Fitch Downgrades US Ratings

Fitch Ratings, a renowned credit rating agency, has recently downgraded the United States of America’s Long-Term Foreign-Currency Issuer Default Rating (IDR) from ‘AAA’ to ‘AA+’ with a Stable Outlook.

- This rating action reflects Fitch’s assessment of the expected fiscal deterioration, growing general government debt burden, and erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the past two decades.

- What are key factors?

- What can be concluded?

- What is the Long-Term Foreign-Currency Issuer Default Rating (IDR)?

- Any past downgrades for USA?

- What are the factors that determine Credit Rating of a Country?

- What are Sovereign Credit Rating Agencies?

- Credit Rating Agencies of India

- Let us understand some associated financial terminologies

- What is Debt-to-GDP Ratio?

What are key factors?

The decision to downgrade the United States’ long-term ratings is based on several critical factors:

- Fiscal Deterioration: Fitch anticipates a fiscal deterioration over the next three years, with the general government deficit projected to rise to 6.3% of GDP in 2023.

- This is attributed to weaker federal revenues, new spending initiatives, and a higher interest burden.

- Erosion of Governance: Over the past two decades, there has been a steady decline in governance standards, including fiscal and debt management.

- Repeated debt-limit standoffs and last-minute resolutions have eroded confidence in the country’s fiscal management.

- Rising General Government Debt: The general government debt-to-GDP ratio is projected to increase to 118.4% by 2025.

- This is well above the pre-pandemic level, and significantly higher than the ‘AAA’ median.

- The growing debt burden raises concerns about the country’s fiscal position in the face of future economic shocks.

- Medium-Term Fiscal Challenges: Fitch highlights that the U.S. has not adequately addressed medium-term challenges related to rising social security and Medicare costs due to an aging population.

- The CBO projects that interest costs will double by 2033, further straining the fiscal trajectory.

- Structural Strengths: Despite the downgrade, Fitch acknowledges several structural strengths underpinning the United States’ ratings.

- These include its large, advanced, well-diversified, and high-income economy, supported by a dynamic business environment.

- Additionally, the U.S. dollar’s status as the world’s primary reserve currency provides extraordinary financing flexibility.

- Economic Outlook: Fitch projects a mild recession in the U.S. economy in 4Q23 and 1Q24, driven by tighter credit conditions, weakening business investment, and a slowdown in consumption.

- The agency forecasts a slower annual real GDP growth of 1.2% in 2023 and an overall growth of just 0.5% in 2024.

- Federal Reserve Actions: The Federal Reserve has already raised interest rates by 25 basis points multiple times in 2023 and is expected to raise them further to combat stubbornly high inflation.

- The resilience of the economy and labour market pose challenges for the Fed in bringing inflation towards its 2% target.

- ESG Considerations: Fitch considers Environmental, Social, and Governance (ESG) factors in its rating assessments.

- The U.S. has ESG relevance scores for political stability, rule of law, institutional quality, control of corruption, human rights, political freedoms, and creditor rights.

- While some scores have a positive impact on the credit profile, others have a negative effect.

- Outlook and Rating Sensitivities: The Stable Outlook indicates Fitch’s expectation of the U.S. maintaining its ‘AA+’ rating in the near term.

- However, factors that could lead to negative rating action include a marked increase in general government debt or a decline in policymaking coherence and credibility.

- Conversely, fiscal adjustments addressing rising mandatory spending or a reversal in governance deterioration could lead to positive rating action.

What can be concluded?

Fitch’s decision to downgrade the United States’ Long-Term Foreign-Currency Issuer Default Rating reflects concerns over fiscal management and growing government debt.

- While structural strengths of the U.S. economy and the dollar’s reserve currency status remain key positive factors, addressing medium-term fiscal challenges and governance improvements will be crucial for future credit rating assessments.

- The stable outlook suggests that the rating agency expects the U.S. to maintain its ‘AA+’ rating in the near term, provided no significant negative developments occur.

What is the Long-Term Foreign-Currency Issuer Default Rating (IDR)?

- Definition:

- The Long-Term Foreign-Currency Issuer Default Rating (IDR) is a credit rating used to evaluate a country’s or corporation’s ability to repay foreign-currency debts over a long period.

- Creditworthiness Assessment:

- Credit rating agencies assign ratings based on their analysis of the borrower’s financial health, economic prospects, and overall stability.

- Foreign-Currency Denominated Debt:

- The rating specifically focuses on debts issued in foreign currencies, meaning loans or bonds that need to be repaid in currencies other than the borrower’s local currency.

- Long-Term Perspective:

- The rating evaluates the borrower’s ability to repay debts over an extended period, typically several years into the future.

- Rating Scale:

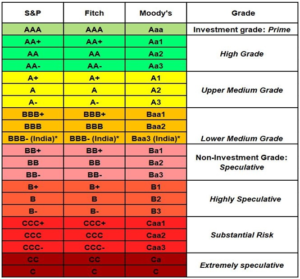

- Ratings are represented by letters or alphanumeric codes. The highest ratings (e.g., AAA) indicate a low risk of default, while lower ratings (e.g., B-, CCC) suggest higher default risk.

- Importance:

- The rating influences the cost of borrowing for the country or corporation.

- Higher ratings lead to lower borrowing costs, while lower ratings can result in higher interest rates on loans.

- Impact on Investors:

- Investors use these ratings to assess the risk associated with investing in a particular country or corporation. Higher-rated entities are generally considered safer investments.

- Dynamic Ratings:

- Ratings can change over time based on economic and financial developments.

- Governments and corporations work to maintain or improve their credit ratings through responsible fiscal and financial management.

Any past downgrades for USA?

- Yes, the USA has been downgraded by credit rating agencies in the past.

- In August 2011, Standard & Poor’s (S&P), one of the major credit rating agencies, downgraded the United States’ long-term debt from its highest rating of AAA to AA+.

- The downgrade came amid contentious debates in the U.S. Congress over raising the debt ceiling and concerns about the country’s ability to address its long-term fiscal challenges.

- S&P cited the political gridlock and the failure to reach a comprehensive solution to reduce the country’s growing debt burden as the main reasons for the downgrade.

- The downgrade marked the first time in history that the USA lost its AAA rating, which had been a symbol of its top creditworthiness for several decades.

What are the factors that determine Credit Rating of a Country?

The credit rating of a country is determined by credit rating agencies based on a comprehensive analysis of various factors that reflect the country’s economic and financial health, as well as its ability to meet debt obligations.

- Economic Performance and Stability:

- GDP growth rate and economic stability.

- Inflation rate and price stability.

- Unemployment rate and labour market conditions.

- Economic diversification and resilience to external shocks.

- Fiscal Position:

- Fiscal deficit and government debt levels.

- Government revenue and expenditure patterns.

- Public debt sustainability and repayment capacity.

- External Position:

- Current account balance and trade balance.

- Foreign exchange reserves and their adequacy.

- Dependence on external financing and foreign debt.

- Monetary Policy and Central Bank Independence:

- Effectiveness of monetary policy in controlling inflation.

- Independence and credibility of the central bank.

- Political Stability and Governance:

- Political institutions and effectiveness of governance.

- The rule of law and control of corruption.

- Political risks and potential for policy instability.

- Institutional Strength:

- Efficiency of legal and regulatory systems.

- Protection of property rights and contract enforcement.

- Business environment and ease of doing business.

- Debt Structure and Creditor Relations:

- Maturity profile of public debt.

- Proportion of foreign-currency-denominated debt.

- History of debt repayment and relations with creditors.

- Social and Demographic Factors:

- Social development indicators (e.g., education, healthcare).

- Demographic trends and labour force dynamics.

- External Vulnerabilities:

- Exposure to external shocks, such as commodity price fluctuations or global economic downturns.

- Dependence on specific industries or sectors.

- Long-Term Prospects and Reforms:

- Potential for sustained economic growth.

- Structural reforms and policy initiatives to improve economic fundamentals.

In Image: Key Factors in Credit Rating of a Country.

What are Sovereign Credit Rating Agencies?

Sovereign credit rating agencies are independent financial institutions that assess and assign credit ratings to countries based on their creditworthiness and ability to meet debt obligations.

- Standard & Poor’s (S&P):

- One of the “Big Three” credit rating agencies, alongside Moody’s and Fitch Ratings.

- Established in 1860, S&P is headquartered in the United States.

- It uses a letter-based rating system, where AAA represents the highest credit quality, and ratings below BB are considered speculative or junk grade.

- S&P Global Ratings affirmed India’s long-term sovereign credit ratings at ‘BBB-‘ with a ‘stable’ outlook.

- Moody’s Investors Service:

- Another member of the “Big Three” credit rating agencies.

- Founded in 1909 and based in the United States.

- Uses a letter-based rating system, similar to S&P, with Aaa as the highest rating and C as the lowest, indicating a substantial credit risk.

- Moody’s has ‘Baa3’ sovereign credit rating on India, with a stable outlook.

- Fitch Ratings:

- The third member of the “Big Three” credit rating agencies.

- Established in 1913 and headquartered in the United States.

- Like S&P and Moody’s, it uses a letter-based rating system, where AAA is the highest and ratings below BB indicate higher risk.

- Fitch has retained India’s rating at ‘BBB-‘ with ‘stable’ outlook.

| Agency | Rating | Meaning | Outlook |

| Moody’s | Baa3 | Lowest Investment Grade | Stable |

| S&P | BBB- | Lowest Investment Grade | Stable |

| Fitch | BBB- | Lowest Investment Grade | Stable |

Credit Rating Agencies of India

India has several credit rating agencies that play a crucial role in evaluating the creditworthiness of Indian entities, including government, corporates, financial institutions, and debt instruments.Some of the prominent credit rating agencies in India are:

- Credit Rating Information Services of India Limited (CRISIL):

- CRISIL is one of the leading credit rating agencies in India, established in 1987.

- It is a subsidiary of Standard & Poor’s (S&P), a global credit rating agency.

- CRISIL provides credit ratings for various entities, debt instruments, and other financial products in India.

- India Ratings and Research (Ind-Ra):

- Formerly known as Fitch India, India Ratings and Research is a credit rating agency wholly owned by the Fitch Group.

- It offers credit ratings, research, and analysis for Indian companies, financial institutions, and government entities.

- CARE Ratings (Credit Analysis and Research Limited):

- CARE Ratings is one of the leading credit rating agencies in India, established in 1993.

- It provides credit ratings for debt instruments, banks, corporates, and other financial entities in the country.

- ICRA Limited (formerly Investment Information and Credit Rating Agency of India Limited):

- ICRA Limited (formerly Investment Information and Credit Rating Agency of India Limited):

- ICRA is a credit rating agency in India, founded in 1991.

- It is a subsidiary of Moody’s Investors Service, a global credit rating agency.

- ICRA offers credit ratings and research services for various sectors in the Indian economy.

- SMERA Ratings Limited:

- SMERA Ratings is a credit rating agency specializing in rating SMEs (Small and Medium-sized Enterprises) in India.

- It is jointly promoted by SIDBI (Small Industries Development Bank of India) and Dun & Bradstreet Information Services India Private Limited.

Let us understand some associated financial terminologies

- Fiscal Deficit:

- The fiscal deficit is the difference between a government’s total expenditures and its total revenues in a given fiscal year.

- It represents the amount by which the government’s expenses exceed its income, indicating a budget shortfall.

- It is an important indicator of the government’s financial health and its ability to manage its budget effectively.

- Revenue:

- Revenue refers to the total income received by the government from various sources, such as taxes (income tax, corporate tax, sales tax), non-tax revenues (fees, fines, licenses), and grants.

- Expenditure:

- Expenditure represents the total amount of money spent by the government to fund its various programs, projects, and services.

- It includes both revenue expenditure (day-to-day expenses like salaries, subsidies, and maintenance) and capital expenditure (investments in infrastructure and assets).

- Primary Deficit:

- The primary deficit is the fiscal deficit minus interest payments on previous debts.

- It reflects the government’s borrowing needs for financing its current operations, excluding the burden of interest payments.

- Financing:

- Financing of fiscal deficit involves raising funds to cover the shortfall in revenues by either borrowing from domestic or international sources.

- Government debt instruments like bonds, treasury bills, and loans are commonly used to finance the deficit.

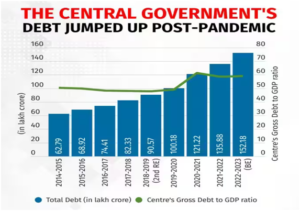

- Debt-to-GDP Ratio:

- The debt-to-GDP ratio measures the government’s debt burden relative to the size of the country’s economy (Gross Domestic Product).

- It is calculated by dividing the total outstanding debt by the GDP and is used to assess the country’s ability to manage its debt.

What is Debt-to-GDP Ratio?

- Debt-to-GDP ratio is a crucial financial indicator that measures a country’s debt burden relative to its economic output.

- It shows how much of a country’s annual GDP is used to service its outstanding debt.

- The Debt-to-GDP ratio is calculated by dividing a country’s total outstanding debt (government debt) by its Gross Domestic Product (GDP) and then multiplying by 100 to express it as a percentage.

- It provides insights into a country’s ability to manage its debt and repayments in comparison to the size of its economy.

- Safe Limits of Debt-to-GDP Ratio:

- There is no universally agreed-upon safe limit for the Debt-to-GDP ratio, as it varies depending on the country’s economic structure, fiscal policies, and overall economic health.

- Generally, lower debt-to-GDP ratios are considered safer, indicating a lower risk of debt default and higher fiscal stability.

- Many economists suggest that a debt-to-GDP ratio below 60% is generally manageable for most countries, while ratios above 90% could lead to potential risks.

- India’s Debt-to-GDP ratio has been gradually increasing in recent years.

- In 2021, India’s Debt-to-GDP ratio was around 60-70%, which is considered moderate and relatively safe.

- After COVID years, this limit has risen been rising continuously.

In Image: The Central Government’s Debt-to-GDP ratio.

BE- Budget Estimate.