Smt. Nirmala Sitharaman and Mr. JooHyunghwan, the Minister of Trade, Industry & Energy of ROK, launched ‘Korea Plus.’

- This special initiative, operating under ‘Invest India,’ the National Investment Promotion and Facilitation Agency of the Government of India, aims to encourage and facilitate Korean investments in India.

- Trade Dynamics and CEPA Impact:

- Since the initiation of CEPA in 2010, the India-ROK trade has experienced noteworthy fluctuations.

- In 2010, trade soared by 40%, surpassing $17.11 billion, with significant increases in both Indian and ROK exports.

- By 2018, it peaked at $21.49 billion, marked by an 18.9% surge in India’s exports.

- Despite a dip in 2020 due to the global pandemic, trade recovered to reach $27.8 billion in 2022.

- Foreign Direct Investment (FDI):

- In the fiscal year 2022-2023, ROK directed $283.97 million in Foreign Direct Investment (FDI) towards India, constituting 0.62% of India’s total FDI inflows and positioning ROK at the 15th rank among contributing countries.

- Sectors witnessing significant investments include automobiles, metallurgical industries, computer hardware and software, electrical equipment, and construction activities.

- Indian Community in the Republic of Korea:

- Approximately 15,000 Indian nationals have established a vibrant community within the Republic of Korea (ROK).

- This community comprises scholars, professionals, and students, contributing significantly to various sectors in the ROK.

- Many are employed by prominent companies, including Samsung, LG, Hyundai, TATA Daewoo, TCS, and Coupang.

India’s 1991 crisis and the RBI Governor’s role

(General Studies- Paper III)

Source : TH

- Venkitaramanan, an esteemed IAS officer and former Governor of the Reserve Bank of India (RBI), passed away recently.

- His tenure, from December 1990 to December 1992, witnessed India grappling with a severe balance of payments stress.

- The crisis emerged due to a slowdown in remittances and a surge in oil prices following Saddam Hussain’s invasion of Kuwait.

- In the 1990-91 fiscal year, the current account deficit soared to 3 percent of the GDP, reaching its highest level in two decades.

Key Highlights

- RBI’s Role in Crisis Management:

- During this critical period, the RBI, under Venkitaramanan’s leadership, played a pivotal role in crisis management.

- Faced with speculation about India defaulting on external payment obligations, the RBI initiated strategic moves, including pledging the country’s gold to international banks in exchange for a hard currency loan.

- In April 1991, the Government raised $200.0 million from the Union Bank of Switzerland through a sale (with a repurchase option) of 20 tonnes of gold confiscated from smugglers.

- Again, in July 1991, India shipped 47 tonnes of gold to the Bank of England to raise another $405.0 million.”

- Despite facing skepticism and mockery domestically for pledging gold, Venkitaramanan’s actions demonstrated courage and strategic economic management.

- Pledging gold was a measure taken to avert a default, showcasing foresight in building reserves for challenging times.

- The move salvaged India’s prestige and reputation as a reliable counterparty in international business.

- Given that India imports around 80 percent of its oil, this maneuver proved crucial in maintaining access to global loan markets to finance imports, even if future export earnings fell short.

- The sale and pledging of India’s gold reserves under Venkitaramanan’s stewardship not only provided a breathing space within the payments crisis but also showcased smart economic management.

- Economic Reforms and Crisis Management

- During S. Venkitaramanan’s tenure as Governor of the Reserve Bank of India (RBI) from December 1990 to December 1992, India faced a severe balance of payments crisis.

- To address this, the RBI, under Venkitaramanan’s leadership, initiated a program of import compression.

- This strategy involved raising the cash margin on imports, with a four-fold increase between October 1990 and April 1991.

- Supplementary measures were also implemented to increase the overall cost of imports, forming a stringent effort to rein in the deficit.

- The import compression strategy proved successful, leading to a significant reduction in the current account deficit.

- The deficit, which had reached 3 percent of the GDP in 1990-91, dropped to a mere 0.3 percent in 1991-92.

- This drastic improvement almost eliminated the immediate need to raise foreign exchange for financing India’s non-debt payments.

- While subsequent economic reforms led by Dr. Manmohan Singh gained more public attention, Venkitaramanan’s leadership during the balance of payments crisis played a crucial role in navigating India through troubled waters.

- The crisis was deemed “successfully resolved” under his stewardship.

- The end of Venkitaramanan’s term, however, was marred by challenges related to the unexpected irregularities in securities transactions from April 1992, known as the “Harshad Mehta scam.”

What is ‘balance of payments crisis’?

- A “balance of payments crisis” refers to a situation where a country is facing severe difficulties in maintaining equilibrium in its balance of payments.

- The balance of payments is a systematic record of a country’s economic transactions with the rest of the world, including trade in goods and services, financial transactions, and monetary flows.

- A crisis in the balance of payments occurs when a country is unable to meet its external financial obligations, such as payments for imports, debt servicing, and other international liabilities.

- This could be due to various factors, including a substantial trade deficit, a decline in foreign exchange reserves, or an inability to attract sufficient foreign capital to cover the deficit.

- This situation can lead to a depreciation of the country’s currency, increased inflation, and economic instability.

- To address a balance of payments crisis, countries often implement measures such as currency devaluation, import restrictions, and seeking financial assistance from international organizations like the International Monetary Fund (IMF).

Why did FIU IND act against virtual asset providers?

(General Studies- Paper III)

Source : TH

The Financial Intelligence Unit India (FIU IND) has taken action against nine offshore Virtual Digital Asset Service Providers (VDA SPs), including prominent names like Binance, Kucoin, Huobi, Bitfinex, and MEXC Global.

- Show-cause notices were issued on December 28, accusing these entities of “operating illegally” without adhering to the provisions of the Prevention of Money Laundering Act, 2002 (PMLA).

- The FIU IND has further requested the Ministry of Electronics and Information Technology to block the URLs associated with these entities.

Key Highlights

- Premise of Non-Compliance:

- In March 2023, regulations were introduced to bring Virtual Digital Asset Service Providers (VDA SPs) in India under anti-money laundering and counter-financing of terrorism frameworks.

- These regulations mandated compliance with the PMLA 2002, requiring VDA SPs to verify the identities of clients, maintain records of financial positions, and monitor potentially suspicious transactions.

- This compliance obligation extends to all VDA SPs operating in India, regardless of physical presence.

- The non-compliance of the mentioned offshore entities was attributed to their failure to register and operate within the Anti Money Laundering (AML) and Counter Financing of Terrorism Network (CFT) framework, despite catering to a significant user base in India.

- As of now, only 31 VDA SPs have registered with FIU IND, highlighting the need for broader compliance within the industry to address potential money laundering and terrorism financing risks.

- Objective of PMLA Compliance:

- The compliance with the Prevention of Money Laundering Act, 2002 (PMLA) and its reporting obligations serves the primary purpose of enabling monitoring and tracking of financial transactions.

- The overarching goal is to combat money laundering and counteract the financing of terrorism.

- These Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) measures are considered crucial for maintaining the integrity of the global financial ecosystem.

- Benefits of KYC Mandates for VDA SPs:

- Ensuring Know Your Customer (KYC) mandates for Virtual Digital Asset Service Providers (VDA SPs) brings several benefits, particularly in addressing regulatory concerns about the potential anonymity of crypto assets and their susceptibility to unlawful purposes.

- This measure aligns with global efforts to regulate cryptocurrencies, with India advocating for comprehensive cryptocurrency regulation within the G-20 framework.

- The framework proposed by the International Monetary Fund (IMF) and the Financial Stability Board to the G-20 in September 2023 is expected to influence actions in 2024, reinforcing the significance of adhering to PMLA obligations for VDA SPs.

- Global Approaches to Virtual Asset Regulation

- Dubai: Bespoke Licensing Framework

- Dubai’s Virtual Assets Regulatory Authority (VARA) has established a comprehensive regulatory regime characterized by a bespoke licensing framework.

- The regulatory focus is on “consumer protection” and preventing illicit finance.

- Mandatory licenses are categorized based on the specific services entities intend to offer, such as advisory, exchange, broker-dealer, and transfer and settlement services.

- Obtaining a license in Dubai requires compliance with Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) laws applicable to virtual asset activities across jurisdictions.

- European Union: Markets in Crypto-Assets Regulation (MiCA)

- The European Union’s MiCA aims to establish uniform market rules for crypto-assets.

- The regulation emphasizes transparency, disclosure, authorization, and supervision of transactions.

- It addresses market manipulation, money laundering, terrorist financing, and other criminal activities.

- Service providers under MiCA need authorization to operate in the EU, and consumers will receive better information about risks, costs, and charges associated with virtual asset operations.

- Notably, significant service providers must disclose their energy consumption to address environmental concerns.

- While enacted in June 2023, the legislation is undergoing consultation stages, with the final report expected in June 2024.

- United States: Current Regulatory Landscape

- The United States lacks a comprehensive nationwide regulatory framework for virtual assets.

- Existing regulations, such as the Bank Secrecy Act and the Anti-Money Laundering Act of 2020, cover certain digital assets and related activities.

- However, a cohesive regulatory approach for the entire virtual asset sector is yet to be established.

- High-Level Policy Options

- The Bureau for International Settlements (BIS) highlights three high-level policy options for regulating virtual assets: outright ban, containment, and regulation.

- Outright Ban:

- Banning virtual assets may face enforcement challenges due to the pseudo-anonymous nature of crypto markets.

- A ban could lead to regulators losing visibility into the market, reducing transparency and predictability.

- Containment:

- Containment involves controlling flows between crypto markets and traditional financial systems, limiting their connections.

- BIS argues that containment may not effectively address inherent vulnerabilities in crypto markets and could pose financial stability risks.

- Regulation:

- Motivations for regulating virtual assets vary across jurisdictions, requiring a careful balance of benefits and costs.

- Regulators must ensure that the benefits of regulation and supervision outweigh the associated costs.

- For EMEs, key considerations include defining regulatory authority, determining the scope of regulation in terms of activity or entity, and addressing data gaps related to technology and interconnections.

- Dubai: Bespoke Licensing Framework

What are Virtual Digital Asset Service Providers (VDA SPs)

- Virtual Digital Asset Service Providers (VDA SPs) refer to entities that offer services related to virtual digital assets or cryptocurrencies.

- These services may include activities such as trading, exchange platforms, advisory services, broker-dealer services, transfer and settlement services, and other related financial operations within the virtual asset space.

India and Pak. exchange list of nuclear installations

(General Studies- Paper II)

Source : TH

India and Pakistan have continued a tradition spanning over three decades by exchanging lists of their nuclear installations.

Key Highlights

- On January 1, the two countries exchanged the lists as part of a bilateral agreement prohibiting attacks on each other’s nuclear facilities.

- The agreement, signed on December 31, 1988, and in effect since January 27, 1991, requires both nations to inform each other of the nuclear installations and facilities covered under the agreement on the first of January each year.

- Despite strained relations, especially concerning the Kashmir issue and cross-border terrorism, this exchange marks the 33rd consecutive year of such lists being shared, with the first exchange occurring on January 1, 1992.

Note: The annual exchange of lists of nuclear installations between India and Pakistan serves the purpose of implementing a bilateral agreement aimed at preventing attacks on each other’s atomic facilities.